- United States

- /

- Transportation

- /

- NYSE:NSC

Norfolk Southern (NSC) Margin Improvement Reinforces Bullish Narratives Despite Valuation Scrutiny

Reviewed by Simply Wall St

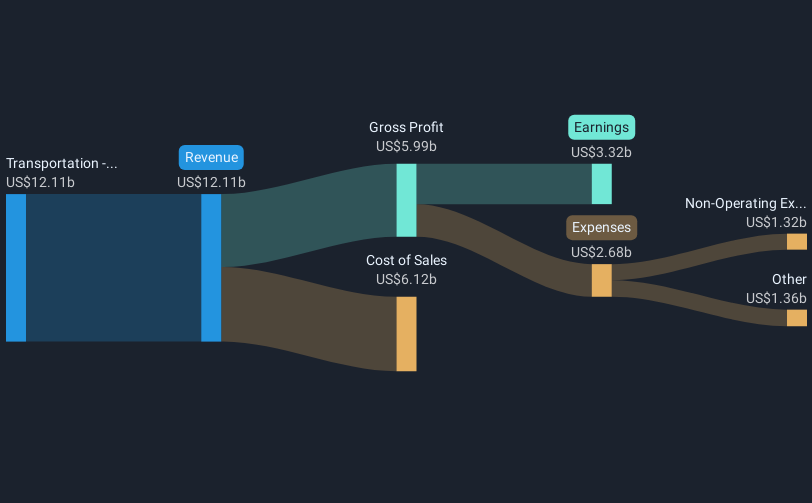

Norfolk Southern (NSC) reported robust earnings growth, with net profit margins climbing to 24.2%, up from 19.8% last year, and annual earnings growth of 22.6% surpassing the five-year average of 1.3%. Earnings are forecast to rise 5.6% per year, while revenue is projected to increase 3.8% per year, signaling continued momentum. With improved margins and a positive outlook, investors are likely to see these results as a sign of stable growth, balanced by moderate valuation concerns and close attention to the company’s financial position.

See our full analysis for Norfolk Southern.Up next, we will see how Norfolk Southern’s numbers compare to the dominant market narratives at Simply Wall St, highlighting where the results may reinforce prevailing views and where they could spur fresh debate.

See what the community is saying about Norfolk Southern

Cost Discipline Lifts Margins

- Productivity and cost reduction initiatives have led to an improvement in net profit margin to 24.2%, up from 19.8% last year.

- Analysts' consensus view highlights how Norfolk Southern’s strategy to drive efficiencies, including its PSR 2.0 transformation and targeted $150 million in savings over three years, is expected to support earnings resilience even if top-line growth slows.

- Consensus narrative notes that recent margin gains are tied to better labor productivity and fuel efficiency, which strengthens the investor case for margin durability.

- However, if one-off cost headwinds such as storm restoration or inflation in operating expenses become more frequent, this could challenge further margin improvement.

- The latest earnings update strengthens the view that Norfolk Southern is executing well on its efficiency playbook. See how this ties into industry sentiment and long-term expectations. 📊 Read the full Norfolk Southern Consensus Narrative.

Mixed Valuation Signals Despite Growth

- Norfolk Southern’s price-to-earnings ratio sits at 21.3x, which is lower than the US Transportation industry average of 26.4x, but represents a small premium over the peer average of 20.3x. The current share price of $280.50 is above the DCF fair value of $214.19.

- The consensus narrative sees this as a balanced picture. While the strong track record of profit growth and dividends supports the current valuation, the narrow gap between share price and the analyst price target of $311.63 suggests most of the near-term upside may already be reflected.

- Bears point to the limited discount versus fair value and sluggish top-line growth forecast of 3.8%, warning that any earnings shortfall or cost spike could quickly erode the premium multiple.

- On the other hand, bulls note that consistent margin strength and cost controls could justify the premium over peers despite moderate revenue momentum.

Revenue Outlook Cushioned by Market Share Gains

- Consensus narrative expects revenue to rise 3.8% annually, supported by long-term market share gains in merchandise and intermodal segments due to a focus on customer confidence and network speed.

- Analysts' consensus view argues these share gains are likely to help offset near-term headwinds such as storm costs and softer coal prices, with strategic bets on industrial growth in steel and food production contributing additional revenue stability.

- Still, the forecast for profit margin to narrow from 27.5% to 25.1% over three years points to ongoing cost pressures, which tempers some of the optimism on revenue leverage.

- If the company can maintain its recent service improvements, consensus holds that it can deliver durable, though modest, top-line growth despite a mixed macro backdrop.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Norfolk Southern on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique angle on the numbers? Craft your own take on Norfolk Southern’s results in just a few minutes and share your perspective. Do it your way

A great starting point for your Norfolk Southern research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Norfolk Southern’s premium valuation and limited near-term upside highlight concerns that growth and margin gains may already be factored into the share price.

If you want greater value for your money, check out these 877 undervalued stocks based on cash flows to discover companies trading well below their intrinsic worth right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Norfolk Southern might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NSC

Norfolk Southern

Engages in the rail transportation of raw materials, intermediate products, and finished goods in the United States.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives