- United States

- /

- Transportation

- /

- NYSE:R

Ryder System (R): Assessing Valuation Following New Facility Launch in Growing Tennessee Logistics Hub

Reviewed by Kshitija Bhandaru

Ryder System (R) has just opened a new full-service truck rental and maintenance facility in Lebanon, Tennessee. This move taps into the area’s expansive growth and surging demand for logistics solutions. The company is clearly pushing to strengthen regional service capabilities.

See our latest analysis for Ryder System.

This Lebanon expansion comes on the heels of Ryder System affirming its regular dividend and making targeted investments in key growth corridors. The stock’s short- and long-term momentum is clear, with a year-to-date share price return of 16.5% and a robust 22.5% total shareholder return over the past year. Longer-term holders have seen outsized gains as growth trends accelerate.

If you’re interested in identifying what’s next in transportation, now’s a great chance to see the full list of leading auto manufacturers: See the full list for free.

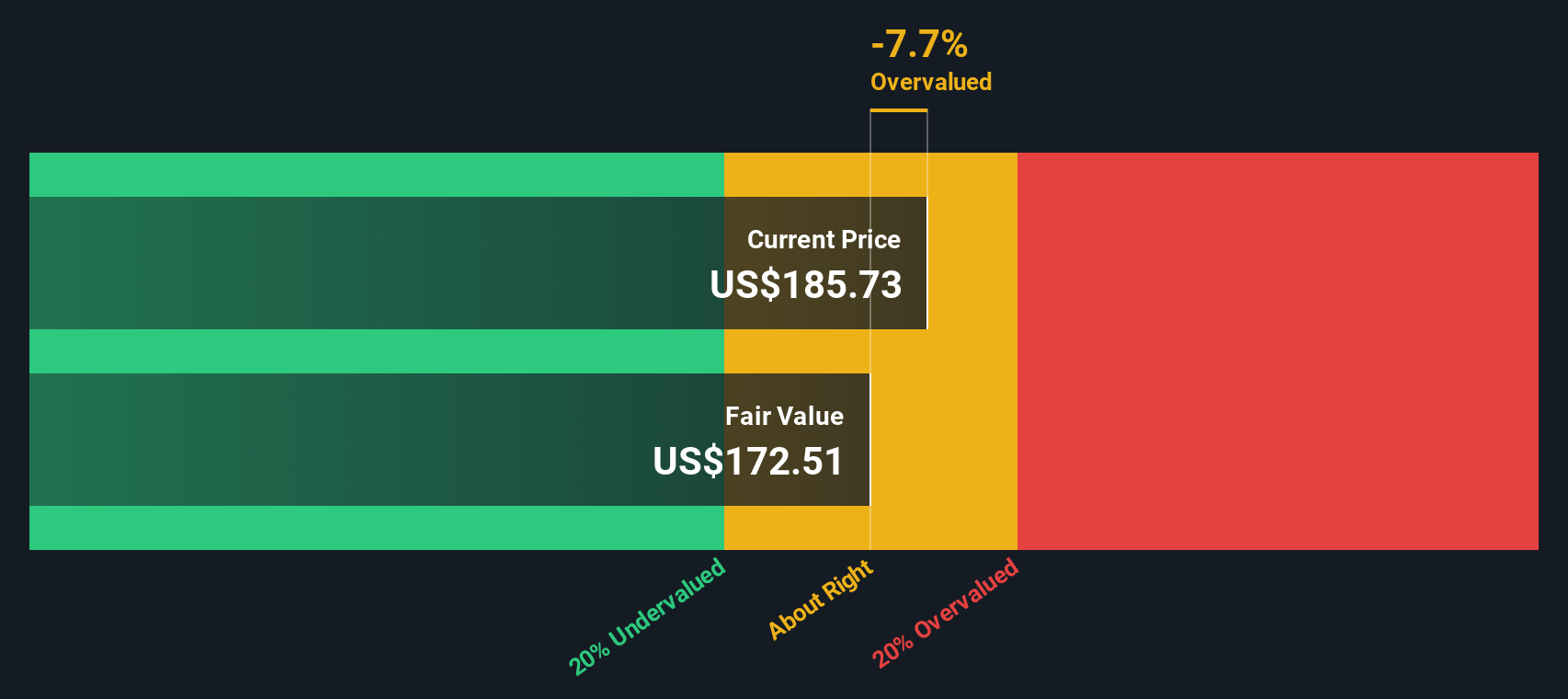

But with shares up double digits over the past year and trading below analyst price targets, the key question for investors is whether Ryder System is still reasonably valued, or if brisk growth is already fully reflected in its price.

Most Popular Narrative: 9.8% Undervalued

Ryder System enters the spotlight with a narrative fair value of $202.11 per share, putting it notably above the latest close of $182.30. Analysts point to future growth catalysts and narrowing discount rates as strong reasons for their optimism about the company's current price level.

Strategic investment in technology, sustainability, and a stable contract-based model supports operational efficiency, competitive edge, and long-term earnings growth. Expanding sustainability initiatives, including fleet electrification and greener solutions, positions Ryder to capture new customer spend as environmental regulations intensify and shippers increase focus on decarbonizing their supply chains. This supports both revenue growth and competitive differentiation.

Curious which forecasts support this higher price tag? The narrative leans heavily on forward-looking projections for sales, earnings, and contract margins. It assumes Ryder will command a profit multiple far below the sector average in the future. Want to know if those numbers justify the bullish consensus? Dive in to see what could set this valuation apart.

Result: Fair Value of $202.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, prolonged freight market downturns or continued pressure on used vehicle sales could quickly challenge Ryder's optimistic growth outlook and disrupt projected earnings gains.

Find out about the key risks to this Ryder System narrative.

Another View: DCF Paints a Different Picture

While narrative and analyst targets signal Ryder System may be undervalued, our DCF model tells a more cautious story, placing fair value at $139.70. This is well below the current price and suggests the stock may be overvalued if future cash flows do not live up to high expectations. Which trajectory will play out?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ryder System for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ryder System Narrative

If you feel there’s a different angle to the story or prefer uncovering insights on your own, you can easily build your own perspective in just minutes. Do it your way

A great starting point for your Ryder System research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let great opportunities pass you by. Take the next step and see what other standout stocks our powerful screener brings to the table.

- Spot reliable income by checking out these 18 dividend stocks with yields > 3%, where robust yields reward investors seeking steady cash flow.

- Connect with major innovation by reviewing these 24 AI penny stocks, focusing on companies powering advances in artificial intelligence.

- Catch undervalued gems before they’re widely noticed with these 870 undervalued stocks based on cash flows and position yourself for smart growth now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:R

Ryder System

Operates as a logistics and transportation company worldwide.

Established dividend payer and good value.

Market Insights

Community Narratives