- United States

- /

- Transportation

- /

- NYSE:UBER

Assessing Uber (UBER) Valuation After Recent Momentum Pullback and Long-Term Share Price Gains

Reviewed by Simply Wall St

See our latest analysis for Uber Technologies.

Even with a slight pullback in recent days, Uber Technologies continues to stand out for its sizable year-to-date share price return of 45%. Short-term momentum has cooled; however, the one-year total shareholder return of 25% and a striking 216% gain over three years underscore the company’s impressive long-term trajectory and shifting investor optimism around future growth and profitability.

If Uber’s run has you curious about what other fast-moving companies might be out there, now's a great time to broaden your investing horizons and discover fast growing stocks with high insider ownership

With Uber shares still trading below some analyst price targets, but after a rapid climb in recent years, the key question now is whether there is real value left for investors or if future growth is already reflected in the stock price.

Most Popular Narrative: 22% Overvalued

Uber’s last close of $91.62 stands above the fair value range determined by the latest narrative, suggesting the current market cap overshoots underlying fundamentals. According to YasserSakuragi's detailed analysis, investors considering today’s price should review the long-term profit and revenue outlook presented below.

2030 Revenue Projection: $65-70B

2030 EBITDA: $14-15B (22% margin with autonomous vehicle benefits)

Fair Value Range: $90-135B market cap

Current Market Cap: $192B (significantly overvalued)

Target Entry Price: $65-75 per share (versus current approximately $95)

Want to know what financial transformation drives this call? The answer links to projections around future margins and major milestones in tech adoption. Curious what assumptions tip the scales? Uncover the surprising calculations and timeline fueling this bold valuation.

Result: Fair Value of $75 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unexpected profitability surges or breakthrough advances in autonomous driving could quickly challenge the current view that the stock is overvalued.

Find out about the key risks to this Uber Technologies narrative.

Another View: Discounted Cash Flow Model Says Undervalued

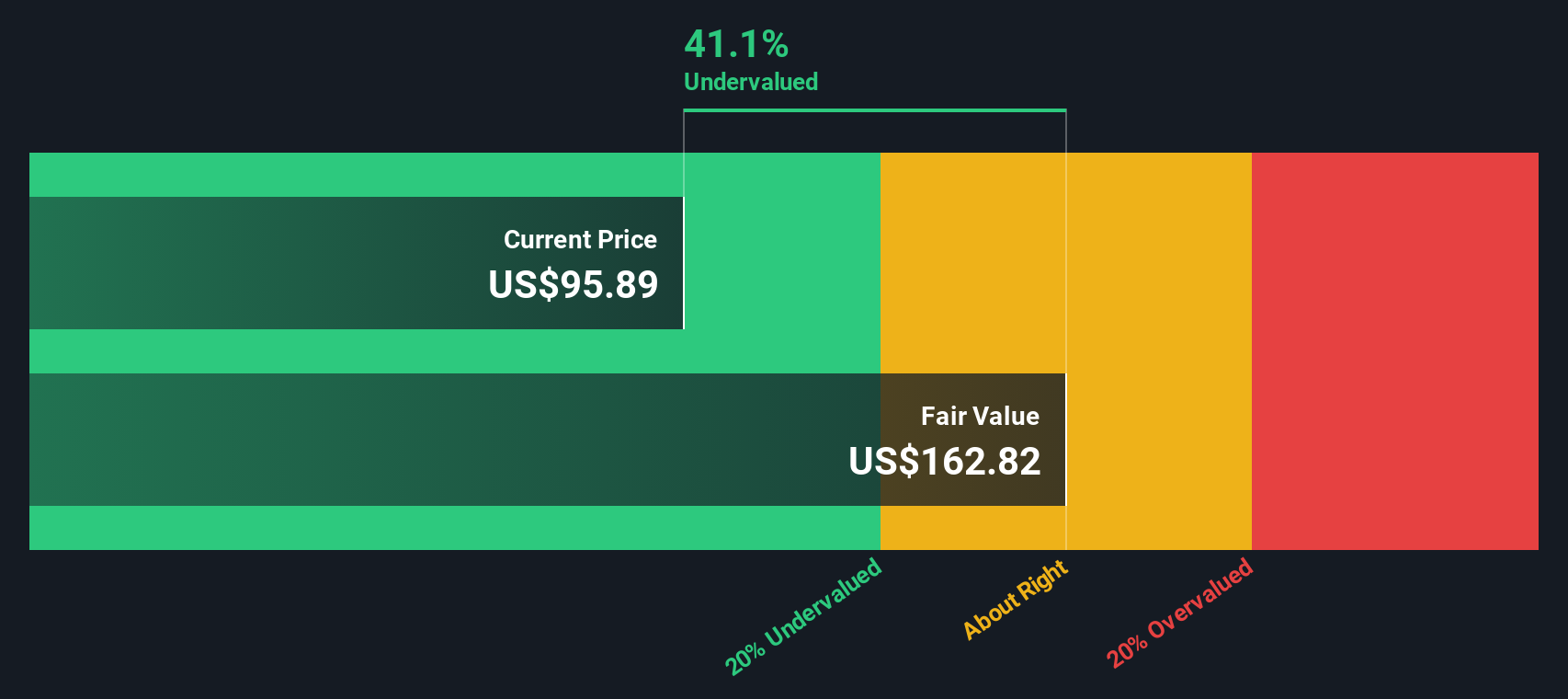

Interestingly, our DCF model tells a very different story. While the fair value narrative finds Uber overvalued, the SWS DCF model estimates fair value at $168.43 per share, showing Uber trading well below this mark. Could market sentiment be underestimating the company’s long-term cash flow potential?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Uber Technologies Narrative

If you see the results differently or enjoy digging into the numbers yourself, you can craft your own perspective on Uber’s value in just a few minutes. Do it your way

A great starting point for your Uber Technologies research is our analysis highlighting 5 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More High-Potential Ideas?

Set yourself up for smarter investing by using the Simply Wall Street Screener to unlock opportunities most investors miss. Move ahead of the pack and never let a winning idea pass you by.

- Amplify your portfolio with these 886 undervalued stocks based on cash flows, a tool that skilled investors use to find hidden bargains poised for long-term growth.

- Kickstart your hunt for exciting breakthroughs by targeting these 25 AI penny stocks, which highlights companies leading transformations in artificial intelligence.

- Explore these 16 dividend stocks with yields > 3% for reliable income streams and steady returns that can help grow your wealth with less guesswork.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UBER

Uber Technologies

Develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Very undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

Intuit Stock: When Financial Software Becomes the Operating System for Small Business

Meta’s Bold Bet on AI Pays Off

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).