- United States

- /

- Logistics

- /

- NYSE:FDX

Will FedEx’s (FDX) Board Decisions Shape Its Strategy or Signal Deeper Operational Challenges?

Reviewed by Sasha Jovanovic

- At its annual meeting held on September 29, 2025, FedEx shareholders elected Richard W. Smith as director and voted down a proposal for an independent board chairman, while the company also extended its senior notes exchange offer and advanced its sustainability initiatives.

- Recent developments highlight FedEx's push towards corporate governance continuity and environmental commitments, but ongoing volatility and operational challenges are driving renewed attention to the company’s financial fundamentals.

- We’ll explore how cost-cutting and persistent economic headwinds are reshaping FedEx’s investment narrative amid the company’s mixed operational signals.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

FedEx Investment Narrative Recap

To own FedEx shares today, investors need confidence in the company's ability to convert structural cost-cutting and efficiency programs into stronger net margins, despite a maturing global delivery market. Recent board and governance news, such as the election of Richard W. Smith and retention of the combined chairman and CEO roles, does not materially impact the key near-term catalysts, which continue to center on the ramp-up of the DRIVE cost-saving initiative while international shipping and macroeconomic uncertainty remain the largest risks to earnings momentum.

The extension of FedEx’s senior notes exchange offer stands out among recent announcements, as it signals active management of the company's debt profile, although it does not shift the narrative around short-term profitability or execution on cost-saving goals. While the extension provides flexibility, investors remain focused on whether FedEx’s ongoing initiatives can offset the pressure from weak international shipping volumes and unpredictable economic trends.

By contrast, investors may want to pay attention to...

Read the full narrative on FedEx (it's free!)

FedEx’s outlook anticipates $95.1 billion in revenue and $5.2 billion in earnings by 2028. This projection is based on annual revenue growth of 2.6% and a $1.1 billion increase in earnings from the current $4.1 billion.

Uncover how FedEx's forecasts yield a $266.39 fair value, a 16% upside to its current price.

Exploring Other Perspectives

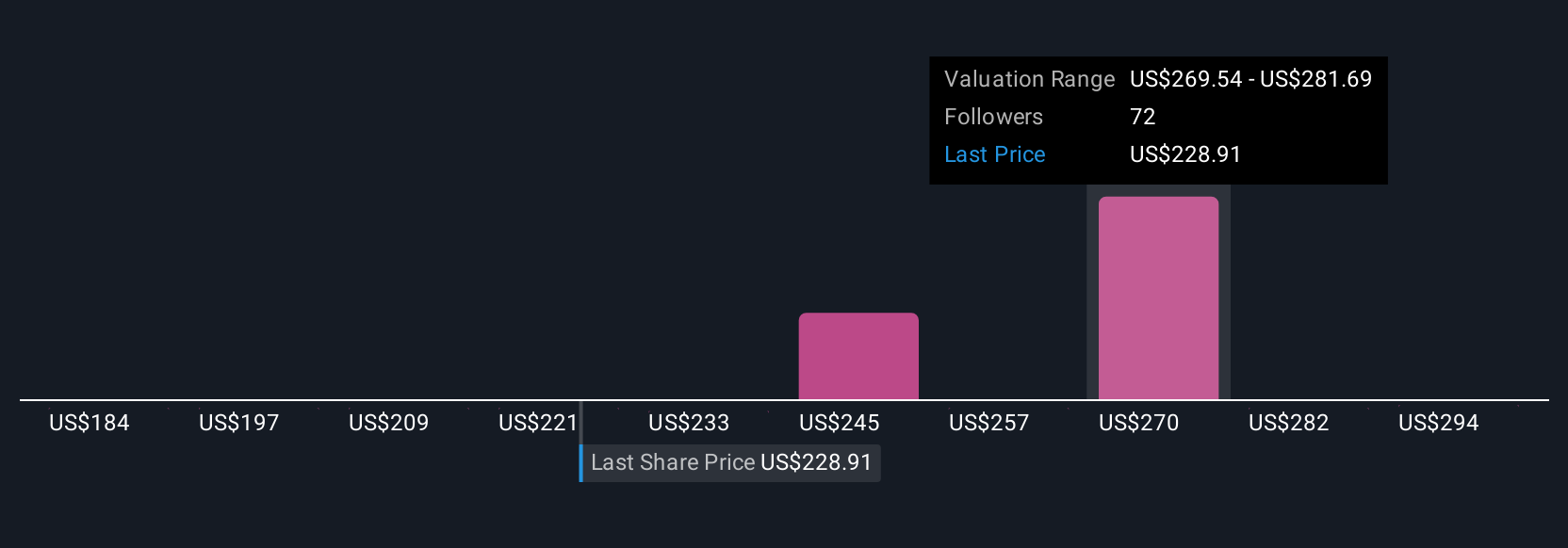

Simply Wall St Community members estimate FedEx’s fair value from US$215.68 to US$406.50 based on 11 opinions. Persistent yield pressure in international shipping highlights the importance of exploring how differing market outlooks could affect your conviction in owning the stock.

Explore 11 other fair value estimates on FedEx - why the stock might be worth 6% less than the current price!

Build Your Own FedEx Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FedEx research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free FedEx research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FedEx's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FDX

FedEx

Provides transportation, e-commerce, and business services in the United States and internationally.

Undervalued established dividend payer.

Market Insights

Community Narratives