- United States

- /

- Transportation

- /

- NYSE:UBER

Both Institutions and Retailers Boosted Their Stake in Uber Technologies, Inc (NYSE:UBER)

Despite the best efforts in 2021, Uber Technologies, Inc. ( NYSE: UBER ) has been drifting downwards, returning to the starting line where it IPO'd almost 3 years ago.

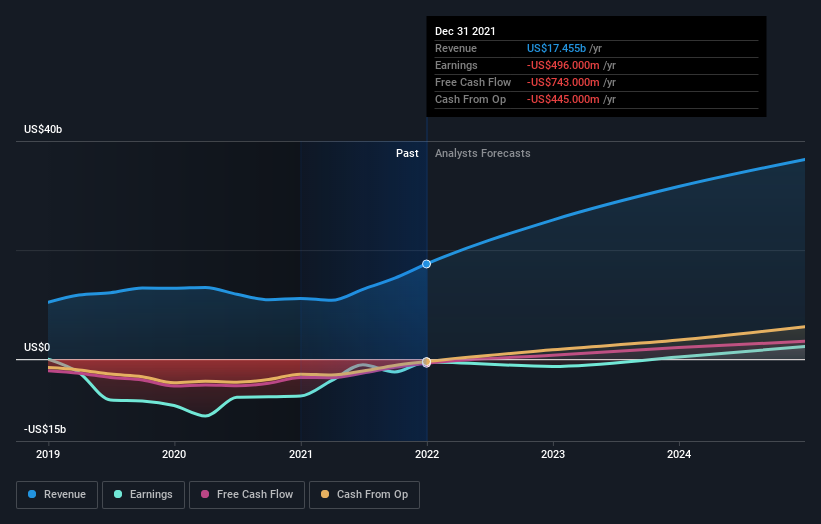

However, the company made some commendable improvements as it started to flirt with sustainable profitability seriously.

View our latest analysis for Uber Technologies

Q4 Earnings Results

- GAAP EPS: US$0.44 (beat by US$0.77)

- Revenue: US$5.78b (beat by US$420m)

- Revenue growth: +82.3% Y/Y

Other highlights:

- Gross bookings – US$25.9b (high end of guidance

- Adjusted EBITDA- US$86m – above the guidance

- Cash: US$4.3b

- Monthly active users (MAU): +8% in Q4, to 118 million

- Guidance Q1 FY2022: gross bookings of US$25b-26b

Revenue exceeded analyst estimates by 2.3%. Earnings per share (EPS) missed analyst estimates by 78%. Over the next year, revenue is forecast to grow 46%, compared to a 21% growth forecast for the industry in the US.

While monthly active users, an essential metric for high-growth businesses, shows healthy growth, net profit margin still leaves a lot to be desired.

However, these results attracted interest from institutions, as Loop Capital stated that while COVID-19 remains an issue, 2022 should bring considerable improvement to the rideshare industry. They maintain a US$70 price target on the stock, which is over 80% upside from the current price. Our valuation model gives about 60% upside, as you can check on the platform .

A Look into the Ownership

With a market capitalization of US$73b, Uber is a pretty large company. Typically institutions would own a significant portion of a company this size.In the chart below, we can see thatinstitutions are noticeable on the share registry.

The following depiction shows the current ownership of Uber Technologies.

What Does The Institutional Ownership Tell Us About Uber Technologies?

Institutions typically measure themselves against a benchmark when reporting to their investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

We can see that Uber Technologies has institutional investors, and they hold a good portion of its stock.This suggests some credibility amongst professional investors. But we can't rely on that fact alone since institutions make bad investments sometimes, just like everyone does.

So it is worth checking the past earnings trajectory of Uber Technologies, (below).

Institutional investors own over 50% of the company, so together than can probably strongly influence board decisions.We note that hedge funds don't have a meaningful investment in Uber Technologies. Our data shows that the largest shareholder is FMR LLC, with 4.8% of outstanding shares.In comparison, the second and third largest shareholders hold about 4.3% and 4.2% of the stock.

Our studies suggest that the top 25 shareholders collectively control less than half of the company's shares, meaning that the shares are widely disseminated, and there is no dominant shareholder.

Insider Ownership Of Uber Technologies

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least.The company management answer to the board, and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

I generally consider insider ownership to be a good thing. However, it makes it more difficult for other shareholders to hold the board accountable for decisions on some occasions.

Our data suggest that insiders own under 1% of Uber Technologies, Inc. in their own names.It is a large company, so it would be surprising to see insiders own a large proportion of the company. Though their holding amounts to less than 1%, we can see that board members collectively own US$105m worth of shares (at current prices). In this sort of situation, it can be more interesting to see if those insiders have been buying or selling.

General Public Ownership

With a 26% ownership, the general public, mostly comprised of individual investors, has some degree of sway over Uber Technologies.While this size of ownership may not be enough to sway a policy decision in their favor, they can still make a collective impact on company policies.

Ownership Changes Over the Last Quarter

While the economy re-opening carried the risk of plummeting food delivery earnings, Uber scored a turnaround in ride-sharing and strong growth in the freight business.

Looking back at the previous ownership report, we can notice that venture capital/private equity exited, selling to the institutions and the general public. While this might spook some investors, we need to point out that this is not untypical. VC/PE firms generally make an early investment in the company, intending to exit after the company goes public eventually.

While it is well worth considering the different groups that own a company, other factors are even more important. To that end, you should be aware of the 2 warning signs we've spotted with Uber Technologies .

Ultimately the future is most important . You can access this free report on analyst forecasts for the company .

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full-year annual report figures.

If you're looking to trade Uber Technologies, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:UBER

Uber Technologies

Develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives