- United States

- /

- Logistics

- /

- NYSE:FDX

FedEx (FDX) Q2 2026 Margin Stability Keeps Efficiency Narratives Under Scrutiny

Reviewed by Simply Wall St

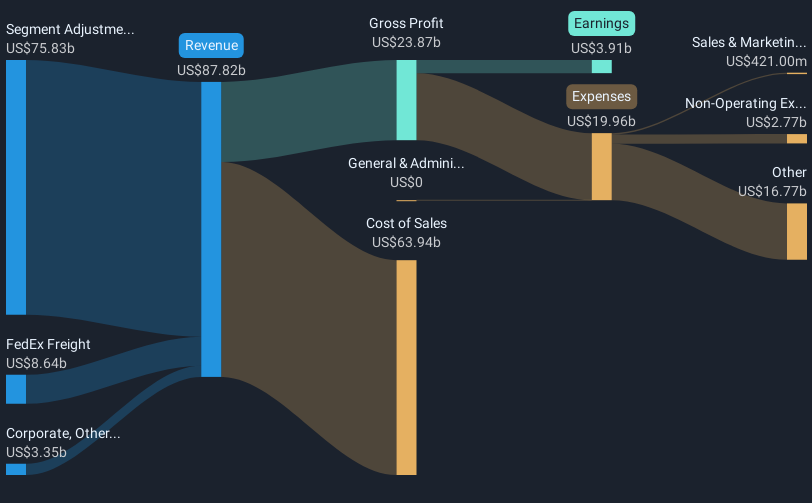

FedEx (FDX) has posted Q2 2026 results with revenue of $23.5 billion and basic EPS of $4.07, anchored by net income of $956 million as the company continues to navigate a steady but measured freight environment. The company has seen revenue move from $21.6 billion in Q3 2025 to $22.0 billion in Q4 2025, $22.2 billion in Q1 2026, and now $23.5 billion in Q2 2026. Basic EPS has ranged from $3.78 to $6.92 over that stretch before landing at $4.07 this quarter, setting up a picture of consistent scale with some earnings volatility that keeps the focus squarely on margins and execution.

See our full analysis for FedEx.With the latest numbers on the table, the next step is to line them up against the dominant narratives around FedEx and see which storylines about growth, profitability, and execution really hold up.

See what the community is saying about FedEx

Margins Steady at 4.6 percent

- On a trailing twelve month basis, FedEx generated $4.3 billion of net income on $90.1 billion of revenue, for a net profit margin of 4.6 percent that is described as high quality.

- Consensus narrative points to cost saving programs like DRIVE and Network 2.0 as future margin levers, yet the latest data still show margins at 4.6 percent

- Analysts expect profit margins to rise toward 5.4 percent over the next three years, so the current 4.6 percent level leaves room for that story to play out.

- At the same time, pressures called out in the narrative, such as weaker industrial B2B volumes and pricing pressure in international shipping, are consistent with margins holding rather than expanding so far.

Growth Running in the Mid Single Digits

- Over the past five years, revenue has grown about 3.9 percent per year and earnings about 3.6 percent per year, while earnings growth over the last year was 1.9 percent, pointing to moderate rather than rapid expansion.

- For bullish investors, a key question is whether initiatives like European tech upgrades and the Tricolor network strategy can lift earnings growth from the recent 1.9 percent pace toward the 8.14 percent per year that is forecast

- Analysts are assuming revenue will grow 2.6 percent annually for the next three years, which is slower than the recent 3.9 percent historical rate, even though operational projects are expected to improve efficiency.

- Expected EPS of $23.52 by about 2028, up from trailing EPS of $18.27, implies that cost efficiency and buybacks, rather than top line acceleration alone, need to do a lot of the heavy lifting to meet bullish expectations.

Debt and Freight Changes Add Execution Risk

- Alongside a 2.02 percent dividend yield, FedEx is flagged as having a high level of debt, and management is also working through the eventual separation of FedEx Freight and other restructuring moves that can add extra costs.

- Bears focus on how elevated leverage and freight restructuring interact with softer freight trends, and the data give them several stress points to track

- Weakness in the industrial economy is already pressuring higher margin B2B volumes in Freight, so any misstep as the segment is separated could feed directly into operating income, even though net margins stand at 4.6 percent today.

- Restructuring programs and the end of the United States Postal Service contract are specifically cited as headwinds for adjusted operating income, meaning debt servicing and transformation spending have to be managed carefully off a modest earnings growth base of 1.9 percent over the last year.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for FedEx on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently and consider the story points from another angle. Turn that view into a concise narrative in minutes, Do it your way.

A great starting point for your FedEx research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Explore Alternatives

FedEx is growing only modestly while juggling elevated debt, freight restructuring, and softer industrial demand. As a result, its execution and balance sheet leave investors exposed.

If that mix of leverage and operational uncertainty feels uncomfortable, use our solid balance sheet and fundamentals stocks screener (1944 results) to quickly focus on financially stronger companies built to handle shocks without sacrificing long term compounding.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FDX

FedEx

Provides transportation, e-commerce, and business services in the United States and internationally.

Established dividend payer and good value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion