- United States

- /

- Airlines

- /

- NYSE:LUV

Does Southwest’s Alaska Expansion and Premium Upgrades Change the Bull Case for LUV?

Reviewed by Sasha Jovanovic

- Southwest Airlines has announced plans to begin service to Anchorage, Alaska’s Ted Stevens Anchorage International Airport in the first half of 2026, adding its 43rd state and fifth new destination announced in 2025, and bringing its total network to 122 airports.

- This move coincides with a slate of in-flight and airport service upgrades, including assigned and premium seating, free Wi-Fi for loyalty members, and considerations for new lounge spaces at Dallas Love Field.

- We’ll explore how Southwest’s entry into the Alaskan market and its expanded premium customer offerings could influence its forward investment thesis.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Southwest Airlines Investment Narrative Recap

For investors in Southwest Airlines, a key belief centers on the company’s ability to convert network growth and customer service investments into sustained profitability, amid pressures from shifting travel demand and rising competition. While Southwest’s entry into Anchorage positions it for long-term network gains, this announcement is unlikely to materially shift the most critical short-term catalyst: improved booking volumes via new distribution channels. The greatest near-term risk remains unpredictable demand swings due to economic or sector volatility.

Among recent company updates, the introduction of assigned and premium seating, in conjunction with free Wi-Fi for loyalty members, stands out as most relevant. These changes align with efforts to capture higher-yield customers and improve revenue per available seat mile, tying directly to the ongoing catalyst of enhanced fare segmentation and customer loyalty initiatives.

However, investors should be mindful that, in contrast, the unpredictable impact of macro uncertainty on leisure travel demand could...

Read the full narrative on Southwest Airlines (it's free!)

Southwest Airlines is expected to reach $32.6 billion in revenue and $1.9 billion in earnings by 2028. This outlook assumes a 5.9% annual revenue growth rate and a $1.5 billion increase in earnings from the current $392 million.

Uncover how Southwest Airlines' forecasts yield a $32.51 fair value, in line with its current price.

Exploring Other Perspectives

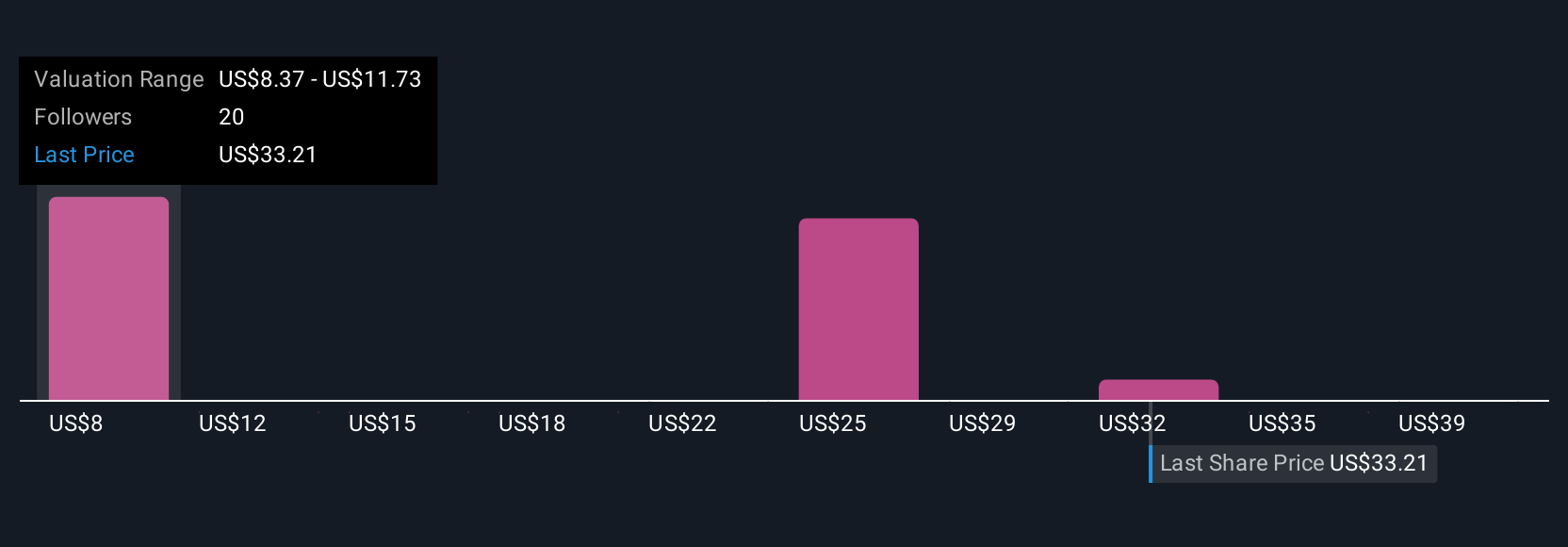

Simply Wall St Community members supplied eight fair value estimates for Southwest Airlines, spanning from US$7.89 up to US$45.91 per share. With economic unpredictability affecting leisure travel, strong differences in opinion highlight the importance of considering several viewpoints before acting.

Explore 8 other fair value estimates on Southwest Airlines - why the stock might be worth less than half the current price!

Build Your Own Southwest Airlines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Southwest Airlines research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Southwest Airlines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Southwest Airlines' overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LUV

Southwest Airlines

Operates as a passenger airline company that provides scheduled air transportation services in the United States and near-international markets.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives