- United States

- /

- Logistics

- /

- NYSE:FDX

FedEx (NYSE:FDX) Reports Q4 Earnings Growth, Completes US$2.9 Billion Share Buyback

Reviewed by Simply Wall St

In the latest month, FedEx (NYSE:FDX) experienced a share price increase of 6%, which aligns with the recent 1.9% climb in the broader market. The company's fourth-quarter earnings announcement on June 24, 2025, highlighted a 5% increase in diluted EPS, reinforcing positive investor sentiment. Additionally, the company's share buyback activities, where FedEx repurchased roughly 0.84% of its outstanding shares, likely contributed to investor optimism. Nonetheless, the unfortunate passing of Founder Frederick W. Smith and the resulting executive changes provided a counterweight to the positive financial performance. Overall, FedEx's monthly performance reflects broader market trends with some unique underlying developments.

We've discovered 1 warning sign for FedEx that you should be aware of before investing here.

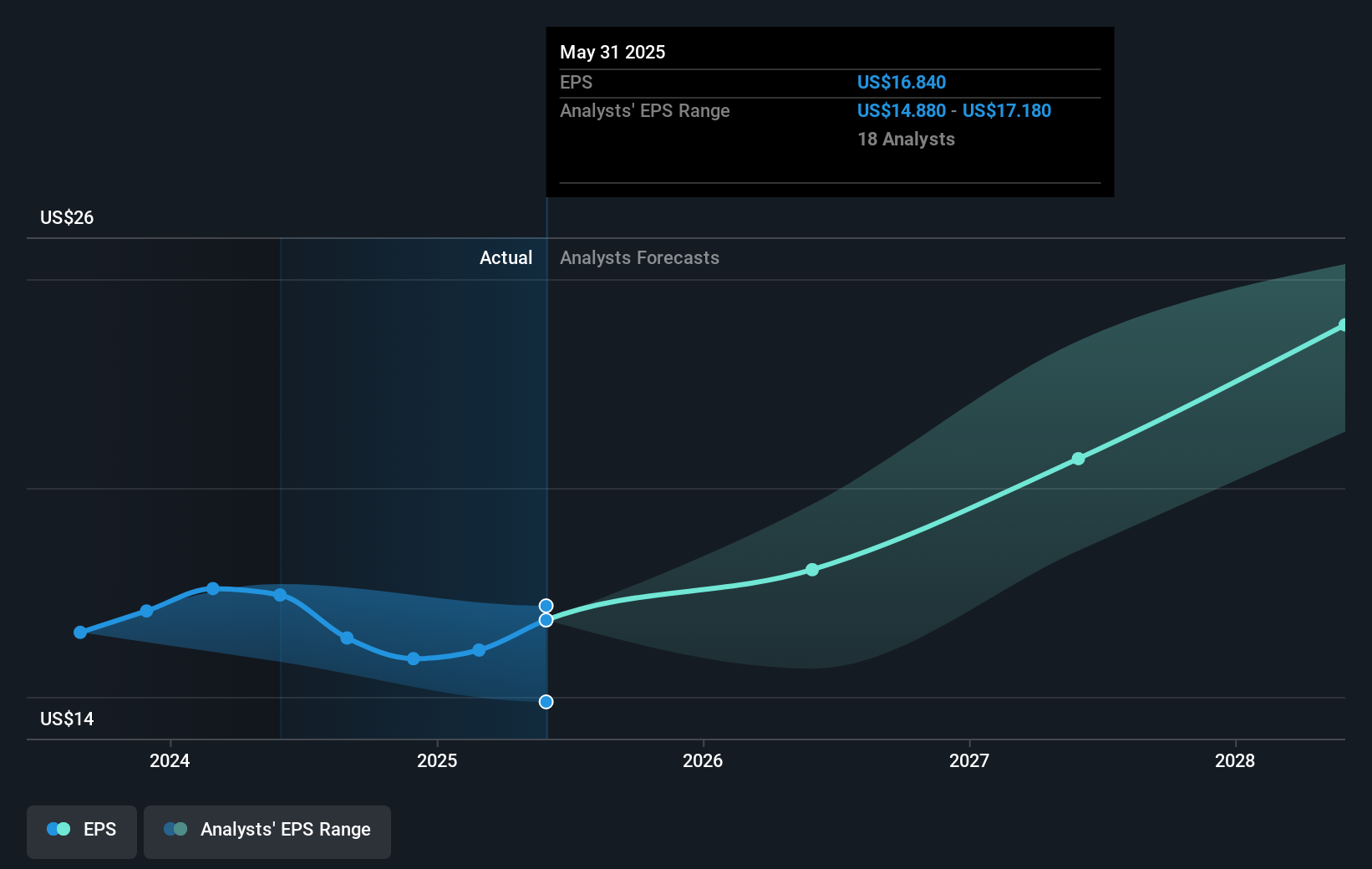

The news of FedEx's modest 6% share price increase, aligned with the broader market trends, and the 5% hike in diluted EPS highlights a cautiously positive sentiment among investors. However, the management changes following the passing of Founder Frederick W. Smith could introduce uncertainty, potentially impacting the company's long-term strategic initiatives like DRIVE and Network 2.0, which aim to enhance efficiency and reduce costs. These developments may influence analysts' revenue and earnings forecasts, as strategic execution may face hurdles amid evolving leadership dynamics.

Over the last five years, FedEx's total shareholder return, including dividends, was 60.25%, illustrating strong longer-term performance. Despite a challenging year where FedEx matched the US Logistics industry's decline of 21.8%, this longer-term return provides a more comprehensive context of the company's resilience and growth capabilities. The current share price stands at US$213.41, highlighting a 23.2% discount to the consensus analyst price target of US$277.78. This indicates a potential undervaluation, where driving factors such as strategic initiatives and market dynamics will play a crucial role in determining if the share price will align more closely with the price target in the future.

Understand FedEx's track record by examining our performance history report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FDX

FedEx

Provides transportation, e-commerce, and business services in the United States and internationally.

Established dividend payer and good value.

Market Insights

Community Narratives