- United States

- /

- Airlines

- /

- NYSE:ALK

Alaska Airlines (ALK): Revisiting Valuation Following Recent Investor Interest in the Airline Sector

Reviewed by Simply Wall St

See our latest analysis for Alaska Air Group.

Alaska Air Group’s share price recently slipped over the past month, though the stock still shows a steady 5.5% total return for shareholders over the last year. Momentum appears to be cooling off a bit after a strong stretch. Investors are keeping a close watch on sector dynamics and the company’s ongoing turnaround story.

If you’re watching airline stocks for new opportunities, it’s a great moment to broaden your perspective and discover See the full list for free.

With shares trading well below analyst targets and solid profit growth in recent reports, the key question is whether Alaska Air is undervalued, with untapped upside ahead, or if the market has already priced in its future rebound.

Most Popular Narrative: 29.6% Undervalued

With the most widely followed narrative estimating fair value at $68.93, sharply higher than the last close of $48.50, there is a striking gap between market price and the future earnings potential analysts see for Alaska Air Group. This sets the scene for one of the key growth catalysts behind the valuation.

The expansion and optimization of the Seattle international gateway, including new long-haul routes and a growing fleet of Boeing 787s, positions Alaska Air Group to benefit from sustained urban growth and increasing travel demand in West Coast cities, anticipated to drive higher passenger volumes and top-line revenue growth.

Curious what’s fueling this “hidden value”? The most popular narrative hinges on bold calls about future earnings power, revenue acceleration, and shifting profit margins. Find out how these projections stack up; one bullish model could surprise you with its targets.

Result: Fair Value of $68.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant integration risks from the Hawaiian merger and rising West Coast operating costs could quickly change this upbeat outlook if not carefully managed.

Find out about the key risks to this Alaska Air Group narrative.

Another View: Looking Through the DCF Lens

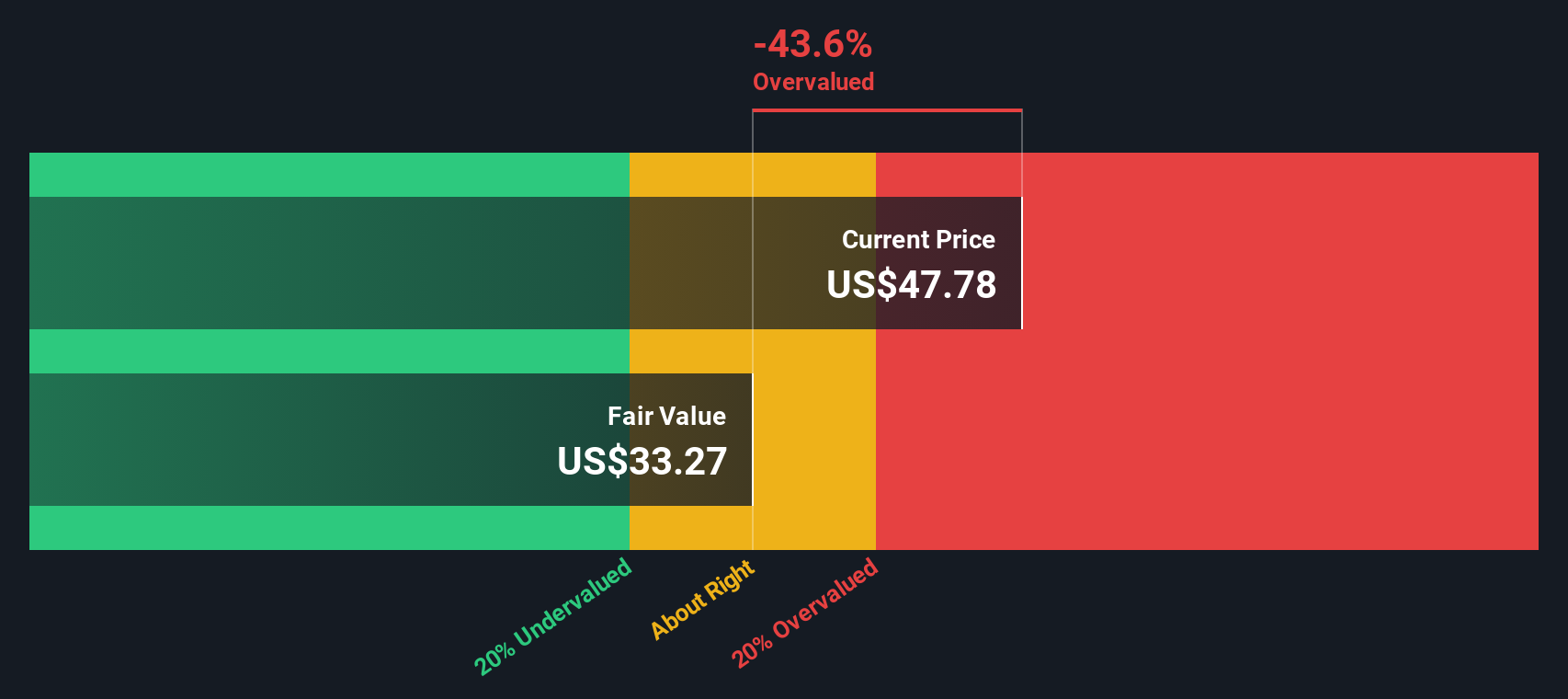

Switching to our SWS DCF model offers a different perspective. In this case, Alaska Air Group appears overvalued, with shares trading above the DCF fair value of $33.22. While analyst targets suggest upside, the cash flow view challenges expectations. Which method deserves more trust in this situation?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Alaska Air Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Alaska Air Group Narrative

If you see the story differently or want to dive into the numbers yourself, it takes just minutes to build your own take on Alaska Air Group. Do it your way

A great starting point for your Alaska Air Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let standout stock picks pass you by. The smartest investors are always one step ahead, tapping into new industries and emerging market trends you might overlook.

- Unlock the earning potential of income-focused choices by tapping into these 17 dividend stocks with yields > 3% with attractive yields above 3% and resilient payout track records.

- Spot value opportunities that others miss with these 872 undervalued stocks based on cash flows, which screens for companies trading below their estimated worth based on future cash flows.

- Ride the next wave of healthcare innovation and artificial intelligence by checking out these 33 healthcare AI stocks, where top picks are advancing in medicine and technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALK

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives