- United States

- /

- Transportation

- /

- NYSE:UBER

Uber Technologies (NYSE:UBER) Expands Autonomous Partnership With WeRide To 15 Global Cities

Reviewed by Simply Wall St

Uber Technologies (NYSE:UBER) saw a significant price move of 32% last month, coinciding with several key announcements. The expansion of its partnership with WeRide to enhance autonomous mobility and the strategic deal with Momenta to introduce autonomous vehicles in Europe underscore Uber's push towards innovation in transportation. Additionally, collaboration with Volkswagen for the deployment of autonomous electric vehicles and potential acquisition talks with Trendyol Go may have bolstered investor confidence. Despite broader market concerns over tariffs and interest rates, Uber's focused advancements through partnerships appear to have positively influenced their stock performance, contrasting the broader market's flat direction.

We've spotted 2 weaknesses for Uber Technologies you should be aware of.

Uber Technologies' recent initiatives in expanding its partnership with autonomous vehicle leaders have driven substantial interest and potential upside in its financial narrative. These developments highlight Uber's commitment to leveraging AV technology to streamline operations and enhance profitability. The introduction of autonomous vehicles in Europe through deals with Momenta and Volkswagen underscores a future-focused approach that could significantly influence revenue by optimizing fleet costs. Meanwhile, the potential merger talks with Trendyol Go highlight Uber's ambitions to expand its geographical footprint, possibly boosting its global user base.

Over the past three years, Uber's total return has been dramatic, appreciating by 270.63%. This outperformance is significant given the backdrop of a market where Uber's one-year performance already exceeded the broader US market's return of 8.2% and beat the Transportation industry's 2.4% decline. Uber's ability to outpace both the market and its industry peers highlights the impact of its strategic investments and market positioning.

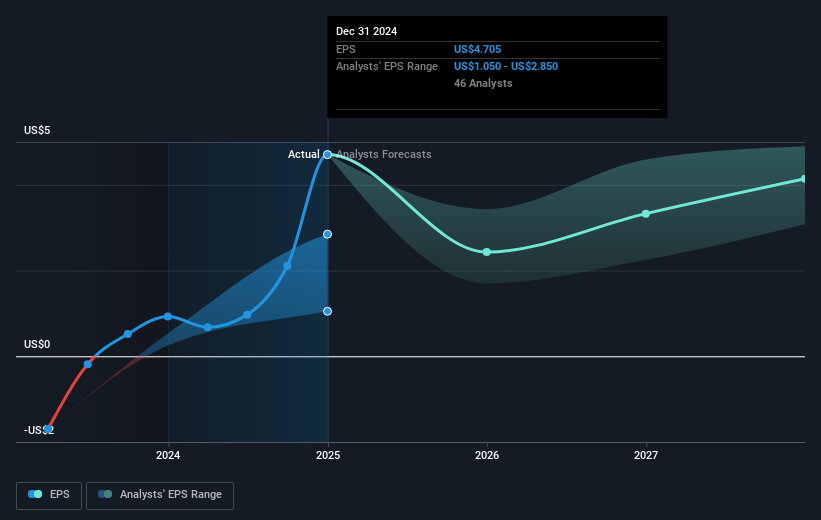

The consensus price target for Uber stands at US$88.40, representing a potential upside from the current share price of US$79.42. While the recent share price movement of 32% over the last month demonstrates strong investor sentiment, it is still below the price target, suggesting analysts' belief in further growth potential. The news around alliances in AV technology is likely to push revenue and earnings forecasts upward, which could progressively close the valuation gap. As such, investors remain attentive to Uber's next moves in solidifying these projections amid cost pressures and potential market shifts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UBER

Uber Technologies

Develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives