- United States

- /

- Marine and Shipping

- /

- NYSE:KEX

How Kirby’s (KEX) $609 Million Share Buyback Could Reshape Its Investment Narrative

Reviewed by Simply Wall St

- Between April 1 and August 8, 2025, Kirby bought back 531,900 shares for US$51.16 million, marking the completion of a long-term repurchase program totaling 7,356,458 shares, or 12.99% of its outstanding shares, at an aggregate cost of US$609.43 million.

- The conclusion of this buyback means Kirby has retired a significant proportion of its equity, a move that can concentrate future earnings among remaining shareholders and impact financial metrics per share.

- With the buyback finished, we will consider how this reduction in share count influences Kirby’s investment narrative and key growth assumptions.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Kirby Investment Narrative Recap

To be a Kirby shareholder, you have to believe that its dominant position in US inland marine transportation and distribution will overcome sector-specific volatility, cost pressures, and cyclicality, delivering consistent earnings ahead of industry peers. The just-completed buyback retires nearly 13% of Kirby’s equity, but this is not likely to materially shift the major near-term catalyst, steady demand for barge transport amid supply constraints, or alter the most immediate challenge, softness in chemical markets and labor cost headwinds.

The most relevant recent announcement is Kirby’s July 2025 earnings report, which showed growth in quarterly revenue and profit, with basic EPS rising to US$1.68. This incremental growth is more visible now that the buyback has reduced the share count, yet the largest risks, especially barge utilization tied to macroeconomic chemical volumes, remain front of mind as the buyback’s impact on underlying business conditions is limited.

However, for investors it is critical to recognize that against a backdrop of improving EPS, challenges like rising labor costs...

Read the full narrative on Kirby (it's free!)

Kirby's narrative projects $3.9 billion revenue and $450.7 million earnings by 2028. This requires 6.0% yearly revenue growth and a $147.7 million earnings increase from $303.0 million.

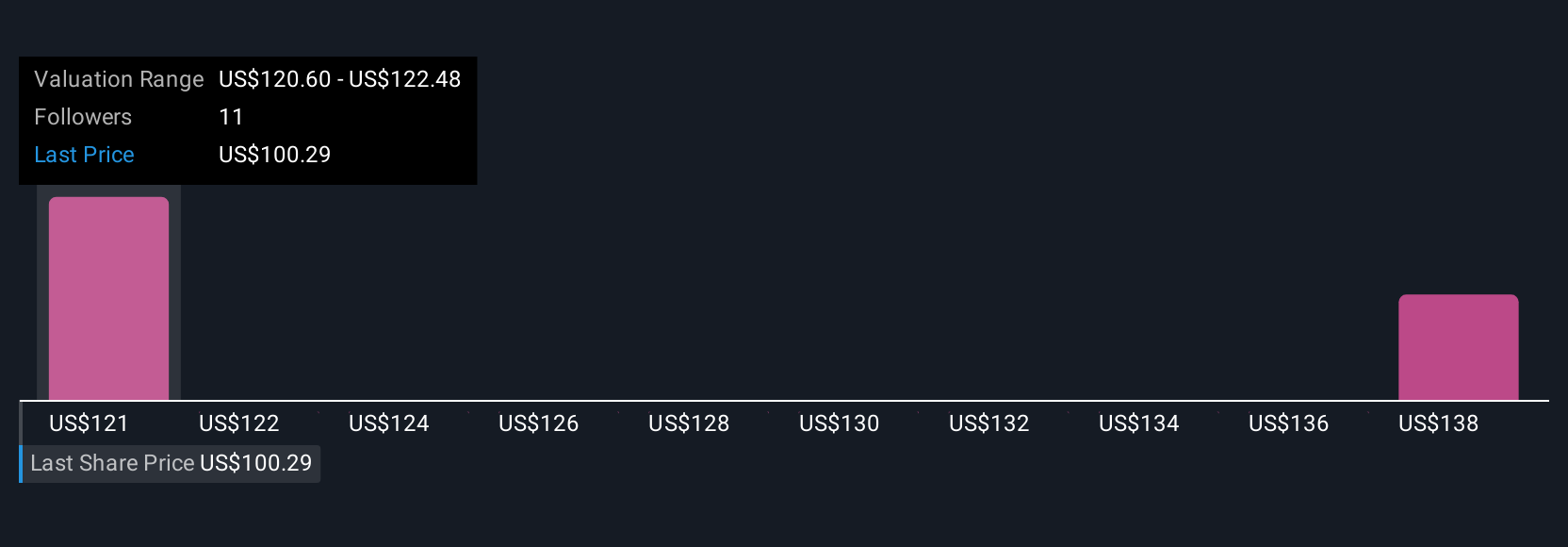

Uncover how Kirby's forecasts yield a $120.60 fair value, a 20% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members supplied two fair value estimates for Kirby ranging from US$60.29 to US$120.60 per share. While opinions vary, ongoing pressure on US petrochemical shipping volumes continues to shape expectations about Kirby’s future performance, so review several viewpoints before forming your own outlook.

Explore 2 other fair value estimates on Kirby - why the stock might be worth as much as 20% more than the current price!

Build Your Own Kirby Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kirby research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Kirby research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kirby's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kirby might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KEX

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives