- United States

- /

- Airlines

- /

- NYSE:JOBY

Is Goldman’s Skepticism of Joby (JOBY) Highlighting a Deeper Question About Its Operator Model?

Reviewed by Sasha Jovanovic

- In recent days, Goldman Sachs initiated coverage on Joby Aviation with a Sell rating, highlighting concerns around the company’s high valuation, regulatory hurdles and capital-intensive operator model despite its lead in eVTOL certification and growing international test operations.

- At the same time, Joby has been expanding real-world flight activity in the UAE and pursuing new test facilities in California, underscoring the tension between its operational progress and increasing analyst skepticism.

- We’ll now examine how this tension between Joby’s certification lead and Goldman’s concerns about its operator model shapes the investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is Joby Aviation's Investment Narrative?

To own Joby today, you have to believe that its first-mover edge in eVTOL certification and its early footholds in places like Dubai and Saudi Arabia can eventually justify an expensive, still pre-revenue story. The core near-term catalysts remain FAA type certification progress, successful piloted and pre-commercial flights in the Gulf, and the build-out of vertiports and manufacturing capacity in California and Ohio. Goldman’s new Sell rating, coming after a very large one-year share price gain and a secondary offering, does not change those operational milestones, but it does sharpen the focus on valuation, execution risk in Joby’s vertically integrated operator model, and the likelihood of further capital raises. The recent pullback suggests sentiment can swing quickly as investors reassess how much to pay for that vision.

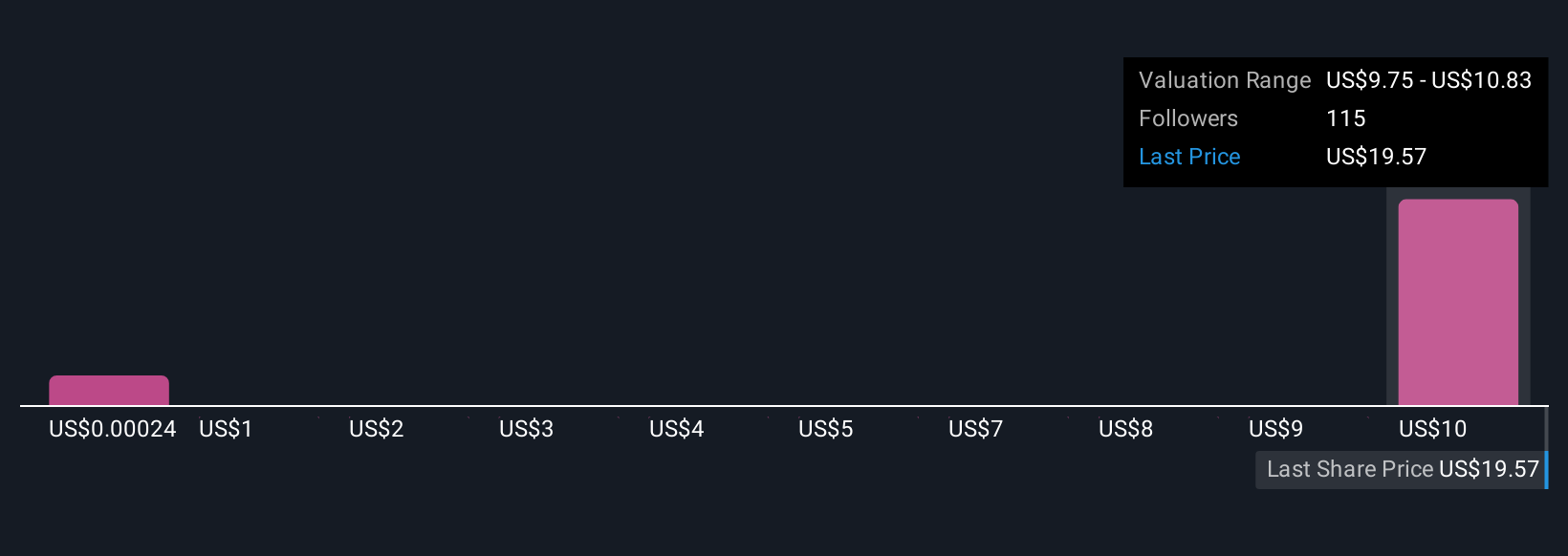

However, investors should be aware of how capital intensity could shape future shareholder returns. Our valuation report unveils the possibility Joby Aviation's shares may be trading at a premium.Exploring Other Perspectives

Explore 13 other fair value estimates on Joby Aviation - why the stock might be worth less than half the current price!

Build Your Own Joby Aviation Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Joby Aviation research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Joby Aviation research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Joby Aviation's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JOBY

Joby Aviation

A vertically integrated air mobility company, engages in building an electric vertical takeoff and landing aircraft optimized to deliver air transportation as a service in the United States and Dubai.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

GOOGL: AI Platform Expansion And Cloud Demand Will Support Durable Performance Amid Competitive Pressures

Trending Discussion