- United States

- /

- Airlines

- /

- NYSE:CPA

Is It Too Late To Consider Copa Holdings After A 40% Rally In 2025?

Reviewed by Bailey Pemberton

- If you are wondering whether Copa Holdings still represents good value after its big run up, or if most of the easy gains are already gone, you are not alone. That is exactly what we are going to unpack here.

- The stock is trading around $119.96 after a solid climb, up 40.0% year to date and 43.2% over the last year, even after a softer patch with a 5.1% dip over the past month.

- Recent headlines around Latin American air travel demand, shifting capacity across regional routes, and airline sector sentiment have helped frame Copa as a high quality play on regional growth rather than just another cyclical airline. At the same time, investors are weighing macro risks and fuel cost volatility, which adds nuance to how the market is pricing its future cash flows.

- Based on our checks, Copa scores a 4/6 valuation score, suggesting it looks undervalued on several fronts but not across the board. We will walk through the main valuation methods next and then finish by exploring an additional way to think about what the stock may be worth.

Approach 1: Copa Holdings Discounted Cash Flow (DCF) Analysis

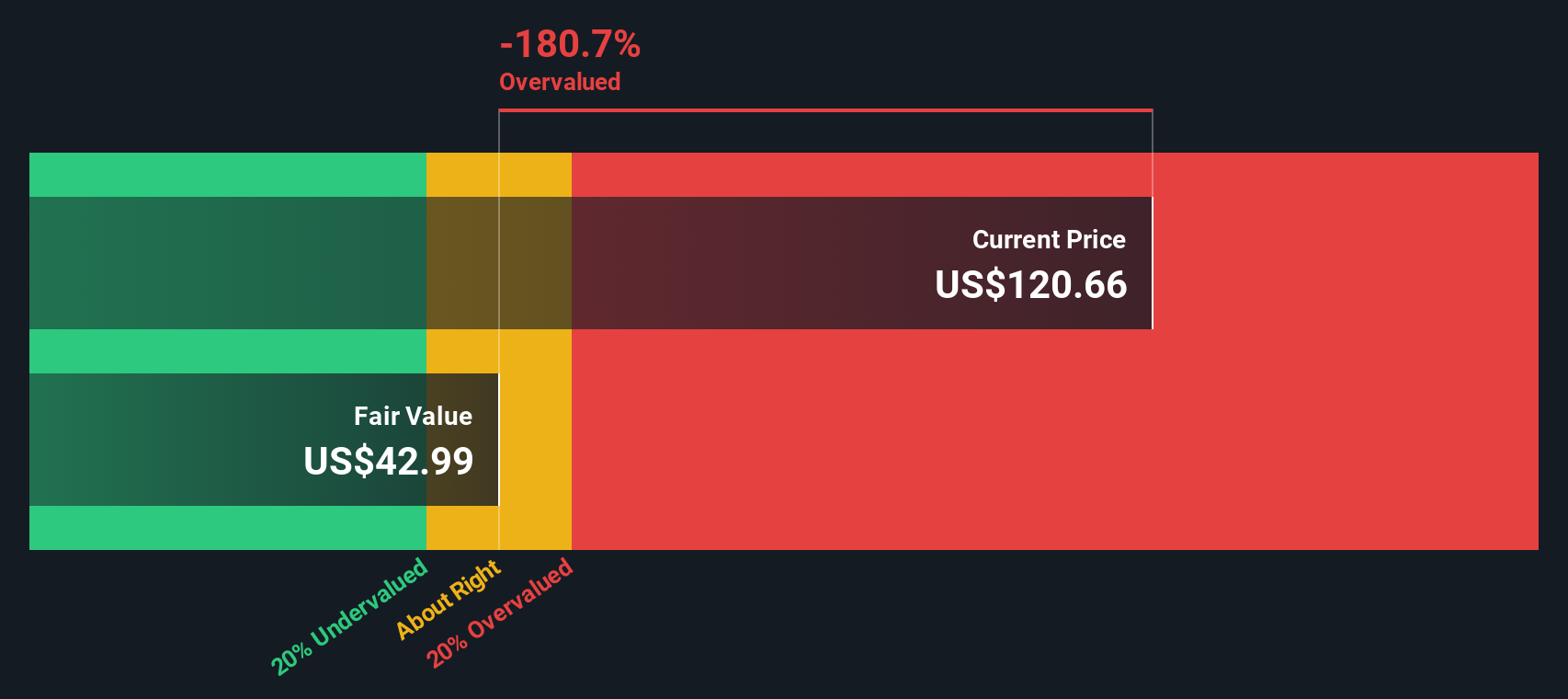

A Discounted Cash Flow model takes forecasts of a company’s future cash flows and discounts them back to today in dollar terms, aiming to estimate what the whole business is worth now. For Copa Holdings, the 2 Stage Free Cash Flow to Equity model starts with last twelve month Free Cash Flow of about $293 million and then applies analyst estimates and gradual slow downs in growth over time.

Analysts only provide explicit forecasts for the next few years, so Simply Wall St extrapolates beyond that, with projected free cash flows ranging from around $551 million in 2026 to about $136 million by 2035 as growth normalizes. When all of these future cash flows are discounted back to today, the model suggests an intrinsic value of roughly $45.23 per share.

Compared to the current share price near $119.96, this implies Copa is around 165.2% overvalued on a DCF basis, meaning the market is paying a substantial premium to the model’s fair value estimate.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Copa Holdings may be overvalued by 165.2%. Discover 918 undervalued stocks or create your own screener to find better value opportunities.

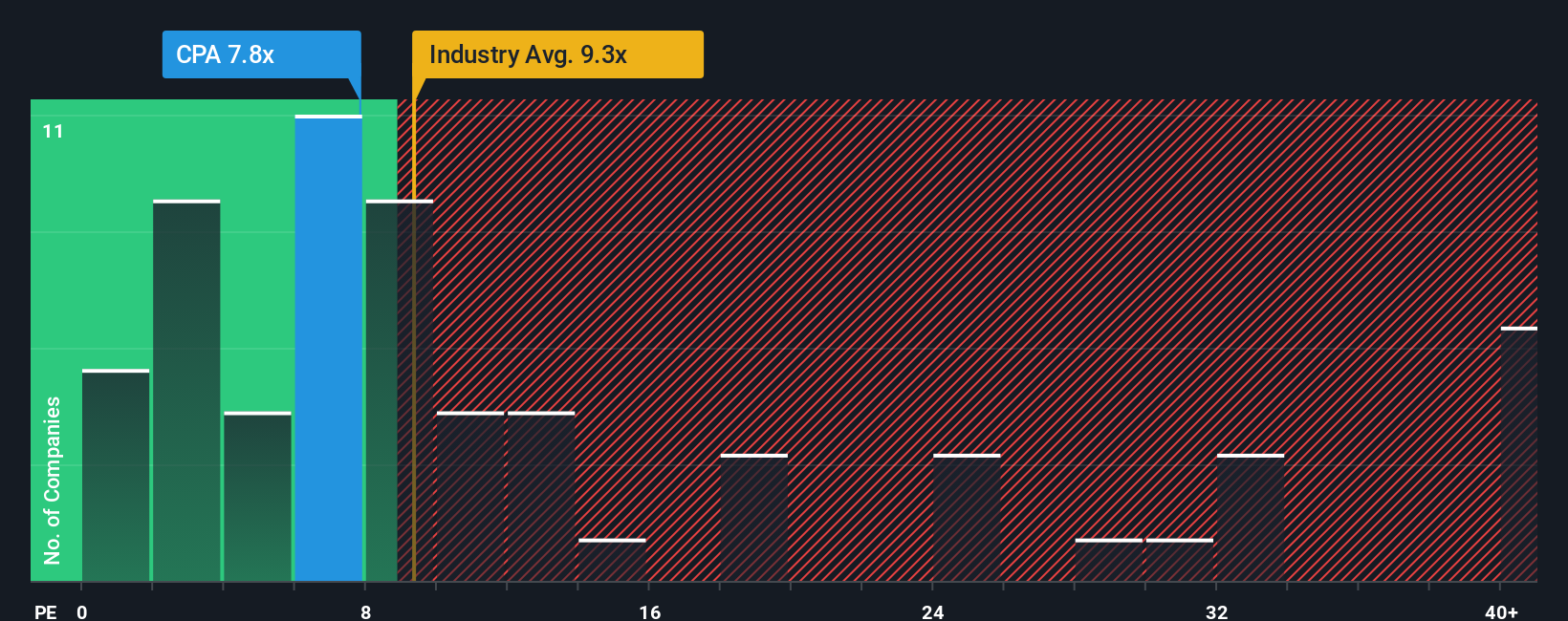

Approach 2: Copa Holdings Price vs Earnings

For profitable companies like Copa Holdings, the price to earnings, or PE, ratio is a useful yardstick because it ties the share price directly to the profits the business is generating today. In general, faster growth and lower perceived risk justify a higher PE, while slower growth and higher uncertainty call for a lower multiple.

Copa currently trades on a PE of about 7.45x. That is below the broader peer group average of roughly 19.70x and also under the Airlines industry average of around 9.56x, suggesting the market is pricing Copa more conservatively than many competitors. Simply Wall St’s proprietary Fair Ratio for Copa is 13.45x, which reflects what investors might reasonably pay given its earnings growth profile, margins, industry, size and specific risks.

This Fair Ratio is more informative than a simple comparison with peers or the industry because it adjusts for company specific fundamentals rather than assuming every airline deserves the same multiple. With Copa’s actual PE at 7.45x compared with a Fair Ratio of 13.45x, the shares appear attractively priced on this earnings based lens.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1460 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Copa Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, an easy tool on Simply Wall St’s Community page that lets you combine your view of Copa’s story with your assumptions for future revenue, earnings and margins. You can link that story to a financial forecast and fair value, and then compare that fair value with today’s price to inform your decision on whether to buy or sell. The Narrative automatically refreshes as new news or earnings arrive. For example, one investor might build a bullish Copa Narrative around expanding routes, rising load factors and a fair value closer to the most optimistic analyst target of about 190 dollars. Another investor might focus on fuel risk, pricing pressure and hub concentration to justify a more conservative fair value near the lowest target of roughly 118 dollars.

Do you think there's more to the story for Copa Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CPA

Copa Holdings

Through its subsidiaries, provides airline passenger and cargo transport services.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion