- United States

- /

- Transportation

- /

- NasdaqGS:WERN

Werner Enterprises (NASDAQ:WERN) Is Due To Pay A Dividend Of $0.14

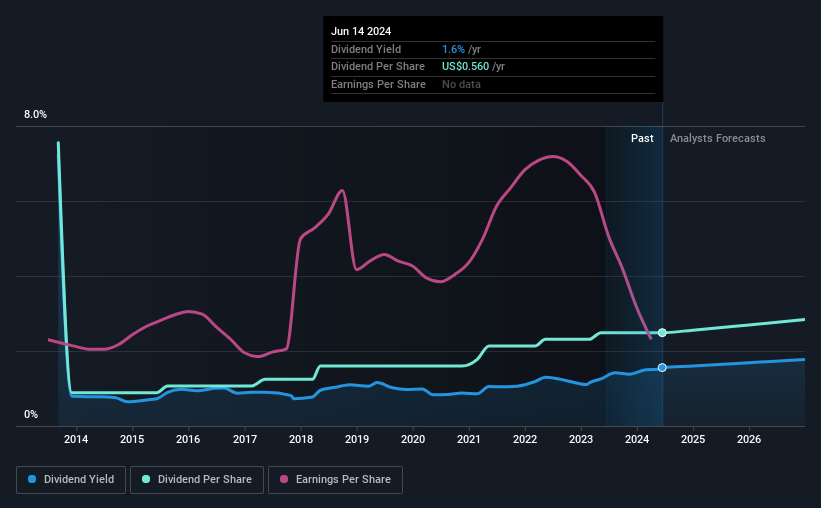

Werner Enterprises, Inc. (NASDAQ:WERN) will pay a dividend of $0.14 on the 17th of July. Based on this payment, the dividend yield will be 1.6%, which is fairly typical for the industry.

View our latest analysis for Werner Enterprises

Werner Enterprises' Dividend Is Well Covered By Earnings

Unless the payments are sustainable, the dividend yield doesn't mean too much. Based on the last payment, Werner Enterprises' earnings were much higher than the dividend, but it wasn't converting those earnings into cash flow. Since a dividend means the company is paying out cash to investors, this could prove to be a problem in the future.

Looking forward, earnings per share is forecast to rise by 78.0% over the next year. Assuming the dividend continues along recent trends, we think the payout ratio could be 26% by next year, which is in a pretty sustainable range.

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. The annual payment during the last 10 years was $1.70 in 2014, and the most recent fiscal year payment was $0.56. The dividend has fallen 67% over that period. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

The Dividend Has Limited Growth Potential

Given that the track record hasn't been stellar, we really want to see earnings per share growing over time. Earnings per share has been sinking by 12% over the last five years. A sharp decline in earnings per share is not great from from a dividend perspective. Even conservative payout ratios can come under pressure if earnings fall far enough. However, the next year is actually looking up, with earnings set to rise. We would just wait until it becomes a pattern before getting too excited.

Werner Enterprises' Dividend Doesn't Look Sustainable

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. While Werner Enterprises is earning enough to cover the payments, the cash flows are lacking. We would be a touch cautious of relying on this stock primarily for the dividend income.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For instance, we've picked out 3 warning signs for Werner Enterprises that investors should take into consideration. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Werner Enterprises might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WERN

Werner Enterprises

Engages in transporting truckload shipments of general commodities in interstate and intrastate commerce in the United States, Mexico, and internationally.

Average dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives