- United States

- /

- Logistics

- /

- NYSE:FDX

FedEx (FDX) Valuation: Is There Still Upside After Recent Share Price Gains?

Reviewed by Simply Wall St

Shares of FedEx (FDX) have delivered steady gains over the past month, rising about 9%. Investors have recently shown renewed interest as the company’s core delivery and logistics business continues to adapt in a shifting economic environment.

See our latest analysis for FedEx.

FedEx’s 1-month share price return of 8.6% reflects fresh optimism around its adaptability in a complex environment, following several operational updates and ongoing efficiency drives. While momentum is picking up in the short term, the stock’s 1-year total shareholder return is still in negative territory. This hints at some lingering caution. However, a standout 66.8% total return over the past three years signals that long-term investors have still come out well ahead.

Curious about where else you might find strong returns and growth stories? It might be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With FedEx shares rebounding recently, the key question is whether the current price still reflects hidden value and room for upside, or if the market is already factoring in the company’s improved prospects and future growth potential.

Most Popular Narrative: 1.4% Overvalued

The narrative sees FedEx trading modestly above its fair value estimate, with the last closing price at $275.68 compared to a narrative fair value of $271.93. This sets the tone for a nuanced discussion on the valuation outlook, weighing recent operational wins against ongoing risks.

The Network 2.0 project aims to optimize 50 U.S. stations, streamlining operations to improve efficiency. By enabling about 12% of FedEx's daily global volume to flow through optimized facilities by the end of FY '25, this initiative should positively impact operating margins and earnings.

Want to know the numbers driving this valuation shift? Behind the scenes, earnings growth, margin expansion, and a bold future profit multiple calculation power the story. Read on to see which assumptions move the needle on FedEx's fair value.

Result: Fair Value of $271.93 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, such as challenges in freight operations and uncertainty around key contracts. These factors could quickly alter the outlook for FedEx.

Find out about the key risks to this FedEx narrative.

Another View: What Does the SWS DCF Model Suggest?

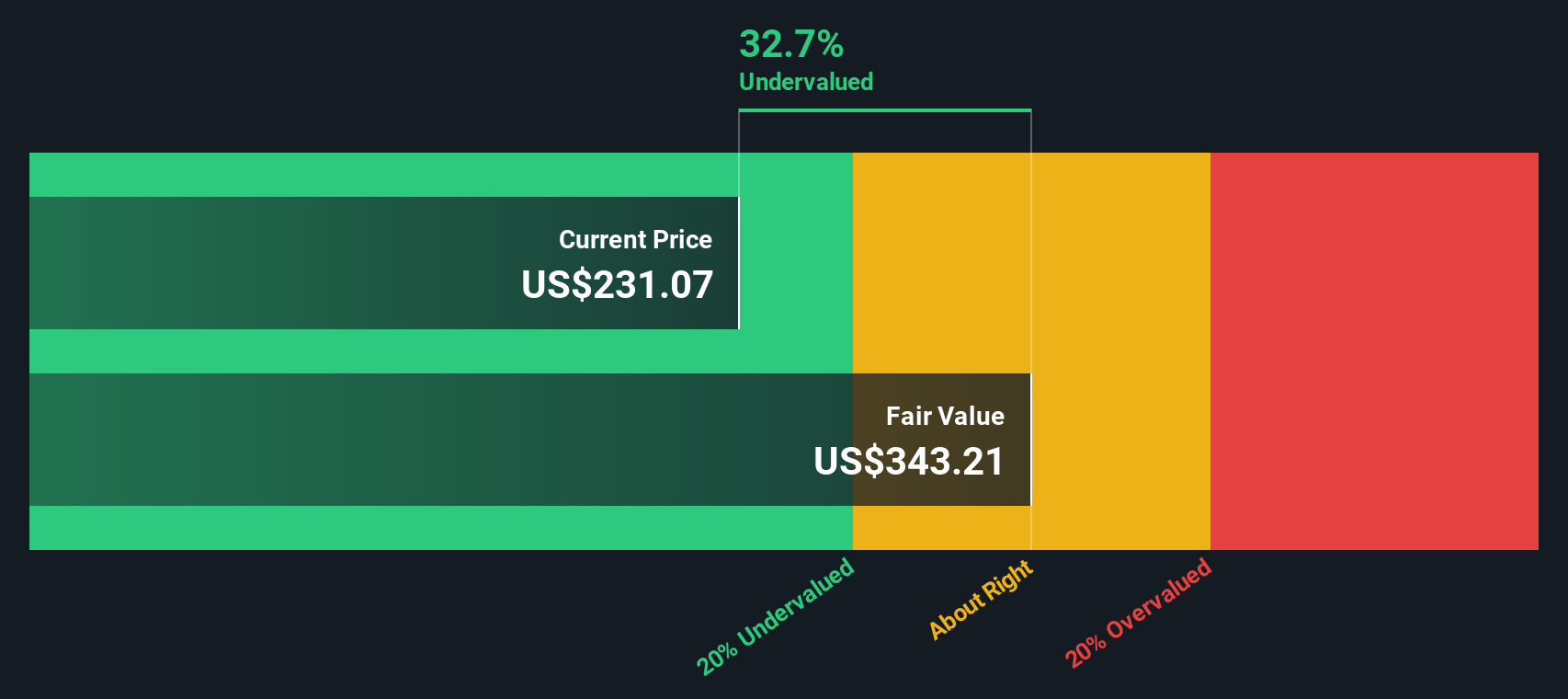

While the current narrative points to FedEx trading a little above its fair value, our SWS DCF model tells a more optimistic story. It estimates FedEx's fair value at $347.94, which is well above the latest market price. This suggests the shares may be meaningfully undervalued. Which view is closer to reality?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own FedEx Narrative

If you have a different take or want to dig into the numbers yourself, you can build your own view and narrative in just minutes. Do it your way

A great starting point for your FedEx research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let the best opportunities pass you by. Simply Wall Street’s screening tools make it easy to uncover high-potential stocks and sectors tailored to your interests.

- Tap into the potential of companies boosting your portfolio’s yield with these 15 dividend stocks with yields > 3% offering 3%+ returns and reliable payouts.

- Uncover remarkable growth by checking out these 916 undervalued stocks based on cash flows, packed with stocks trading below intrinsic value for strong upside possibilities.

- Benefit from tomorrow's technological breakthroughs by searching these 28 quantum computing stocks at the frontier of quantum computing innovation and industry transformation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FDX

FedEx

Provides transportation, e-commerce, and business services in the United States and internationally.

Undervalued established dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026