- United States

- /

- Airlines

- /

- NYSE:CPA

What Copa Holdings (CPA)'s September Traffic Gains Reveal About Demand Resilience and Efficiency

Reviewed by Sasha Jovanovic

- Copa Holdings announced its preliminary September 2025 traffic results, reporting year-over-year increases in available seat miles, revenue passenger miles, and load factor.

- This growth in key operational metrics ahead of the company’s November earnings release highlights ongoing demand strength and improved efficiency across its flight network.

- We’ll explore how Copa’s September uptick in load factor and passenger traffic informs the company’s broader investment outlook.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Copa Holdings Investment Narrative Recap

To be a Copa Holdings shareholder, you have to believe in the company’s ability to leverage Panama’s geographic advantage and its disciplined cost approach amid significant intra-Latin America airline competition. The September rise in available seat miles, revenue passenger miles, and load factor is a positive prelude to the upcoming November earnings release, but does not materially shift the most important short term catalyst, sustained margin improvement, and the main near-term risk of yield pressure from increased industry capacity.

Of the recent announcements, the affirmation of a quarterly dividend of US$1.61 per share stands out. Continued dividend payments signal management’s confidence in Copa’s underlying cash generation, which remains a key counterpoint to the current competitive and pricing pressures that could challenge the company’s ability to maintain both payouts and margins across cycles.

Yet, investors should remain alert: while September’s traffic growth underscores demand, it does not resolve the issue of ongoing passenger yield decline and...

Read the full narrative on Copa Holdings (it's free!)

Copa Holdings is projected to achieve $4.4 billion in revenue and $855.0 million in earnings by 2028. This outlook assumes an annual revenue growth rate of 8.4% and represents a $217.5 million increase in earnings from the current $637.5 million.

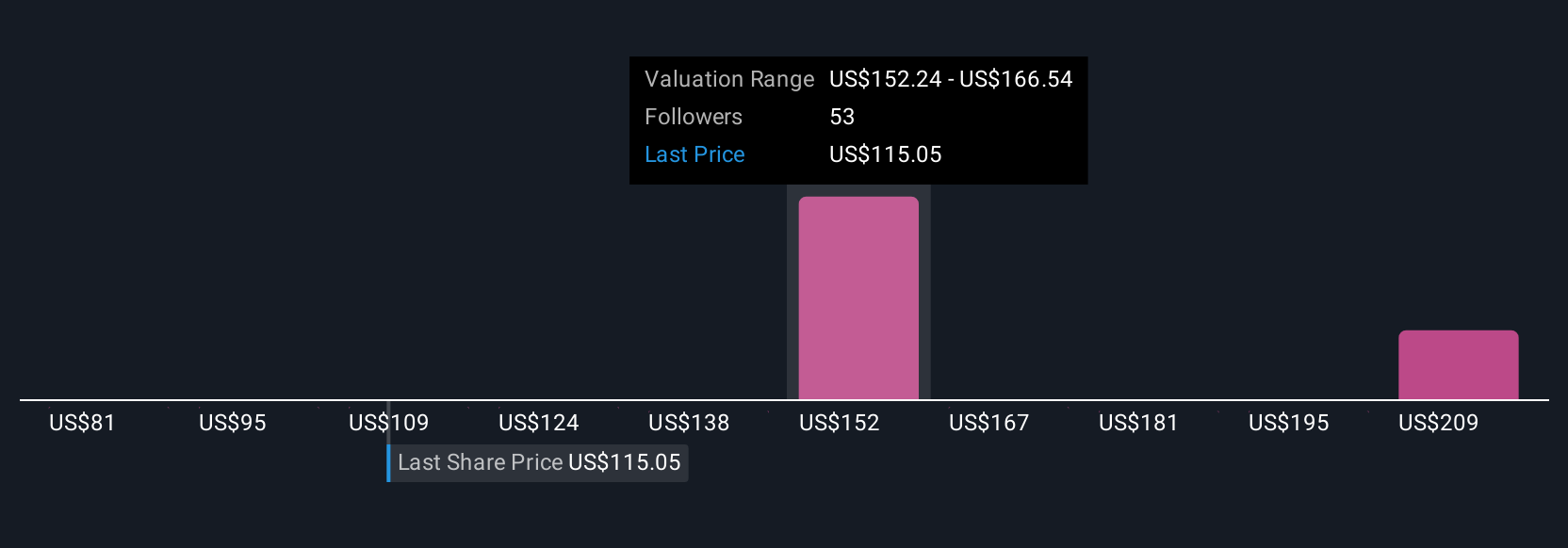

Uncover how Copa Holdings' forecasts yield a $154.20 fair value, a 26% upside to its current price.

Exploring Other Perspectives

Nine Simply Wall St Community fair value estimates for Copa Holdings range from US$43.23 to US$154.20 per share. With the company facing ongoing competitive yield pressure, it’s clear market participants weigh risks and catalysts differently, be sure to compare these variations in outlook for a fuller view.

Explore 9 other fair value estimates on Copa Holdings - why the stock might be worth as much as 26% more than the current price!

Build Your Own Copa Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Copa Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Copa Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Copa Holdings' overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CPA

Copa Holdings

Through its subsidiaries, provides airline passenger and cargo transport services.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives