- United States

- /

- Transportation

- /

- NYSE:RXO

Will Rising Regulatory Pressures Shift RXO’s (RXO) Competitive Edge in the Trucking Sector?

Reviewed by Sasha Jovanovic

- Recently, RXO highlighted ongoing fragility in the truckload capacity environment due to increased regulatory enforcement and carrier attrition, which could create significant freight rate volatility in 2026, and reported modest rate improvements during a subdued Q3 spot market with expectations for a modest Q4 peak season.

- Director Adrian Kingshott's purchase of 9,350 company shares continued a year-long trend of insider buying, suggesting sustained management confidence amid industry uncertainty.

- We'll explore how warnings about possible major structural changes in the U.S. truckload sector could influence RXO's investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

RXO Investment Narrative Recap

To own RXO stock, investors must believe that the company’s technology-driven and diversified approach can support sustained margin improvement and position RXO as a long-term winner as the U.S. freight industry faces major potential structural change. The recent update on regulatory enforcement and carrier exits does not materially alter the company’s short-term outlook, but it does reinforce that freight rate volatility remains the most important near-term catalyst and also the main risk, especially if truckload demand stays weak.

RXO’s Q3 update, which showed a modest rate uptick and continued softness in the spot market, ties directly to management’s warning about fragile capacity and upcoming volatility. This aligns with the company’s view that ongoing rate pressure and surges in regulatory activity may set the stage for disruptive market changes, leaving investors focused on the balance between risk and the promise of operational leverage and margin growth as the market finds a new equilibrium.

However, against a backdrop of regulatory shifts, investors should be aware that RXO remains highly exposed to...

Read the full narrative on RXO (it's free!)

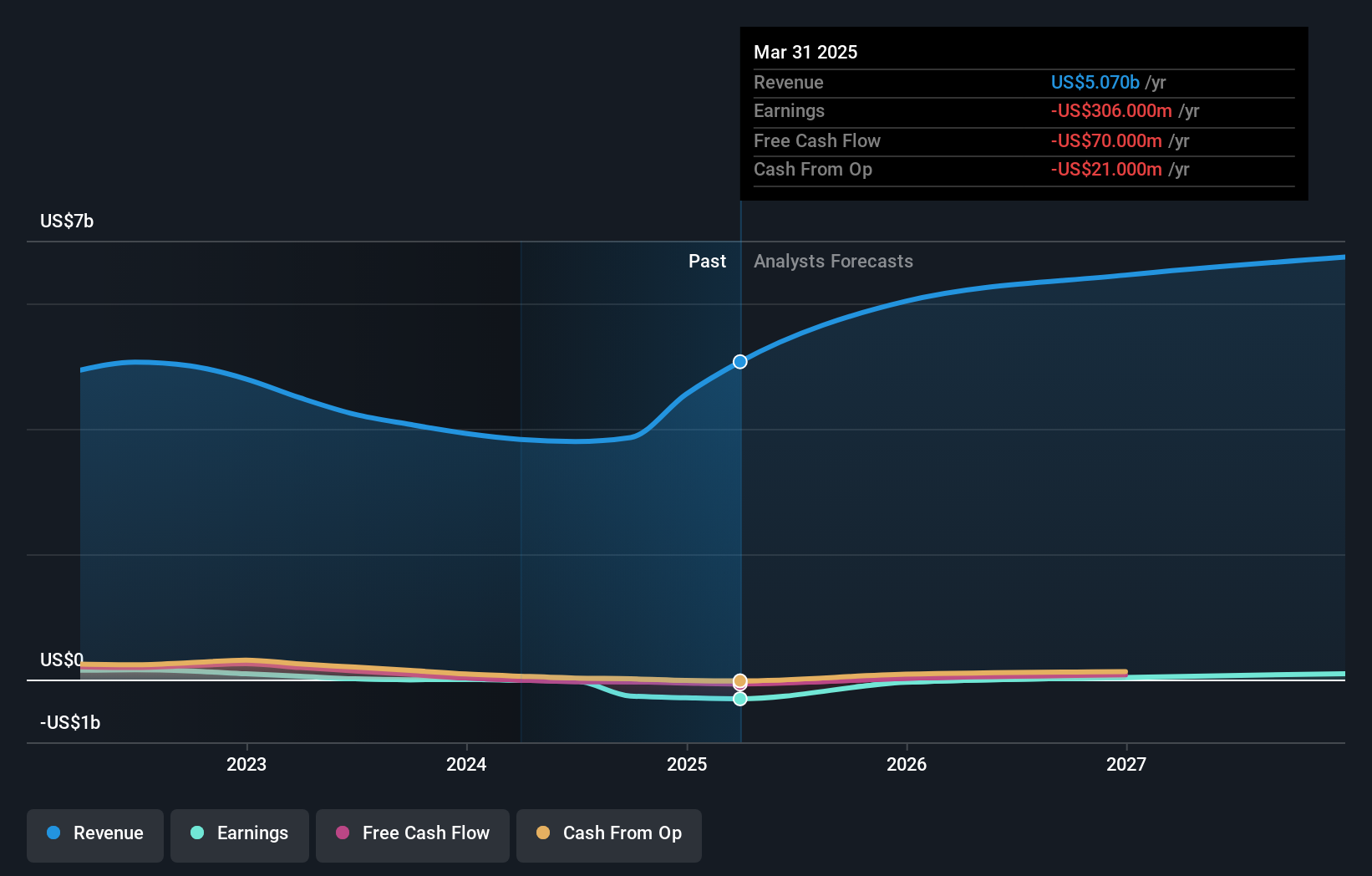

RXO's narrative projects $6.9 billion revenue and $132.5 million earnings by 2028. This requires 7.3% yearly revenue growth and a $440.5 million earnings increase from the current earnings of -$308.0 million.

Uncover how RXO's forecasts yield a $15.67 fair value, a 37% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community place RXO between US$14.47 and US$15.67 per share, with both above the current market price. In contrast, ongoing regulatory changes may challenge RXO’s ability to maintain earnings stability, highlighting why opinions about the company’s outlook can vary widely, consider reviewing these diverse viewpoints before making decisions.

Explore 2 other fair value estimates on RXO - why the stock might be worth just $14.47!

Build Your Own RXO Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your RXO research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free RXO research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate RXO's overall financial health at a glance.

No Opportunity In RXO?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RXO

RXO

Engages in truck brokerage business in the United States, Canada, Mexico, Asia, and Europe.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives