- United States

- /

- Transportation

- /

- NYSE:NSC

A Fresh Look at Norfolk Southern (NSC) Valuation as Investors Weigh Recent Performance Data

Reviewed by Simply Wall St

Norfolk Southern (NSC) shares barely moved today, trading at $283.98 as investors digested recent performance data. With railroad operators facing a shifting demand landscape, the stock’s valuation is drawing some interest among market watchers.

See our latest analysis for Norfolk Southern.

Norfolk Southern’s latest share price is holding firm after a strong year-to-date run, with a 21.05% gain since January. Its 1-year total shareholder return of 11.02% underscores a steady but moderating momentum. Recent headlines have focused more on the sector’s broad shifts in demand rather than major company-specific events, so investors are watching carefully to see if these gains can be sustained through changing economic cycles.

If recent moves in rail and transport stocks have you thinking bigger, this could be an opportune moment to broaden your search and explore fast growing stocks with high insider ownership

With Norfolk Southern holding near highs, some investors are asking whether its solid fundamentals are still underappreciated or if current prices reflect all that future earnings growth has to offer. Is there still a buying opportunity here?

Most Popular Narrative: 8.9% Undervalued

Norfolk Southern’s fair value, based on the most widely followed narrative, is $311.63 per share, notably above the recent closing price of $283.98. The consensus points to a market that could be missing key drivers behind the company’s long-term outlook.

The company’s focus on increasing customer confidence through consistent service improvements is leading to meaningful market share gains, particularly in merchandise and intermodal segments, which could bolster future revenue growth.

Why do analysts see so much more potential ahead? Find out what set of assumptions on future sales, profit margins, and sector leadership justify paying a premium for Norfolk Southern. Don’t guess at the hidden math. Read the full narrative and see what’s fueling these projections.

Result: Fair Value of $311.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent industrial weakness and the risk of further storm-related costs could challenge Norfolk Southern’s path to sustainable margin improvement in the future.

Find out about the key risks to this Norfolk Southern narrative.

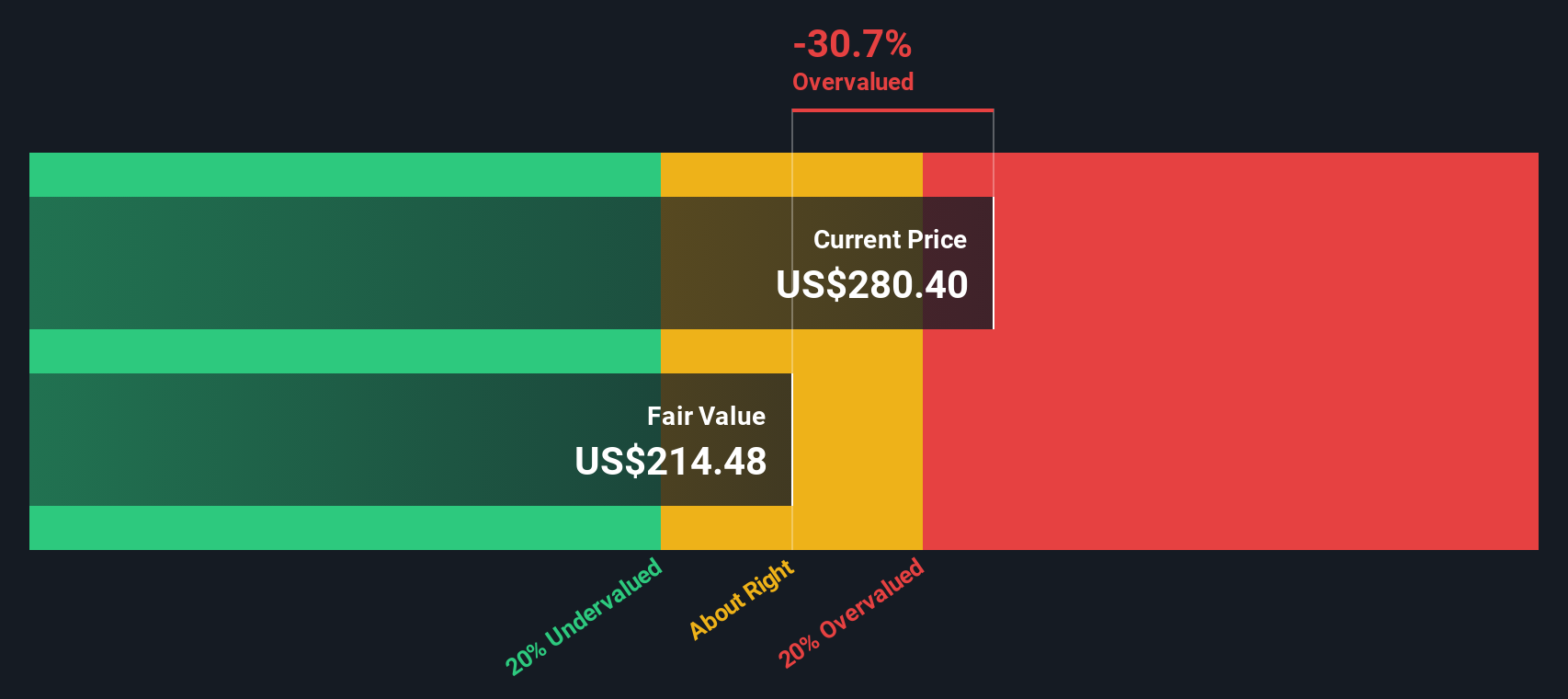

Another View: Our DCF Model Says Overvalued

While multiples suggest Norfolk Southern may be appealing compared to its industry, looking at our SWS DCF model paints a different picture. The DCF approach estimates fair value at $224.31, so shares are trading well above what future cash flows might justify. Are investors overlooking longer-term risks?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Norfolk Southern Narrative

If you see things differently or want to test your own assumptions, you can quickly build your own view and see how it stacks up. Do it your way

A great starting point for your Norfolk Southern research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don't let opportunities slip by when there are so many powerful ways to unlock your next winning investment with Simply Wall Street's tailored screeners.

- Maximize your yield and build steady income by reviewing these 16 dividend stocks with yields > 3% offering attractive payouts and resilient business models.

- Spot undervalued opportunities before the crowd by checking out these 879 undervalued stocks based on cash flows based on strong cash flow fundamentals and room for price growth.

- Strengthen your portfolio with exposure to the future of artificial intelligence by selecting from these 25 AI penny stocks. These companies are driving innovation and competitive edge in this high-growth space.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Norfolk Southern might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NSC

Norfolk Southern

Engages in the rail transportation of raw materials, intermediate products, and finished goods in the United States.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives