- United States

- /

- Transportation

- /

- NYSE:KNX

Is Knight-Swift’s (KNX) Profit Decline and Legal Scrutiny Shifting Its Medium-Term Investment Case?

Reviewed by Sasha Jovanovic

- Knight-Swift Transportation Holdings reported third quarter 2025 results that included US$1.72 billion in sales and net income of US$7.86 million, reflecting a large decline from the prior year due to significant one-time charges related to its insurance business and intangible assets.

- The disclosure of these unexpected charges has triggered a legal investigation into the company’s communications around its financial risks during 2025, raising new questions for stakeholders.

- Next, we examine how the decline in profitability and legal scrutiny may influence Knight-Swift's medium-term investment outlook.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Knight-Swift Transportation Holdings Investment Narrative Recap

To be a shareholder in Knight-Swift Transportation Holdings, you need to believe that the company’s ongoing investments in expanding its less-than-truckload (LTL) segment and technology can deliver meaningful operating leverage as macro conditions improve. The recent profit decline and legal review around financial disclosures underscore how quickly one-time charges or communication issues can reshape the short-term picture, making revenue growth from LTL a less prominent catalyst until transparency and risk management concerns subside.

The third-quarter 2025 earnings announcement is most relevant to the current situation, as it revealed a sizeable hit to earnings stemming from write-downs in the insurance and intangible asset accounts, as well as highlighted ongoing operating ratio pressure in LTL due to DHE integration costs. This has amplified the spotlight on management’s ability to manage the upfront costs, integration process, and effective communication of risks to all stakeholders as they work toward stabilizing profits and regaining trust.

By contrast, while the company’s long-term growth plans remain intact, investors should pay close attention to how unresolved questions surrounding past disclosures could...

Read the full narrative on Knight-Swift Transportation Holdings (it's free!)

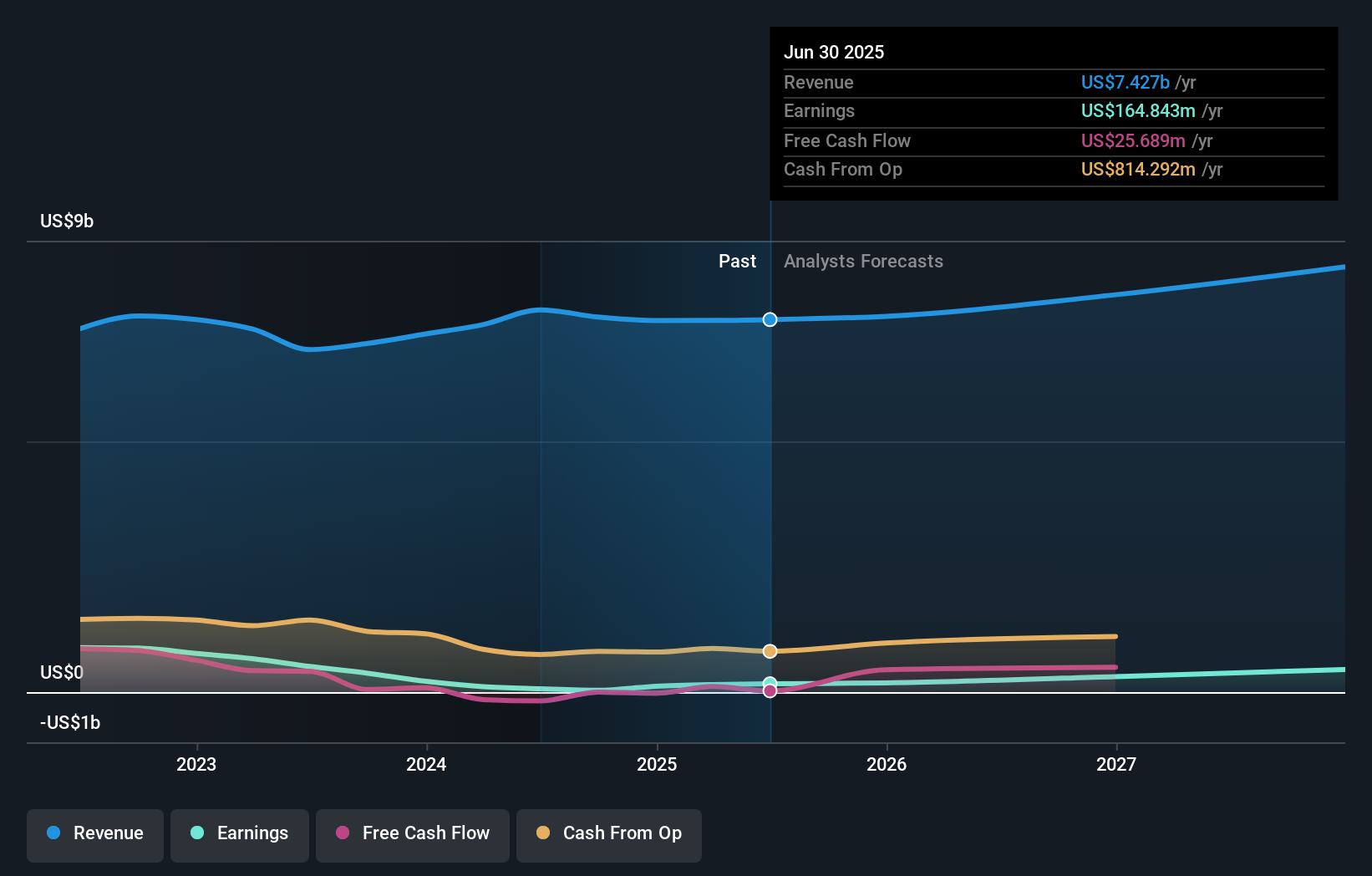

Knight-Swift Transportation Holdings is projected to reach $8.7 billion in revenue and $524.7 million in earnings by 2028. This outlook is based on an expected 5.3% annual revenue growth rate and an increase in earnings of $359.9 million from the current $164.8 million.

Uncover how Knight-Swift Transportation Holdings' forecasts yield a $53.25 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Retail investors in the Simply Wall St Community estimate Knight-Swift’s fair value in a range from US$53.25 to US$66.05, based on their own growth forecasts. With only two perspectives included and ongoing legal scrutiny adding complexity, you may want to consider how sudden risk events can challenge all assumptions, explore the broader community sentiment and perspectives for a complete picture.

Explore 2 other fair value estimates on Knight-Swift Transportation Holdings - why the stock might be worth as much as 46% more than the current price!

Build Your Own Knight-Swift Transportation Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Knight-Swift Transportation Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Knight-Swift Transportation Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Knight-Swift Transportation Holdings' overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Knight-Swift Transportation Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KNX

Knight-Swift Transportation Holdings

Provides freight transportation services in the United States and Mexico.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives