- United States

- /

- Marine and Shipping

- /

- NYSE:CMRE

Costamare (CMRE) Is Up 5.6% After Strong Earnings And Backlog Momentum Boost Sentiment – Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- In early November 2025, Costamare reported upbeat quarterly results, underpinned by strong containership charter demand and a sizeable multi-year contract backlog that supports earnings visibility.

- These earnings, combined with Costamare’s identification as an overbought industrial name with high technical momentum, highlight how sentiment can quickly shift when solid contracted revenue meets strong trading signals.

- We’ll now explore how this earnings beat and sizeable contracted backlog might reshape Costamare’s existing investment narrative and risk profile.

Find companies with promising cash flow potential yet trading below their fair value.

Costamare Investment Narrative Recap

To own Costamare, you need to believe its contracted containership revenues and sizeable US$2.5 billion backlog can support resilient cash flows even if shipping conditions soften. The latest earnings beat and momentum driven share price jump do not materially change that core thesis in the short term, but they sharpen the key risk that current tight charter markets and high rates could prove less durable than many investors expect.

The most relevant recent update is the November 4 quarterly result, where Costamare delivered solid net income growth with essentially flat revenue, reinforcing the idea that multi year charters and high fleet employment are doing the heavy lifting. That print, combined with the stock’s new 52 week high and “overbought” technical label, feeds directly into the main catalyst around elevated contracted revenues while also reminding shareholders that expectations for sustained strong charter markets can reset quickly.

Yet beneath the strong backlog and recent share price strength, there is an important risk around how long today’s tight container markets and elevated charter rates can really last that investors should be aware of...

Read the full narrative on Costamare (it's free!)

Costamare's narrative projects $448.3 million revenue and $285.2 million earnings by 2028.

Uncover how Costamare's forecasts yield a $12.25 fair value, a 24% downside to its current price.

Exploring Other Perspectives

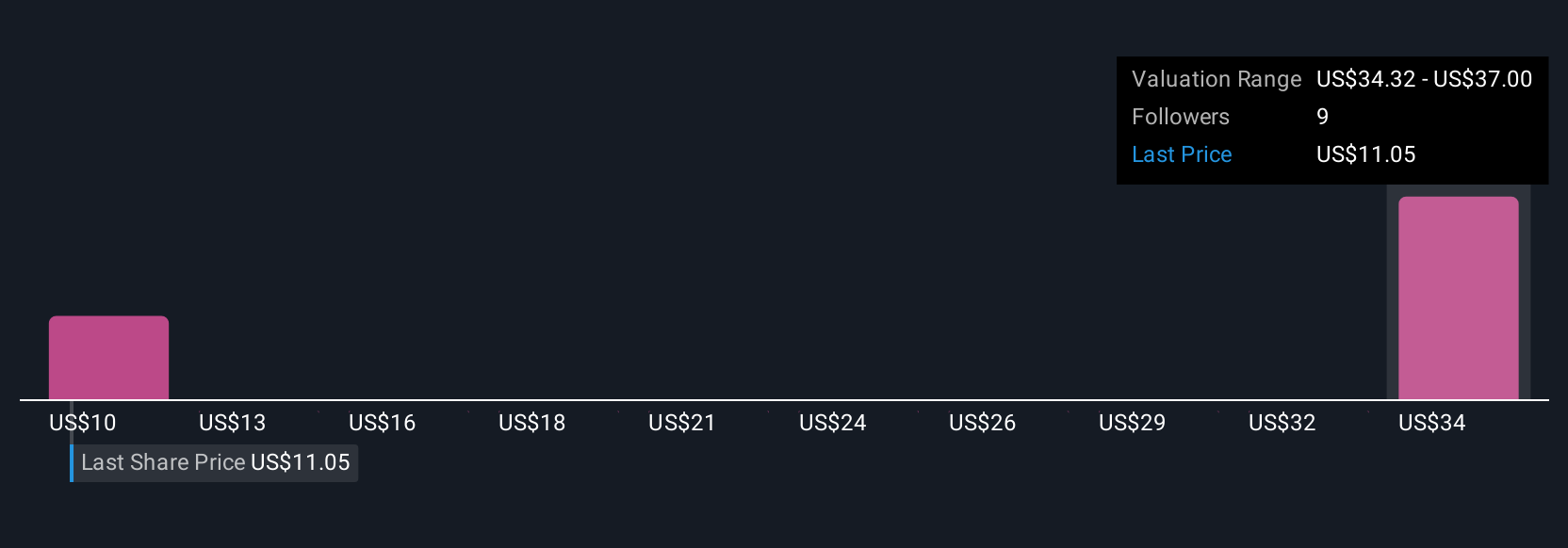

Two Simply Wall St Community fair value estimates cluster between US$10.15 and US$12.25, showing how far opinions can diverge from current trading levels. Against that backdrop, the reliance on tight containership supply and elevated charter rates as a key earnings driver gives you a clear focal point for comparing these different views on Costamare’s future performance.

Explore 2 other fair value estimates on Costamare - why the stock might be worth 37% less than the current price!

Build Your Own Costamare Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Costamare research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Costamare research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Costamare's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMRE

Costamare

Owns and operates containerships and dry bulk vessels worldwide.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026