- United States

- /

- Marine and Shipping

- /

- NYSE:NMM

Navios Maritime Partners (NMM): A Fresh Look at Valuation After Recent Modest Stock Movements

Reviewed by Kshitija Bhandaru

Navios Maritime Partners (NYSE:NMM) is drawing attention after recent trading sessions, with its stock price moving modestly in both directions over the past week. Investors are watching to see how ongoing trends could shape the outlook.

See our latest analysis for Navios Maritime Partners.

Navios Maritime Partners’ share price may look fairly steady week to week, but zooming out shows the longer story. While the 1-year total shareholder return is essentially flat at -0.28%, patient holders have seen a strong 6.3% total return over five years. This suggests that long-term momentum still counts for more than recent minor reversals.

If you’re looking for new opportunities beyond the shipyard, now is the perfect time to broaden your investing search and discover fast growing stocks with high insider ownership

With shares trading at a sizable discount to analyst targets despite years of consistent returns, the question now is whether Navios Maritime Partners is an undervalued play for future gains or if the market has already factored in its potential growth.

Most Popular Narrative: 32.6% Undervalued

With the last close at $44.79, the narrative’s fair value estimate sits meaningfully higher. This sets the stage for a bullish reevaluation, especially if key company shifts play out.

Ongoing fleet renewal with significant investment in newer, more energy-efficient vessels positions Navios to capitalize on tightening environmental regulations. This results in lower operating costs and allows for premium charter rates, thereby supporting improved net margins and competitive advantage over peers with older fleets.

Curious what bold projections power this narrative’s upside? The path to the higher price target leans on aggressive profit improvements and strategic market pivots. Want to discover what financial assumptions fuel this optimism? The full narrative reveals the details behind the valuation lift.

Result: Fair Value of $66.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weak freight markets or costly new vessel investments could quickly challenge the bullish outlook and put pressure on future earnings and margins.

Find out about the key risks to this Navios Maritime Partners narrative.

Another View: Valuing by Earnings

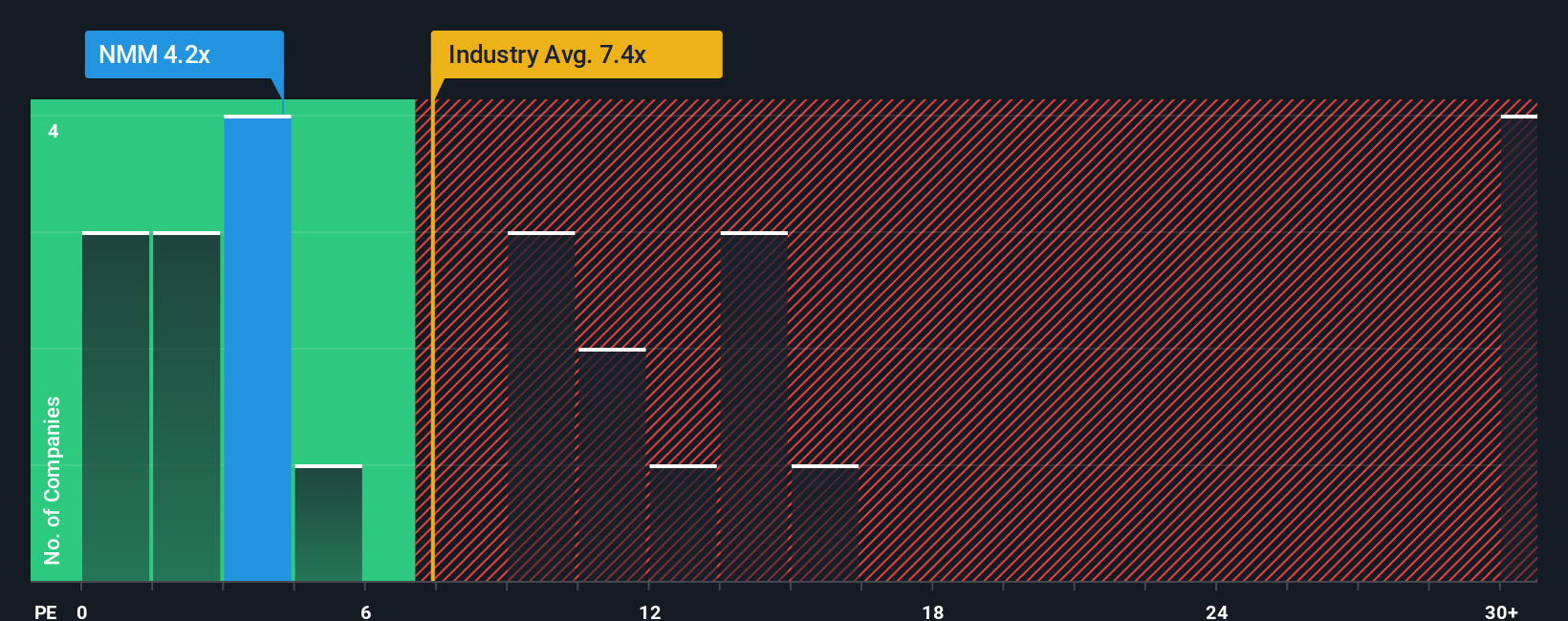

Analysing Navios Maritime Partners using earnings, the company's price-to-earnings ratio stands out at just 4.4x. This is noticeably lower than both the industry average of 8.2x and the calculated fair ratio of 11.8x. Does this discount show overlooked value, or is there a hidden risk?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Navios Maritime Partners for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Navios Maritime Partners Narrative

If the consensus view does not quite match your outlook, or you want to dive deeper into the facts, you can build your own narrative in just minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Navios Maritime Partners.

Looking for More Investment Ideas?

Broaden your horizons and boost your portfolio by acting on proven opportunities that suit every investing style. Don’t wait; these stocks won’t stay under the radar for long.

- Capture reliable income streams and inflation-defense strategies by targeting these 19 dividend stocks with yields > 3% with healthy yields above 3%.

- Take the lead on digital transformation trends and target financial growth with these 78 cryptocurrency and blockchain stocks powering the evolution of blockchain solutions.

- Spot the untapped potential of technology’s next wave with these 25 AI penny stocks in companies driving artificial intelligence breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Navios Maritime Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NMM

Navios Maritime Partners

Owns and operates dry cargo vessels in Asia, Europe, North America, and Australia.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives