- United States

- /

- Transportation

- /

- NYSE:NSC

How Investors Are Reacting To Norfolk Southern (NSC) Trimming Revenue Guidance Despite Beating Earnings Estimates

Reviewed by Simply Wall St

- Norfolk Southern recently reported second-quarter 2025 earnings that exceeded forecasts due to effective cost management, though railway operating revenues came in slightly below expectations and 2025 growth guidance was lowered.

- The announcement also highlighted increased operational pressures, including tariff-related disruptions and a cautious analyst outlook, underscoring ongoing industry challenges facing the company.

- We'll explore how Norfolk Southern's revised revenue guidance and ongoing economic uncertainties may reshape its investment narrative going forward.

AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Norfolk Southern Investment Narrative Recap

For shareholders, the core thesis in Norfolk Southern relies on management's ability to boost efficiency and contain costs, even as economic volatility and regulatory changes introduce risk. The recent earnings update, which featured an earnings beat driven by cost controls but softer revenues and reduced guidance, places greater weight on near-term revenue momentum. Right now, revenue consistency under ongoing tariff pressures remains the biggest catalyst, and the largest risk, while productivity improvements appear less likely to offset weak demand in the short run.

The most relevant recent announcement centers on Norfolk Southern's adjustment of its 2025 revenue growth guidance to 2-3%, a shift that directly ties to softer operating revenue and reflects a more cautious outlook. This move follows analyst downgrades and signals how external headwinds like tariffs and shifting trade flows may dampen expected improvements from ongoing efficiency initiatives.

Yet, with analyst expectations moving lower, the impact of further economic shocks on Norfolk Southern's ability to deliver stable margins is something investors should be aware of...

Read the full narrative on Norfolk Southern (it's free!)

Norfolk Southern's outlook anticipates $13.7 billion in revenue and $3.4 billion in earnings by 2028. This is based on a projected annual revenue growth rate of 3.9% and a $0.1 billion increase in earnings from the current $3.3 billion.

Uncover how Norfolk Southern's forecasts yield a $298.16 fair value, a 6% upside to its current price.

Exploring Other Perspectives

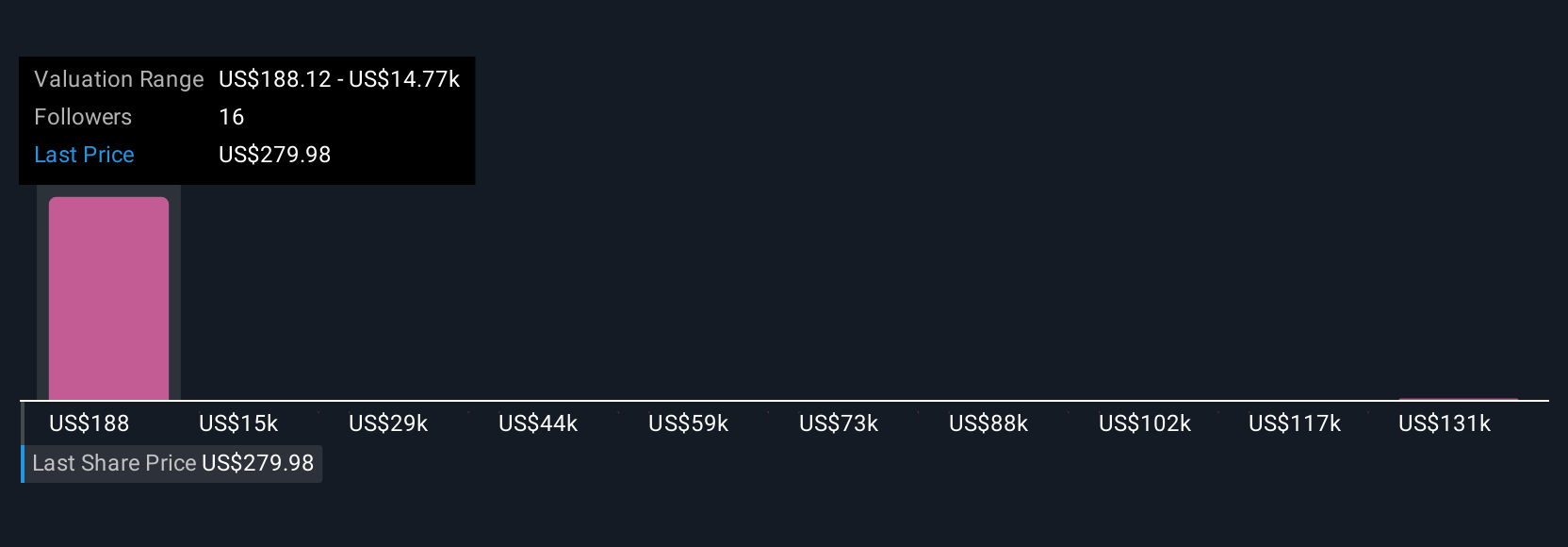

Seven members of the Simply Wall St Community put forward fair value estimates for Norfolk Southern that stretch from US$188 up to an outlier above US$146,000. This wide span in individual analyses stands in contrast to recent downward revisions in analyst revenue forecasts, reflecting just how differently investors may weigh the company's exposure to tariff risks and shifting demand patterns.

Explore 7 other fair value estimates on Norfolk Southern - why the stock might be worth 33% less than the current price!

Build Your Own Norfolk Southern Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Norfolk Southern research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Norfolk Southern research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Norfolk Southern's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Norfolk Southern might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NSC

Norfolk Southern

Engages in the rail transportation of raw materials, intermediate products, and finished goods in the United States.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives