- United States

- /

- Transportation

- /

- NasdaqGS:WERN

Why Werner Enterprises (WERN) Shares May Move on $18 Million Class Action Settlement After Long Legal Battle

Reviewed by Sasha Jovanovic

- Werner Enterprises, Inc. has agreed to settle the consolidated class action lawsuits Abarca et al. v. Werner for US$18 million after more than a decade of litigation, with the settlement covering allegations by tens of thousands of drivers from 2010 to 2023 and still subject to court approval.

- This long-awaited agreement addresses a significant source of legal uncertainty and potential liability that has weighed on the company for years.

- We'll examine how resolving this longstanding class action may alter Werner's investment outlook, especially regarding its ongoing legal risks and operating costs.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Werner Enterprises Investment Narrative Recap

To be a shareholder in Werner Enterprises, you typically need to believe in its ability to drive operational efficiencies and stable growth by investing in fleet modernization and expanding logistics services, despite industry headwinds such as rising costs and stiff competition. The agreement to settle the longstanding class action for US$18 million meaningfully reduces near-term legal uncertainty, but elevated litigation and insurance costs remain a structural risk that could continue to affect margins and the primary investment narrative in the short run.

The settlement comes on the heels of a recent favorable ruling by the Texas Supreme Court that overturned a prior US$90 million verdict against Werner. This string of legal developments may be seen as progress in containing legal overhangs, yet it does not fully eliminate ongoing industry-wide risks from insurance and litigation expenses, which are still widely cited as a significant drag on profitability and remain a central concern for shareholders seeking clarity on future earnings power.

However, investors should be aware that persistent margin pressure from insurance and litigation costs could still weigh on results if claims trends do not improve...

Read the full narrative on Werner Enterprises (it's free!)

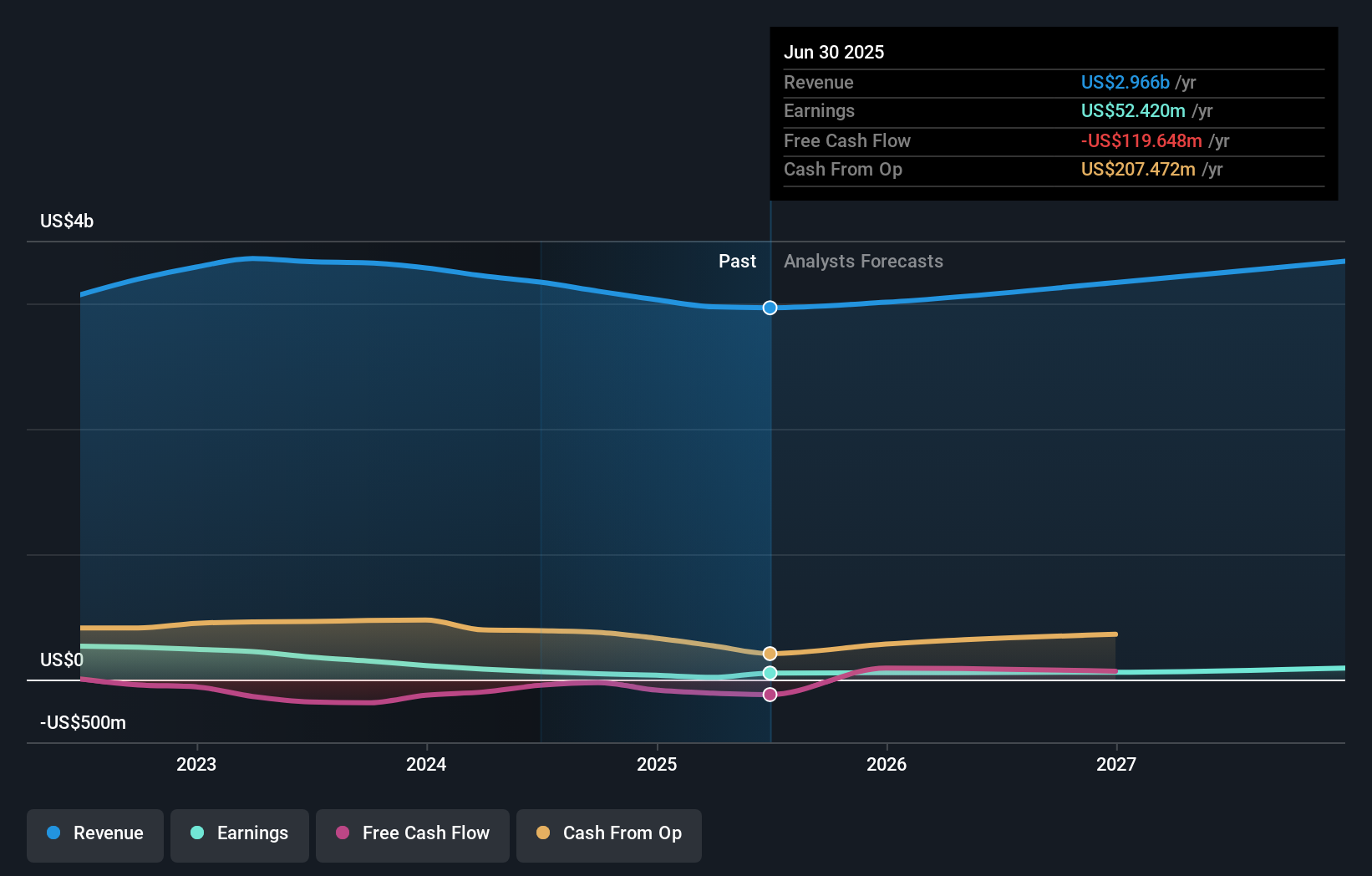

Werner Enterprises' outlook anticipates $3.4 billion in revenue and $100.2 million in earnings by 2028. This is based on a 5.0% annual revenue growth rate and an increase in earnings of $47.8 million from the current $52.4 million.

Uncover how Werner Enterprises' forecasts yield a $27.00 fair value, a 5% downside to its current price.

Exploring Other Perspectives

The Simply Wall St Community shared one fair value estimate for Werner Enterprises at US$27, reflecting limited recent diversity in opinion. As legal risks remain prominent, you may want to compare this community perspective with a range of analyst and peer views on the company’s ability to sustain margin recovery.

Explore another fair value estimate on Werner Enterprises - why the stock might be worth as much as $27.00!

Build Your Own Werner Enterprises Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Werner Enterprises research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Werner Enterprises research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Werner Enterprises' overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Werner Enterprises might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WERN

Werner Enterprises

Engages in transporting truckload shipments of general commodities in interstate and intrastate commerce in the United States, Mexico, and internationally.

Average dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives