- United States

- /

- Marine and Shipping

- /

- NYSE:CMRE

Costamare (NYSE:CMRE): Revisiting Valuation After a Strong Multi-Month Share Price Rally

Reviewed by Simply Wall St

Costamare (NYSE:CMRE) has quietly delivered a strong run, with the stock up about 26% over the past month and 35% in the past 3 months, despite declining annual revenue.

See our latest analysis for Costamare.

Zooming out, Costamare’s roughly 21% year to date share price return and powerful 1 year total shareholder return of about 73% suggest momentum is firmly building as investors reassess the company’s earnings resilience and asset values.

If Costamare’s recent move has you thinking about what else might be gathering steam in shipping and beyond, this could be a good moment to explore fast growing stocks with high insider ownership.

But with revenue contracting, analyst targets sitting below the current price, and valuation screens flagging limited value appeal, is Costamare still trading at a discount or is the market already baking in much of its future growth?

Most Popular Narrative: 33.3% Overvalued

Compared to the narrative fair value of $12.25, Costamare’s last close at $16.33 implies investors are paying up for its earnings resilience story.

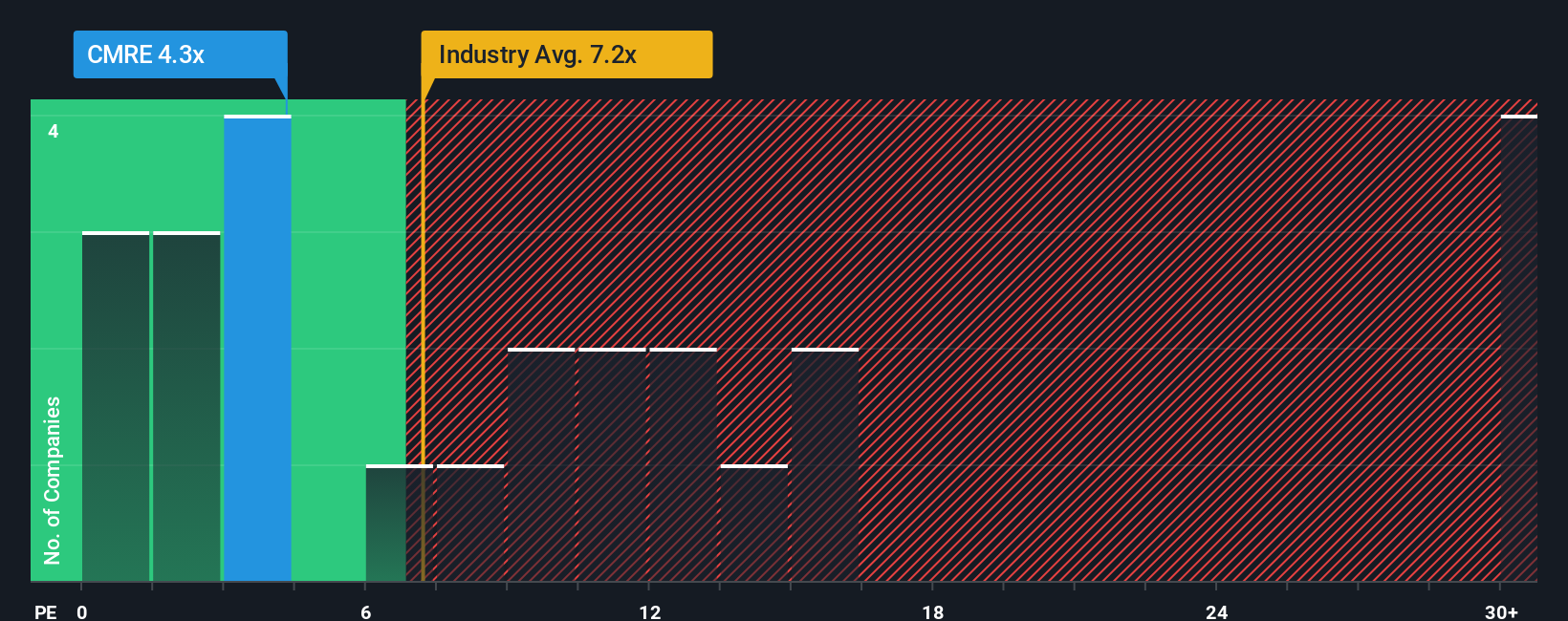

The analysts have a consensus price target of $10.15 for Costamare based on their expectations of its future earnings growth, profit margins and other risk factors. In order for you to agree with the analyst's consensus, you would need to believe that by 2028, revenues will be $448.3 million, earnings will come to $285.2 million, and it would be trading on a PE ratio of 6.1x, assuming you use a discount rate of 12.3%.

Want to see what holds this valuation together despite shrinking revenues? The narrative leans on margin expansion, resilient earnings, and a future multiple that challenges today’s market assumptions.

Result: Fair Value of $12.25 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if contracted revenues, fleet renewal and Neptune leasing keep earnings steadier than expected, today’s cautious narrative could prove too pessimistic.

Find out about the key risks to this Costamare narrative.

Another Angle on Value

On simple earnings multiples, the story looks different. Costamare trades on about 6.6 times earnings, cheaper than the wider US market at 18.7 times but richer than close peers at roughly 5.4 times. With a fair ratio near 9.3 times, is the market underpricing resilience or overpaying for a cyclical spike?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Costamare Narrative

If this perspective does not quite fit your view, or you would rather work from first principles, you can build a personalized narrative in minutes, Do it your way.

A great starting point for your Costamare research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Some investors regularly build their watchlist. You can take a few minutes to scan fresh opportunities on Simply Wall Street before others do the same.

- Identify potential multi-baggers early by using these 3571 penny stocks with strong financials to research under-the-radar growth opportunities before they become widely followed.

- Explore structural shifts in healthcare by using these 30 healthcare AI stocks to find companies that are working with medical data and AI.

- Research income opportunities through these 15 dividend stocks with yields > 3% that may help you focus on companies with a track record of paying dividends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMRE

Costamare

Owns and operates containerships and dry bulk vessels worldwide.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026