- United States

- /

- Logistics

- /

- NYSE:GXO

Evaluating GXO Logistics (GXO) After New European Bond Issue and Relaxed Leverage Covenants

Reviewed by Simply Wall St

GXO Logistics (GXO) just moved to sharpen its balance sheet, tweaking key leverage covenants to net more cash and locking in €500 million of 3.75% senior notes in its first European bond deal.

See our latest analysis for GXO Logistics.

The financing moves come after a choppy stretch, with a 30 day share price return of negative 9.32% but an 18.34% share price return year to date and a 17.44% three year total shareholder return. This suggests improving momentum despite more muted recent performance.

If GXO's refinancing story has your attention, this could be a good moment to explore fast growing stocks with high insider ownership as you look for other compelling ideas beyond logistics.

But with leverage rules relaxed, fresh euro debt secured and shares trading about 25% below analyst targets, is GXO quietly mispriced after a rocky year, or is the market already pricing in its next leg of growth?

Most Popular Narrative: 20.3% Undervalued

With GXO Logistics last closing at $50.97 against a narrative fair value of $63.94, the story frames the stock as meaningfully mispriced and increasingly leveraged to a freight and contract cycle recovery.

Enhanced deployment of automation, AI, and proprietary software (with recent launches like GXO IQ) is rapidly improving warehouse productivity, reducing labor costs, and increasing operational efficiency, which is beginning to drive margin expansion and should positively impact net earnings and EBITDA margins.

Want to see how steady contract wins, rising margins and shrinking share count come together in this valuation playbook? The narrative spells out the exact growth path, profitability lift and future earnings multiple that need to line up for this upside to materialise. Curious which assumptions really carry the fair value, and how aggressive they are versus today’s thin margins? Read on to unpack the full blueprint behind that target.

Result: Fair Value of $63.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the bullish script could unravel if Wincanton integration stumbles or macro headwinds slow key customers, which could pressure margins and delay that earnings ramp.

Find out about the key risks to this GXO Logistics narrative.

Another Lens On Valuation

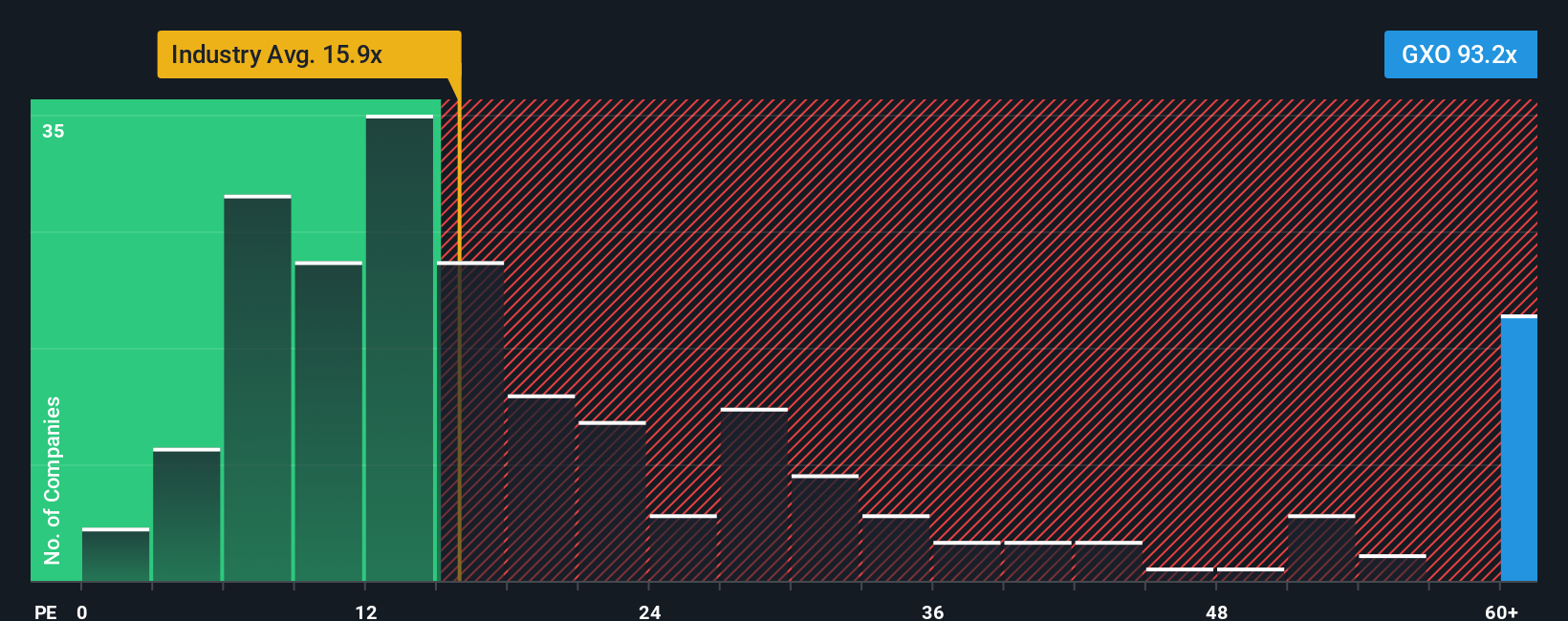

Step away from the narrative fair value, and the picture looks harsher. On a price to earnings basis, GXO trades at about 65.6 times, far richer than the logistics industry at 16 times, peers at 22.7 times, and even its own 41.3 times fair ratio. This raises the risk that any stumble could hit the share price hard.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own GXO Logistics Narrative

If you see the numbers differently or would rather dig into the details yourself, you can quickly shape a custom view in under three minutes: Do it your way.

A great starting point for your GXO Logistics research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop at one opportunity. Use the Simply Wall St Screener to surface fresh, data driven stocks that could sharpen your portfolio’s long term edge.

- Capture potential mispricings by targeting companies trading below intrinsic value through these 927 undervalued stocks based on cash flows grounded in detailed cash flow analysis.

- Ride structural growth trends by focusing on innovators in machine learning and automation via these 25 AI penny stocks with strong momentum stories.

- Strengthen your income stream by zeroing in on reliable payers using these 14 dividend stocks with yields > 3% offering yields above 3% with solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GXO

Moderate growth potential with very low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026