- United States

- /

- Marine and Shipping

- /

- NYSE:KEX

A Look at Kirby (KEX) Valuation Following New U.S. Truck Import Tariff Decision

Reviewed by Kshitija Bhandaru

The U.S. government's announcement of a 25% tariff on imported medium and heavy-duty trucks has caught the attention of transportation sector investors. Kirby (NYSE:KEX), while rooted in marine transportation, could still feel ripple effects from this policy shift.

See our latest analysis for Kirby.

Kirby’s share price has come under pressure this year, with a decline of 22.3% year-to-date and a 1-year total shareholder return of -32.3%, pointing to fading momentum. Even with last year’s tough backdrop, the company’s 5-year total return of 113.9% shows it still has strong long-term credentials if market confidence returns.

If this shift in sentiment has you thinking about where to look next, it may be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

The big question now is whether Kirby’s falling share price signals an undervalued opportunity, or if the current valuation already reflects muted growth prospects and ongoing industry headwinds.

Most Popular Narrative: 28.6% Undervalued

Kirby's most widely followed narrative sees fair value running significantly ahead of the last close at $81.54. This suggests a notable upside and brings bold assumptions about future industry growth and Kirby's positioning into focus. Ready for a glimpse into the logic behind the optimism?

Data center-driven demand for power generation equipment is fueling a robust and growing backlog in Kirby's Distribution and Services segment. This indicates sustained multi-year revenue and earnings growth, particularly as data center and industrial investments accelerate nationwide.

Want to know what fuels that high price target? The narrative is built around aggressive revenue expansion, rising profit margins, and a future profit multiple usually reserved for sector leaders. Curious which forecasts carry the most weight? The numbers powering this valuation could surprise you.

Result: Fair Value of $114.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, key risks, such as declining chemical shipping volumes or persistent cost pressures, could quickly challenge this optimistic outlook and limit Kirby’s upside potential.

Find out about the key risks to this Kirby narrative.

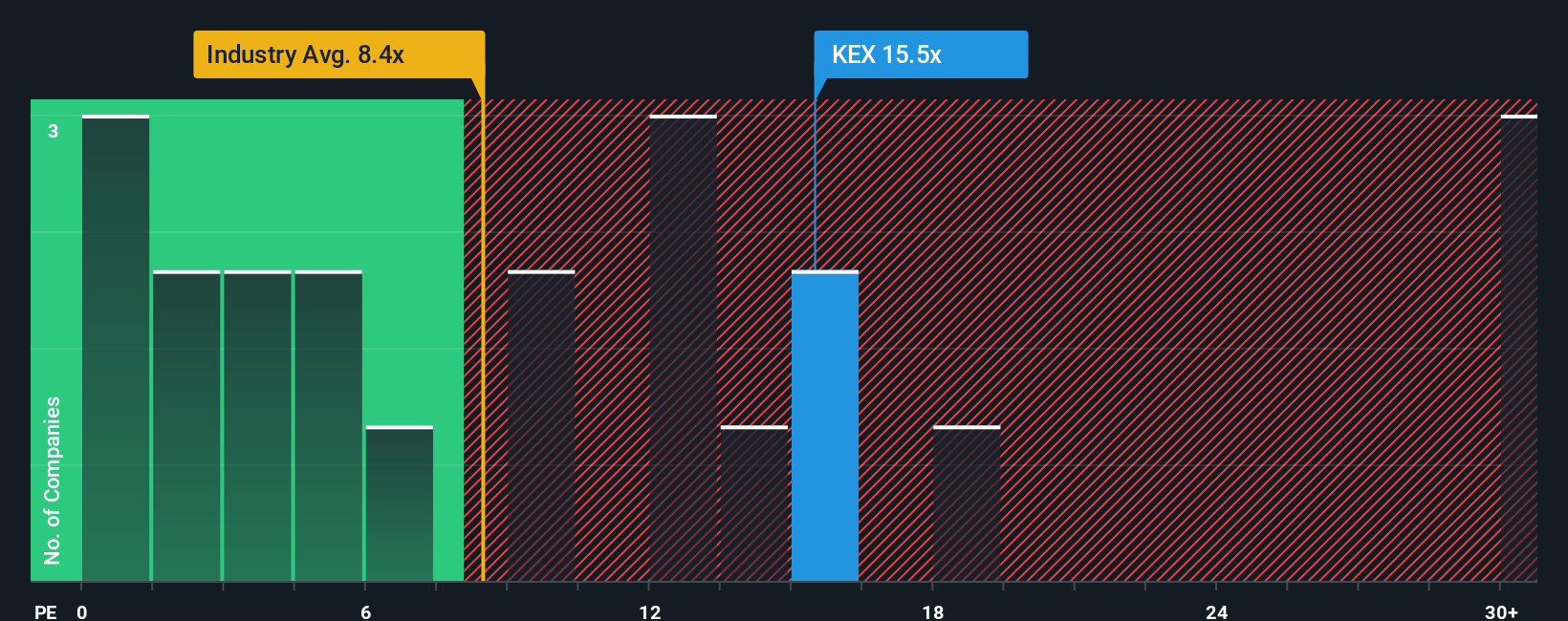

Another View: Looking at Earnings Ratios

While optimistic earnings forecasts support a higher price target, Kirby's current price-to-earnings ratio stands at 15x, which is nearly double the industry average of 8.2x and well above its fair ratio of 12.1x. This premium raises questions about how much future growth is already factored into today's price, and whether the stock has room to run or risks running out of steam.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kirby Narrative

If you see the story differently or want to dig deeper into the data yourself, you can build a narrative of your own in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Kirby.

Looking for More Investment Ideas?

Don’t let the next top stock slip through your fingers. The Simply Wall Street Screener gives you a head start on market-beating opportunities you might not have considered.

- Uncover high-yield potential and steady income by reviewing these 19 dividend stocks with yields > 3%, which offers consistent returns above 3% annually.

- Spot breakout trends and innovation leaders when you evaluate these 25 AI penny stocks, benefiting from advancements in artificial intelligence and automation.

- Harness growth before the crowd and analyze these 3577 penny stocks with strong financials, gaining momentum with strong financials and unique value propositions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kirby might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KEX

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives