- United States

- /

- Marine and Shipping

- /

- NYSE:CMRE

A Look at Costamare (NYSE:CMRE) Valuation Following New High-Vote Share Issuance to Bolster Family Control

Reviewed by Kshitija Bhandaru

Costamare (NYSE:CMRE) has issued 1,200 Series F high-vote, non-economic preferred shares to the Konstantakopoulos family, increasing their voting power to 75.7%. This move helps the company align with new Chinese rules that restrict U.S. control in vessel operations.

See our latest analysis for Costamare.

Costamare’s latest move to shore up family control comes after a strong run for shareholders. The stock’s three-year total return is an impressive 84%, with a five-year total return topping 200%. Recent price momentum has been mixed, with a significant 24% rise over the last 90 days but a modest dip over the past month, reflecting some short-term uncertainty following news of the new share issuance and shifting regulatory dynamics abroad. Even so, Costamare’s latest steps may help position the company for greater resilience in an evolving market environment.

If you’re keeping an eye on companies making bold moves at the leadership level, now’s a great chance to discover fast growing stocks with high insider ownership

But with returns already strong and the company trading near its latest analyst targets, the real question is whether Costamare is currently undervalued or if the market has already priced in all of its future growth potential.

Most Popular Narrative: 14.1% Overvalued

Costamare’s most widely-followed narrative points to a consensus fair value of $10.15, which is over a dollar below the recent close of $11.58. This difference sets the stage for debate about whether optimism around long-term earnings can really justify today's price premium.

The recent long-term charters for new containership orders and forward fixtures (with $310 million incremental contracted revenues and $2.5 billion total contracted revenues) may be leading the market to expect sustained high earnings and cash flow visibility, which could overstate future earnings if market conditions weaken.

Think those huge five-year returns are built to last? The fair value boils down to bold revenue shrinkage and sky-high profit margins, bet on today’s fleets. The full narrative uncovers the radical financial projections that set this target; are they realistic or just wishful thinking?

Result: Fair Value of $10.15 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a strong pipeline of contracted revenues and a disciplined, modern fleet could cushion Costamare against downside scenarios, which challenges the overvaluation thesis.

Find out about the key risks to this Costamare narrative.

Another View: What Do the Multiples Say?

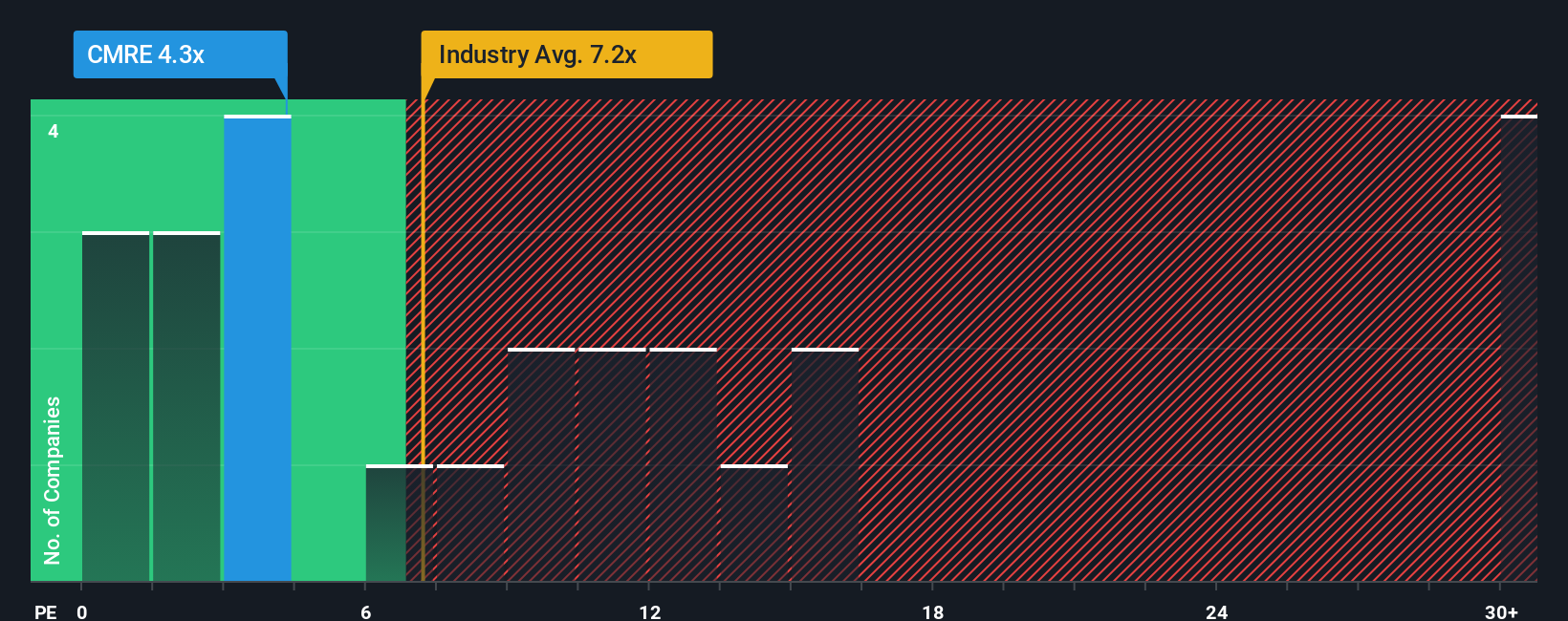

Taking a look at Costamare through the lens of earnings multiples offers a very different take. The company trades at just 4.4 times earnings, well below both peer (6x) and industry (7.1x) levels, and even under the fair ratio of 7.2x. This could point to an undervalued opportunity if the market re-rates shipping stocks upward. But do low ratios alone guarantee the stock is cheap, or are the risks fully factored in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Costamare Narrative

If you see things differently or want to form your own perspective, dive into the data and build your personal take in just a few minutes. Do it your way

A great starting point for your Costamare research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Your investment journey does not have to end with just one company when standout opportunities are waiting elsewhere. Give yourself an edge and act while others hesitate.

- Tap into steady cash flow by securing positions among these 18 dividend stocks with yields > 3% with consistent yields and strong payout histories.

- Spot the innovators fast-tracking breakthroughs in medicine and technology with these 33 healthcare AI stocks that are driving healthcare’s transformation.

- Supercharge your portfolio’s growth with these 868 undervalued stocks based on cash flows that are poised to outperform as the market realigns with their true potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMRE

Costamare

Owns and operates containerships and dry bulk vessels worldwide.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives