- United States

- /

- Transportation

- /

- NYSE:RXO

RXO (NYSE:RXO) Valuation in Focus After Law Firm Launches Disclosure Investigation and Profitability Concerns Emerge

Reviewed by Simply Wall St

RXO, Inc. is under investigation by a law firm regarding whether it and certain officers may have failed to disclose important information to investors. This raises questions about transparency and adds pressure amid already mounting profitability concerns.

See our latest analysis for RXO.

RXO’s share price has rebounded over the past month with a 15.9% return. However, it remains down more than 25% year-to-date, and the 1-year total shareholder return sits firmly in the red at -36.5%. Recent headlines around an ongoing investigation and pressure on margins have added to already shifting sentiment. The short-term price recovery suggests investors are closely watching for signs of a sustained turnaround.

If you’re curious to see what else savvy investors are keeping an eye on, this could be the perfect moment to explore fast growing stocks with high insider ownership.

Given mixed returns, regulatory scrutiny, and lingering profitability doubts, the central question emerges: is RXO’s current share price a genuine discount, or has the market already accounted for the risks and potential growth ahead?

Most Popular Narrative: 6% Overvalued

RXO's most widely followed narrative puts its fair value at $16.78, a touch below the last close at $17.73. It suggests that optimism around rapid margin gains and tech-driven growth is slightly outpacing the current business reality.

RXO's relentless investment in AI-powered, proprietary digital freight-matching technology is rapidly boosting employee productivity (up 45% in two years) and driving operating leverage. As digital adoption accelerates in logistics, this sets up sustainable margin and EBITDA growth, making current valuation disconnect notable.

Discover what Wall Street is betting on with RXO's future. There is a bold growth leap, margin turnaround assumptions, and elevated profit multiples hiding in the details. Find out what justifies the price tag and the kind of market recovery narrative analysts are counting on. You will not want to miss these drivers.

Result: Fair Value of $16.78 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing weakness in the automotive sector and continued freight demand softness could undermine RXO’s projected recovery and margin expansion in the months ahead.

Find out about the key risks to this RXO narrative.

Another View: DCF Model Signals Deep Undervaluation

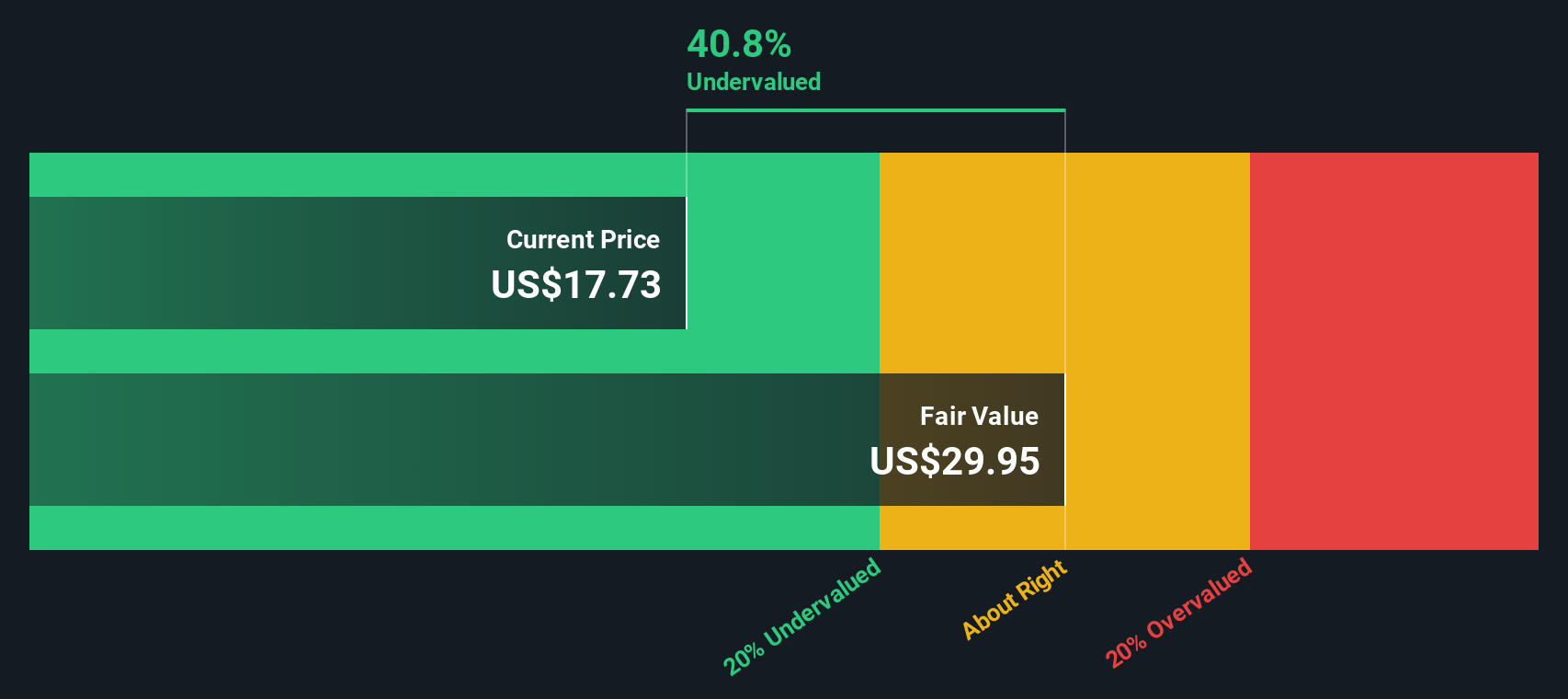

While the prevailing narrative calls RXO overvalued against analyst targets, our SWS DCF model tells a different story. It estimates RXO’s fair value at $29.88, which is about 40% above today’s price. This wide gap raises questions about whether the market is being overly cautious or missing potential upside. Does the DCF optimism signal an opportunity that multiples-based models overlook?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own RXO Narrative

Of course, if you prefer taking matters into your own hands or want to investigate the numbers firsthand, you can craft a tailored RXO story in just minutes. Do it your way

A great starting point for your RXO research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t wait on the sidelines while others spot tomorrow’s winners. Uncover even more stock ideas that could boost your portfolio by tapping into these curated strategies:

- Capture high passive income with reliable yields by checking out these 22 dividend stocks with yields > 3% set to reward shareholders with over 3% returns.

- Ride the AI innovation wave and accelerate your growth prospects by exploring these 26 AI penny stocks driving change in automation and smart technologies.

- Find overlooked gems trading below their real value and seize opportunities now with these 832 undervalued stocks based on cash flows based on solid cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RXO

RXO

Engages in truck brokerage business in the United States, Canada, Mexico, Asia, and Europe.

Undervalued with moderate growth potential.

Market Insights

Community Narratives