- United States

- /

- Transportation

- /

- NYSE:RXO

Can New Truck Tariffs and Legal Scrutiny Reshape RXO’s (RXO) Competitive Edge?

Reviewed by Sasha Jovanovic

- In recent days, RXO has been affected by the announcement of a new 25% U.S. tariff on imported medium and heavy-duty trucks, effective November 2025, alongside news of a federal securities law investigation and company conference participation.

- This combination of regulatory, legal, and operational developments is especially relevant as the trucking and logistics sector faces shifting cost structures and heightened scrutiny.

- We'll examine how the new 25% truck tariff could shift RXO's competitive outlook and alter risk considerations in its investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

RXO Investment Narrative Recap

Owning RXO stock means believing in the company's ability to harness technology-driven efficiencies and growing LTL brokerage volumes to overcome headwinds in freight demand and the automotive sector. The newly announced 25% U.S. truck import tariff adds another layer of uncertainty, but its near-term impact on RXO's tech-focused, asset-light model and digital brokerage catalysts appears secondary for now; however, the ongoing securities law investigation may heighten legal and reputation risks in the short term.

Of the recent company updates, RXO’s upcoming Q3 2025 earnings release on November 6 stands out, as it will offer the first formal management commentary since the tariff and legal probe headlines. Investors looking for clarity on how these events might affect RXO’s cost structure, customer mix, and broader freight market outlook may find meaningful signals in that discussion, especially with LTL brokerage continuing to act as a stabilizing force against cyclical exposure.

However, investors should be aware that, in contrast to RXO’s ambitious growth initiatives, the legal and regulatory overhang could ...

Read the full narrative on RXO (it's free!)

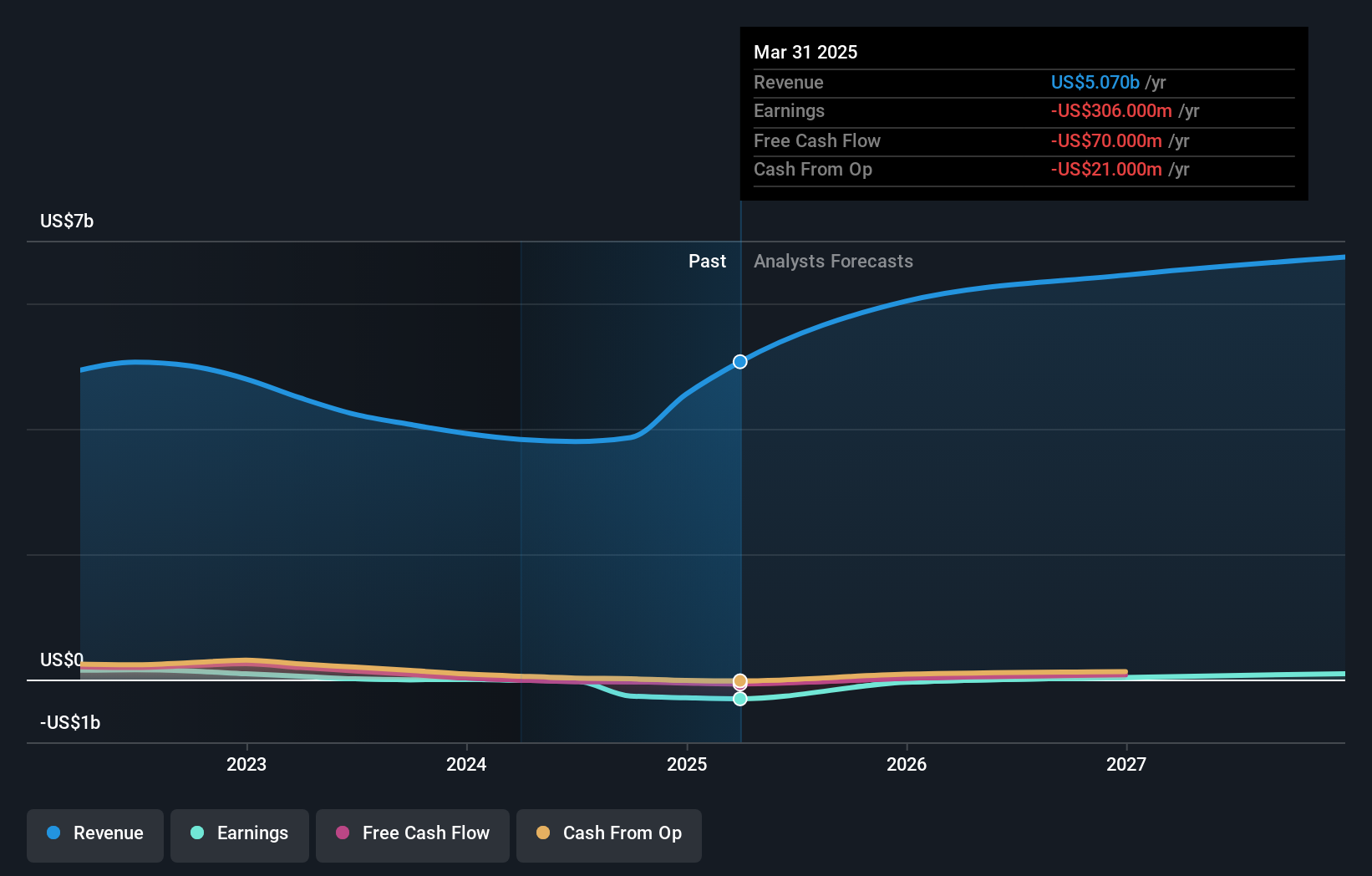

RXO's narrative projects $6.9 billion in revenue and $132.5 million in earnings by 2028. This requires 7.3% yearly revenue growth and a $440.5 million earnings increase from current earnings of -$308.0 million.

Uncover how RXO's forecasts yield a $16.24 fair value, a 4% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided two fair value estimates ranging from US$16.24 to US$33.75 per share. While opinions differ, persistent legal and cost risks may continue to shape expectations for RXO’s performance, consider several viewpoints before forming your own.

Explore 2 other fair value estimates on RXO - why the stock might be worth just $16.24!

Build Your Own RXO Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your RXO research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free RXO research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate RXO's overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RXO

RXO

Engages in truck brokerage business in the United States, Canada, Mexico, Asia, and Europe.

Undervalued with moderate growth potential.

Market Insights

Community Narratives