- United States

- /

- Transportation

- /

- NYSE:NSC

Is Norfolk Southern Still Attractive After Recent 5% Drop in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with your Norfolk Southern shares, or considering getting in? You are not alone. The past year has been a ride, with Norfolk Southern’s stock climbing 13.5% over the last twelve months and a notable 20.1% year-to-date. Those numbers are impressive, especially compared to some of its railroad peers. Still, the last few weeks have thrown a bit of cold water on investor enthusiasm. The stock slid 3.3% over the last week and is down 5.3% this past month, as Wall Street reacts to a mix of factors swirling around the entire sector.

Much of the recent noise has centered on industry-wide regulatory chatter, investment in safety upgrades, and ongoing infrastructure developments. While none of this is earth-shaking enough to redefine Norfolk Southern’s growth prospects overnight, it has pushed some investors to reassess exactly how much risk they are comfortable taking on in the near term. Despite enduring volatility, the company’s solid 3-year return of 32.4% and 5-year gain of 45.2% show that long-term holders have generally been well rewarded.

But are those rewards likely to continue, and more importantly, is Norfolk Southern actually undervalued right now? By strictly quantifying the valuation, the company checks only 1 out of 6 boxes for being considered undervalued, so it does not scream “bargain” at first glance. Of course, looking at all the classic valuation methods is just one part of the puzzle. Next, we will break down those methods, and before we are done, I will share a smarter way to think about whether Norfolk Southern is truly a deal at today’s price.

Norfolk Southern scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Norfolk Southern Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the true value of a business by projecting its future cash flows and then discounting those back to today. This process provides an intrinsic value for the company. For Norfolk Southern, the latest reported Free Cash Flow stands at $1.41 billion. Analysts forecast steady growth in cash generation, with projections reaching $2.86 billion by 2029. After that point, Simply Wall St extrapolates figures using historical trends, resulting in a forecast of over $3.5 billion in Free Cash Flow within a decade.

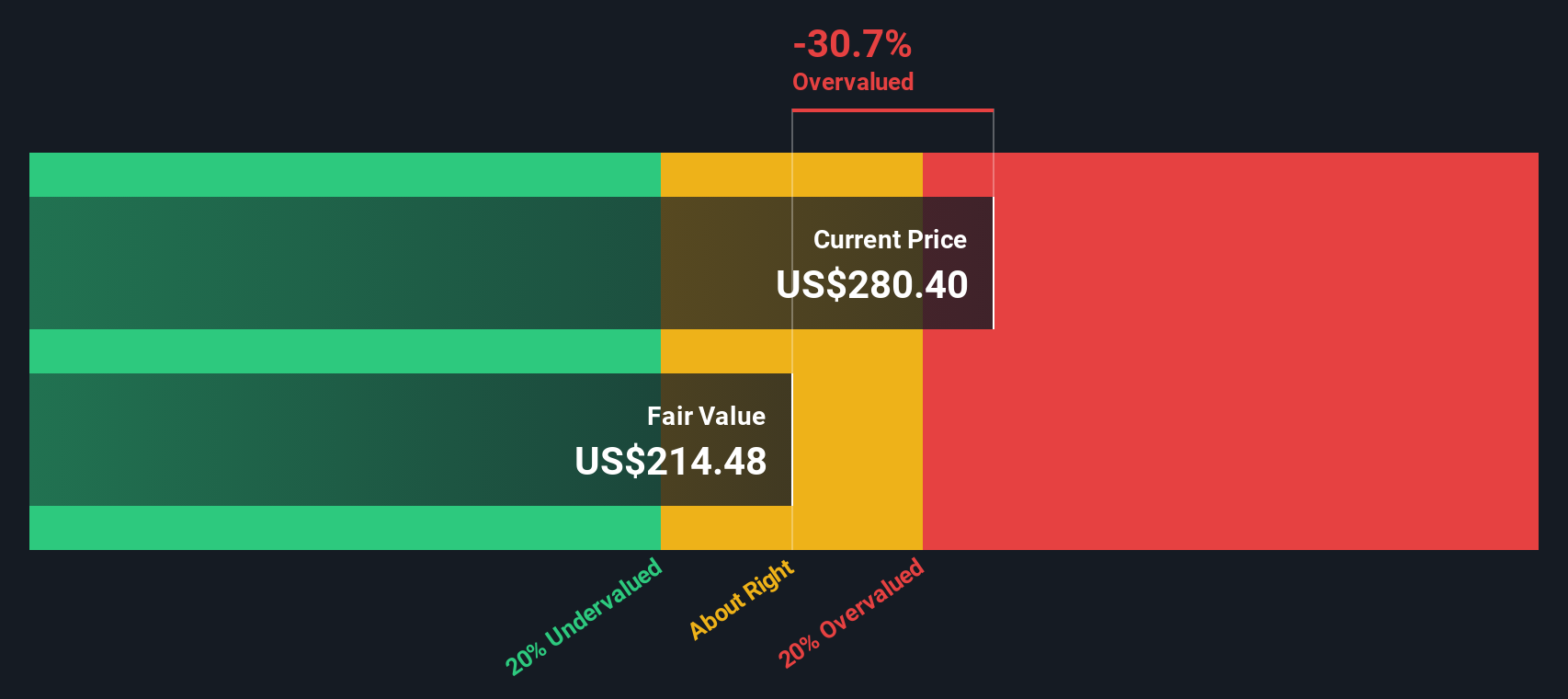

All cash flow numbers are in US dollars. These projections use the 2 Stage Free Cash Flow to Equity model, which is well suited for established companies like Norfolk Southern with a record of predictable cash flows. After discounting these future cash flows to the present, the resulting intrinsic value is calculated at $214.63 per share.

Comparing this intrinsic value to the company’s current trading price suggests the stock is approximately 31.2% overvalued according to this DCF approach. This indicates the market is pricing in greater growth or safety than the current projections justify.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Norfolk Southern may be overvalued by 31.2%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Norfolk Southern Price vs Earnings

The Price-to-Earnings (PE) ratio is a go-to metric for valuing profitable companies like Norfolk Southern because it shows how much investors are willing to pay for each dollar of earnings. Profitable, established firms with a solid track record of consistent earnings are well suited for this approach, making the PE ratio both intuitive and widely used.

Of course, what counts as a "normal" or "fair" PE ratio will reflect growth expectations and perceived risk. Fast-growing businesses or those seen as less risky often command higher PE ratios, while slower growers or riskier firms typically trade at lower multiples.

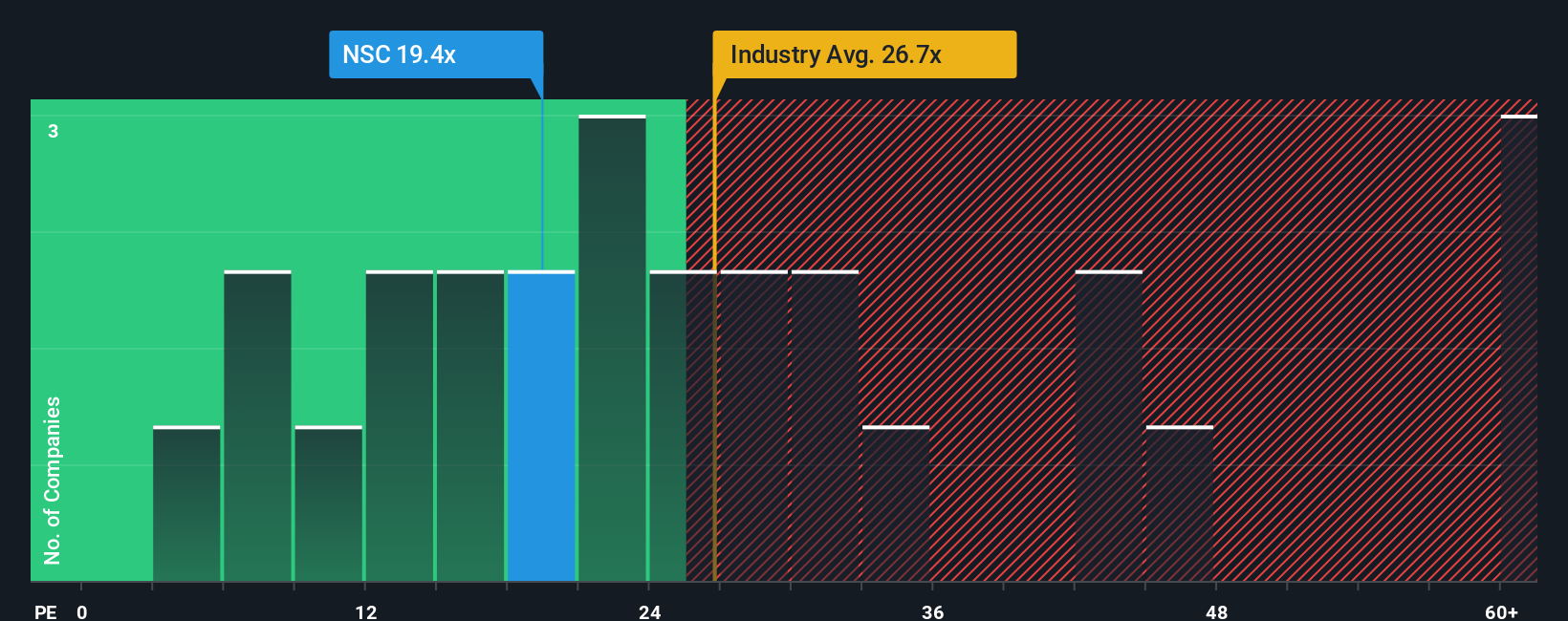

Currently, Norfolk Southern trades at 21.36x earnings. For context, this is above its peer group average of 20.47x but below the transportation industry average of 26.37x. More importantly, Simply Wall St's proprietary "Fair Ratio" provides a nuanced benchmark, adjusting for specific company factors like earnings growth, profit margins, industry landscape, market cap, and potential risks. For Norfolk Southern, the Fair Ratio is 16.89x, which is meaningfully lower than where the stock trades today.

While comparing to peers or industry averages gives some perspective, the Fair Ratio is a much sharper tool. It recognizes that not all companies within an industry have the same prospects, risk profiles, or profitability, and so it can adjust the bar accordingly.

With Norfolk Southern’s current PE ratio sitting several points above its Fair Ratio, the stock looks expensive relative to the risk and growth investors can reasonably expect at this point.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Norfolk Southern Narrative

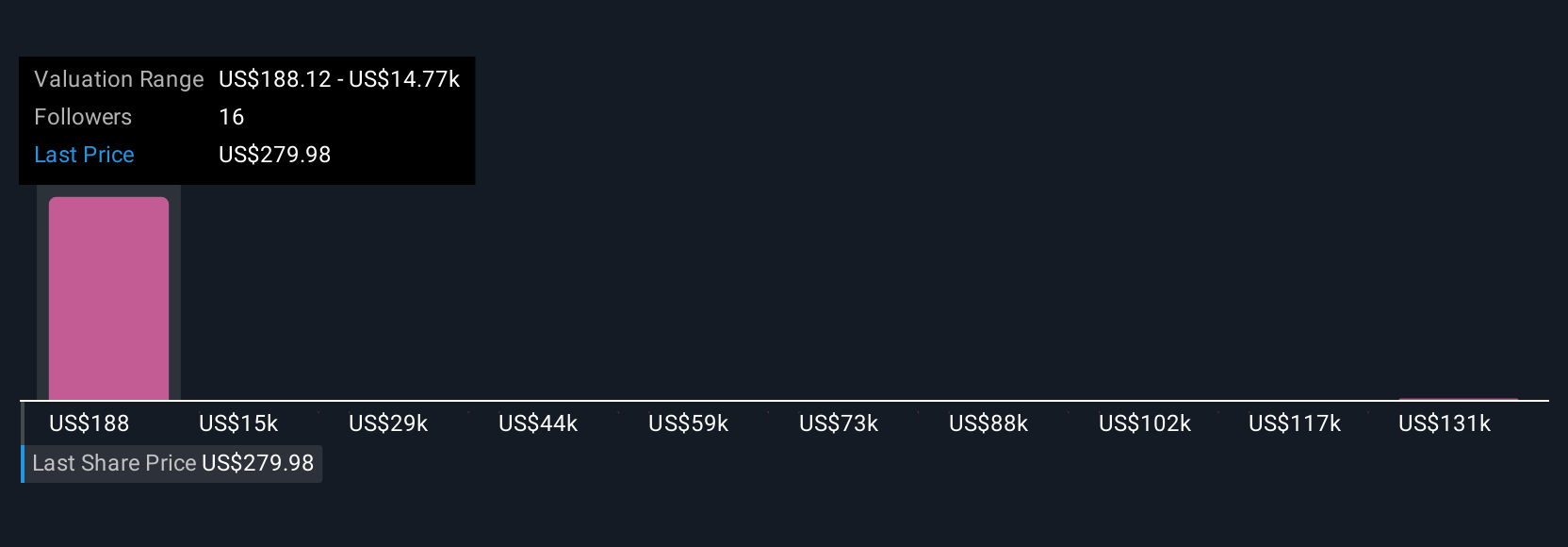

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative lets you clearly connect your own story about the company, what you believe about its future, the industry, potential risks, and opportunities, to a set of real financial forecasts and an estimate of fair value. On Simply Wall St’s Community page, millions of investors can now see and create Narratives, making this powerful tool accessible and easy to use for everyone, no spreadsheet required.

Narratives arm you with a structured way to decide when to buy or sell: you build or select a Narrative which reflects your view, see its resulting fair value, and instantly compare this to the latest share price. Because Narratives are dynamic, they automatically update whenever new news, earnings results, or fundamental data arrive, so your investment logic is always grounded in the freshest information.

For Norfolk Southern, one Narrative might be bullish, assuming full success with operational transformation, future earnings at the top end of analyst forecasts, and a fair value above $330. Another investor could lean bearish, highlighting regulatory risks and industry headwinds with a fair value closer to $235. The choice is yours: Narratives empower you to invest with conviction, clarity, and agility.

Do you think there's more to the story for Norfolk Southern? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Norfolk Southern might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NSC

Norfolk Southern

Engages in the rail transportation of raw materials, intermediate products, and finished goods in the United States.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives