- United States

- /

- Logistics

- /

- NYSE:FDX

FedEx Corporation's (NYSE:FDX) External Concerns Aren't Large Enough to Conceal Internal Weaknesses

FedEx Corporation (NYSE:FDX) faces one of the most significant single-day declines after it announced a recession. The company is now bracing for more challenging times ahead by restructuring its operations and undergoing cost-cutting measures.

Highlights:

- The company withdrew full-year guidance

- Closing down 90 offices and 5 corporate locations and deferring new hiring

- The dividend looks safe at a low payout ratio, but there is more to the story

FDX Preliminary Earnings Results (official results published on September 22)

- EPS: US$3.44 vs. US$5.14 consensus (US$1.70 miss)

- Revenue: US$23.2b vs US$23.59b (US$390m miss)

New CEO Raj Subramaniam stated that he believes the economy is going into a worldwide recession. This is an unusual comment that market participants might consider an excuse for the latest earnings result. While withdrawing guidance is a concern, we must keep in mind that it kept the buyback plan unchanged, planning to repurchase US$1.5b of common shares.

While often skipped, investors should also consider currency impact. With the US dollar at 20-year highs, it is expected that the foreign markets should experience currency pressures to pay in US dollars and would instead use services paid in the domestic currency.

Cash Flow Slowdown and Its Impact on the Dividend

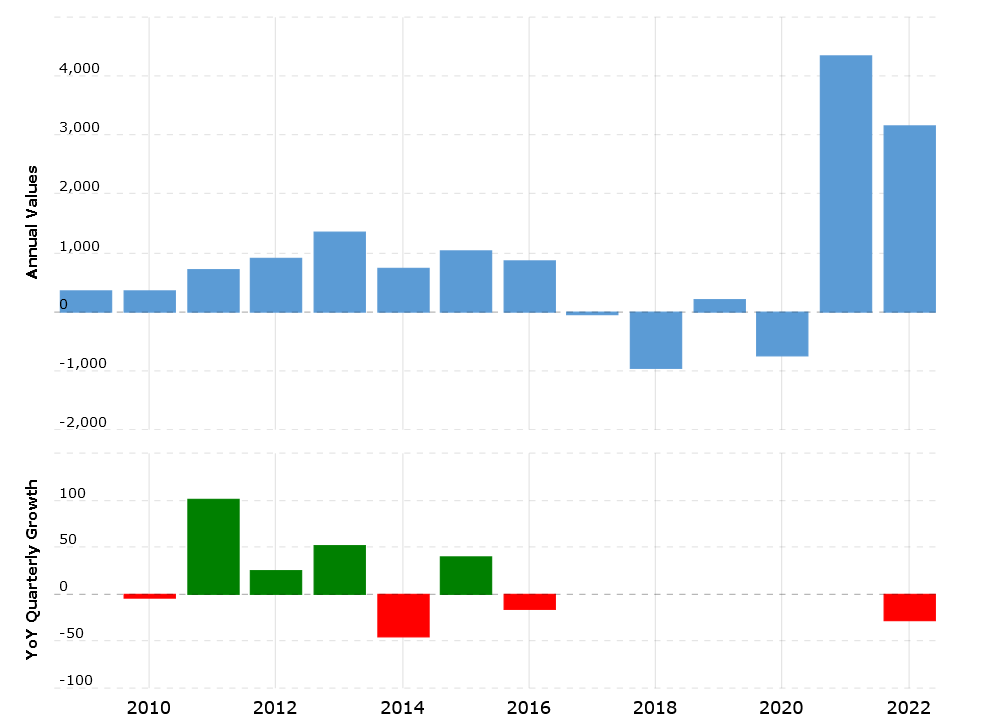

FDX has a long dividend history, and over the last decade, it grew its dividend from the annual payment of US$0.5 in 2012 to the latest yearly payment of US$4.6 – indicating a 24% per year growth. This is solid growth, but the latest circumstances might make it less sustainable.

The chart above shows FDX's free cash flow from 2010, indicating a problematic situation before the Covid-19 pandemic that caused a record-high rebound – whose effects are now fading. This is why the 39% cash flow dividend coverage that looks reasonable now isn't as reasonable going forward when considering the forward-looking cash flow expectations.

When Macro Slowdown Meets Internal Weakness

FedEx contractors have been engaging in a public battle with the company, arguing that increasing fuel, labor, and maintenance costs made their operations increasingly unsustainable. The largest contractor, Spencer Patton, who founded Trade Association for Logistics Professionals (TALP), has been vocal about these issues – even threatening a coordinated strike during the holiday season. FDX responded by severing ties with his company and launching a lawsuit.

Although contractors suffered margin erosions over the years, we have to point out a significant disparity between FDX's margins and those of its closest rival, United Parcel Service (NYSE: UPS). While both companies have relatively similar gross margins of around 25%, FDX has a net profit margin of 4.08%, while UPS boosts 10.92% - well over double. While FDX is suspending all the hiring, UPS announced it plans to add over 100,000 seasonal employees ahead of the holiday rush.

There are other factors our readers should be conscious of before pouring capital into a stock. Taking the debate a bit further, we've identified 2 warning signs for FedEx that investors need to be conscious of moving forward.

We have also put together a list of global stocks with a market capitalization above $1bn and yielding more than 3%.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:FDX

FedEx

Provides transportation, e-commerce, and business services in the United States and internationally.

Undervalued established dividend payer.

Market Insights

Community Narratives