- United States

- /

- Transportation

- /

- NasdaqGS:WERN

Werner Enterprises (WERN): Evaluating Valuation Following Sector Rally Sparked by J.B. Hunt’s Strong Results

Reviewed by Kshitija Bhandaru

Shares of Werner Enterprises (WERN) rose 5% after J.B. Hunt Transport Services posted stronger than expected quarterly results. The upbeat report from J.B. Hunt seems to have lifted sentiment across the trucking sector.

See our latest analysis for Werner Enterprises.

Werner’s share price jump comes after a stretch of subdued performance, with a 1-year total shareholder return of -24.9%. Even as the broader sector buzzes with optimism from peers’ results, the latest move hints at improving sentiment, but sustained momentum has yet to materialize for long-term investors.

If today’s sector rally has you wondering what else might be stirring in logistics and transport, broaden your horizon and discover See the full list for free.

With Werner’s shares still lagging over the past year despite today’s rally, the big question is whether the current price reflects hidden value or if the market has already factored in the company’s future prospects. Could this be a buying window, or is everything already priced in?

Most Popular Narrative: 10% Overvalued

Analyst consensus suggests Werner’s last close price of $27.84 sits slightly above their recalculated fair value of $27.80, hinting at a market leaning toward over-optimism despite lingering freight uncertainty. It’s a narrow gap that sets the stage for debate about the validity of current expectations.

Recent street research on Werner Enterprises reflects a mix of cautious outlooks and isolated areas of optimism among analysts. Lowered price targets signal a challenging operating environment. However, opinions on execution and valuation differ, highlighting where analysts see opportunities or lingering risks into upcoming quarters.

Guess what? The fair value here hinges on assumptions only the boldest analysts dare to make. The secret lies in forward-looking projections that many would call aggressive, even for a recovery play. Want to uncover which financial levers and margin shifts are driving this razor-thin premium? There is more to the consensus than meets the eye.

Result: Fair Value of $27.80 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent insurance costs or a renewed downturn in freight demand could quickly offset optimism and challenge expectations for Werner’s recovery narrative.

Find out about the key risks to this Werner Enterprises narrative.

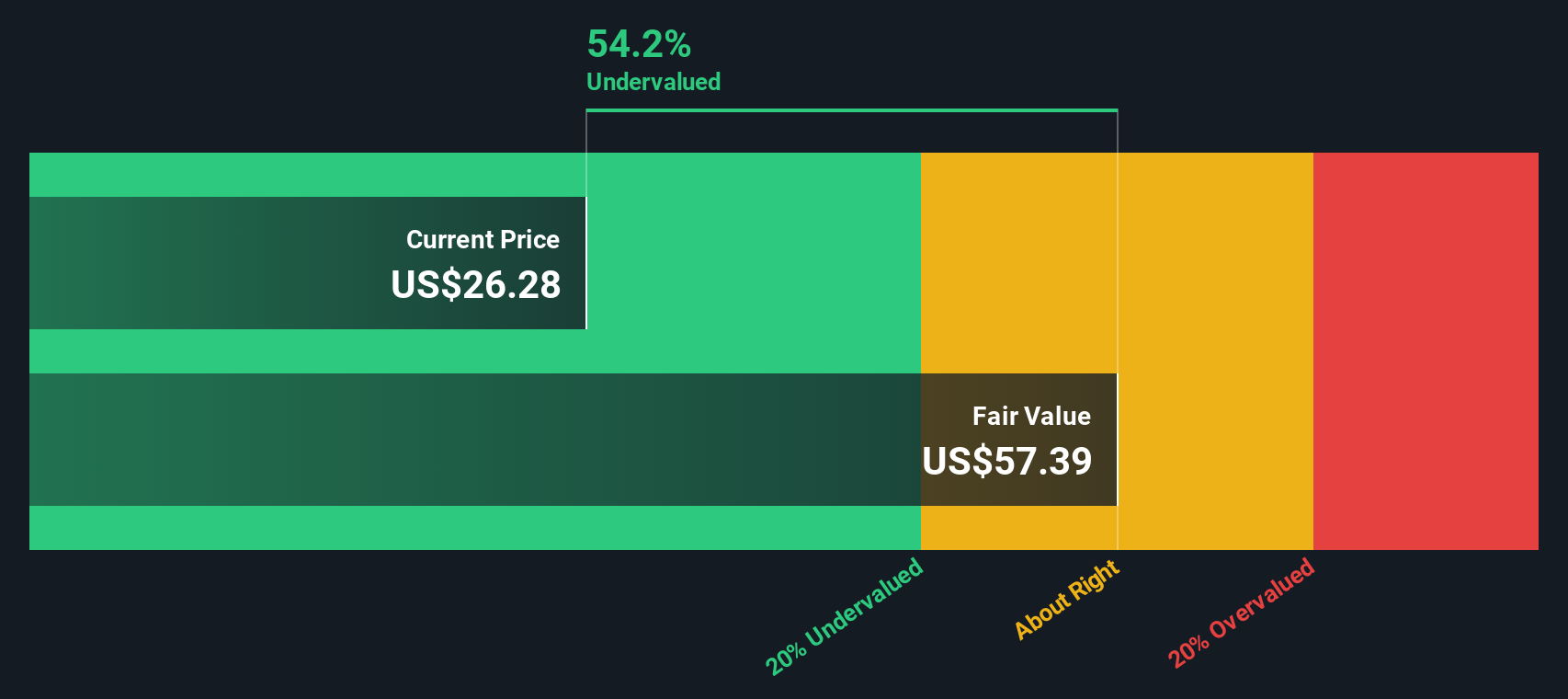

Another View: DCF Suggests Undervaluation

While current market and analyst expectations lean toward Werner being slightly overvalued, our DCF model presents a strikingly different perspective. According to these cash flow projections, the stock could be trading more than 50% below its estimated fair value. Does this imply hidden upside, or is there a catch in these long-range forecasts?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Werner Enterprises for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Werner Enterprises Narrative

If you see things differently or want to explore the numbers firsthand, it takes under three minutes to build your own perspective. Do it your way

A great starting point for your Werner Enterprises research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let your next big opportunity slip away. Let Simply Wall Street’s powerful screeners guide you to potential winners you might otherwise miss.

- Uncover new frontiers in medicine by browsing these 33 healthcare AI stocks, where AI-driven breakthroughs are transforming healthcare for investors and patients alike.

- Capitalize on market value by targeting these 872 undervalued stocks based on cash flows, which trade below their intrinsic worth and can give you a smarter edge in your portfolio.

- Amplify your yield-seeking strategy with these 18 dividend stocks with yields > 3%, featuring companies that consistently reward shareholders with attractive and reliable returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Werner Enterprises might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WERN

Werner Enterprises

Engages in transporting truckload shipments of general commodities in interstate and intrastate commerce in the United States, Mexico, and internationally.

Average dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives