- United States

- /

- Airlines

- /

- NYSE:CPA

Copa Holdings (NYSE:CPA) Valuation in Focus After Strong Q3 Results and Upbeat Growth Outlook

Reviewed by Simply Wall St

Copa Holdings (NYSE:CPA) delivered strong third quarter results, with higher revenue, net income, and an improved load factor compared to the previous year. The company also reaffirmed its 2025 outlook and shared an encouraging capacity forecast for 2026.

See our latest analysis for Copa Holdings.

Investors have responded positively to Copa Holdings’ recent earnings beat and upbeat outlook, with the share price climbing 42.1% year-to-date and a one-year total shareholder return of 40.2%. Momentum appears to be solidifying as the company posts consistent operational growth and reaffirms confidence in its future.

If Copa’s ongoing run has you interested in broader opportunities, now could be the right time to broaden your search and discover fast growing stocks with high insider ownership

The big question now is whether Copa Holdings is trading at a bargain given its impressive growth, or if recent gains mean the market has already factored in the company’s future prospects. Could there still be a buying opportunity?

Most Popular Narrative: 22.5% Undervalued

With the narrative fair value at $157.13 and the last close at $121.80, the prevailing market view sees Copa Holdings trading well below consensus expectations. This gap highlights bullish bets on the company’s future and sets the tone for a closer look at the factors fueling such optimism.

Expansion of Copa's network through new and returning destinations (including San Diego, Los Cabos, Puerto Plata, Salvador de Bahia, Salta, and Tucuman), along with the ongoing airport infrastructure enhancements at Panama's Tocumen hub, position Copa to capitalize on rising passenger volumes. Growth in the middle class and continued urbanization across Latin America may also support sustained top-line revenue growth.

Wondering if the current price leaves upside on the table? The story behind this valuation points to a bold forecast for earnings and margins, as well as strategic moves that could reshape Copa's position in the industry. Discover which assumptions drive this sharp price target and why the narrative stakes are so significant.

Result: Fair Value of $157.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent competitive pressures in Latin American markets and volatile jet fuel prices could challenge Copa's growth and put future margins at risk.

Find out about the key risks to this Copa Holdings narrative.

Another View: What Does the DCF Model Say?

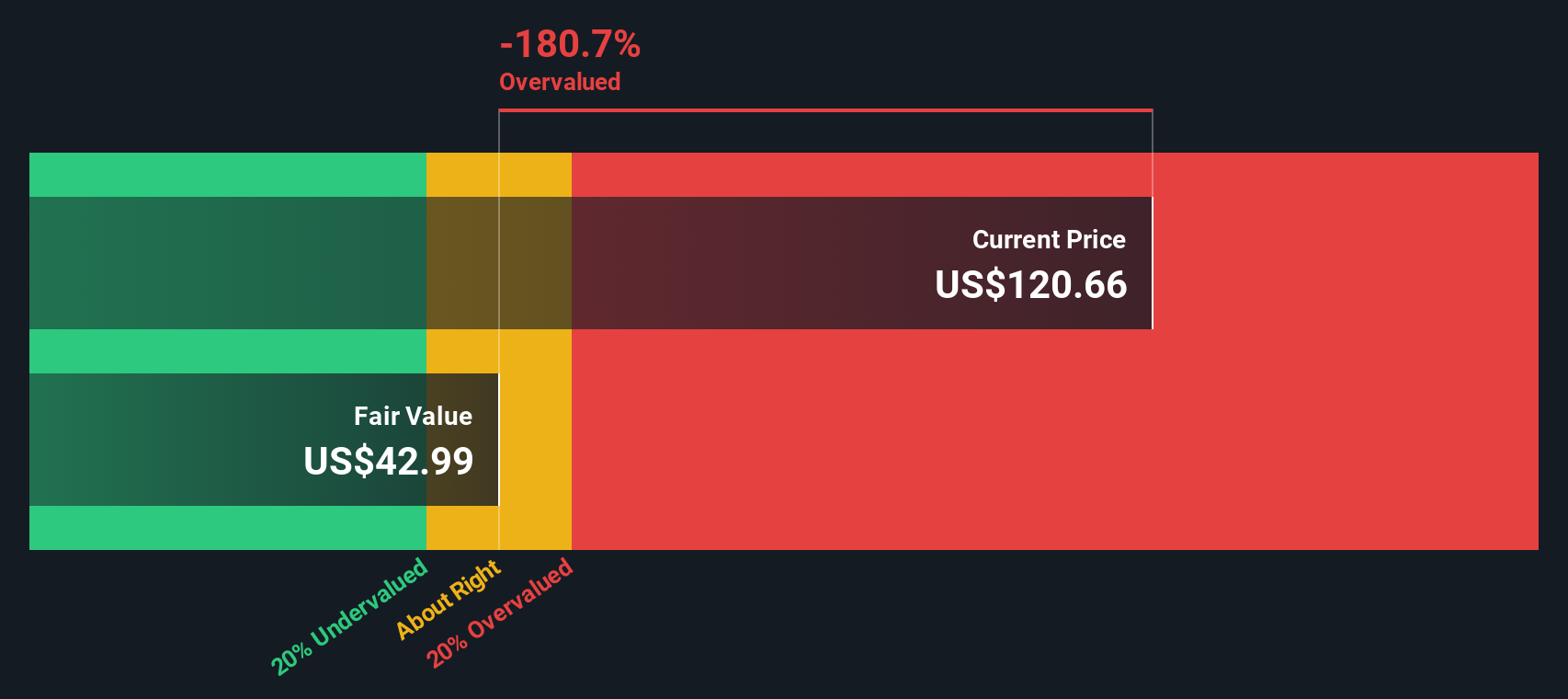

Looking at Copa Holdings from the SWS DCF model perspective provides a sharply different outlook. This approach estimates a fair value of just $32.98 per share, suggesting substantial overvaluation at today’s price. Which view comes closer to reality—the bullish consensus or the deeply discounted DCF?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Copa Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 913 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Copa Holdings Narrative

If you see things differently or want to dive into the numbers yourself, you can build your own take on Copa Holdings in just a few minutes. Do it your way

A great starting point for your Copa Holdings research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Open up your investing playbook and go beyond the obvious. There are high-potential opportunities you do not want to overlook, waiting in industry-shaping market trends.

- Spot steady income options by reviewing these 15 dividend stocks with yields > 3% that consistently deliver yields above 3% and strengthen your portfolio's cash flow.

- Kickstart your search for cutting-edge companies with these 25 AI penny stocks driving artificial intelligence breakthroughs and transforming entire industries.

- Capitalize on undervalued opportunities using these 913 undervalued stocks based on cash flows to find stocks trading below their cash flow potential right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CPA

Copa Holdings

Through its subsidiaries, provides airline passenger and cargo transport services.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026