- United States

- /

- Marine and Shipping

- /

- NYSE:GNK

Genco Shipping & Trading Limited's (NYSE:GNK) Shareholders Might Be Looking For Exit

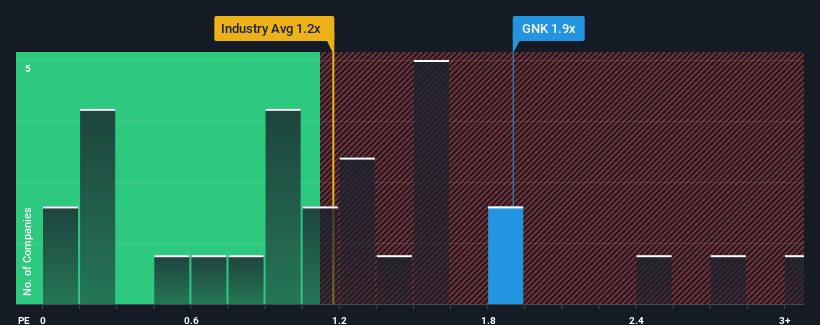

Genco Shipping & Trading Limited's (NYSE:GNK) price-to-sales (or "P/S") ratio of 1.9x may not look like an appealing investment opportunity when you consider close to half the companies in the Shipping industry in the United States have P/S ratios below 1.2x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Genco Shipping & Trading

How Has Genco Shipping & Trading Performed Recently?

With revenue that's retreating more than the industry's average of late, Genco Shipping & Trading has been very sluggish. One possibility is that the P/S ratio is high because investors think the company will turn things around completely and accelerate past most others in the industry. If not, then existing shareholders may be very nervous about the viability of the share price.

Keen to find out how analysts think Genco Shipping & Trading's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Genco Shipping & Trading would need to produce impressive growth in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 33%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 7.2% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the eight analysts covering the company are not good at all, suggesting revenue should decline by 7.1% per annum over the next three years. With the rest of the industry predicted to shrink by 0.04% each year, it's a sub-optimal result.

With this information, it's strange that Genco Shipping & Trading is trading at a higher P/S in comparison. With revenue going quickly in reverse, it's not guaranteed that the P/S has found a floor yet. There's strong potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth.

The Bottom Line On Genco Shipping & Trading's P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Genco Shipping & Trading currently trades on a much higher than expected P/S since its revenue forecast is even worse than the struggling industry. When we see a weak revenue outlook, we suspect the share price is at risk of declining, sending the high P/S lower. In addition, we would be concerned whether the company's revenue prospects could slide further under these tough industry conditions. Unless there's a material improvement in the forecast revenue growth for the company, it's hard to justify the share price at current levels.

Having said that, be aware Genco Shipping & Trading is showing 3 warning signs in our investment analysis, and 1 of those doesn't sit too well with us.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:GNK

Genco Shipping & Trading

Engages in the ocean transportation of drybulk cargoes worldwide.

Flawless balance sheet average dividend payer.