- United States

- /

- Transportation

- /

- NasdaqGS:ULH

Is Universal Logistics Holdings, Inc. (NASDAQ:ULH) A High Quality Stock To Own?

While some investors are already well versed in financial metrics (hat tip), this article is for those who would like to learn about Return On Equity (ROE) and why it is important. To keep the lesson grounded in practicality, we'll use ROE to better understand Universal Logistics Holdings, Inc. (NASDAQ:ULH).

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

View our latest analysis for Universal Logistics Holdings

How To Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Universal Logistics Holdings is:

18% = US$41m ÷ US$228m (Based on the trailing twelve months to October 2020).

The 'return' is the income the business earned over the last year. That means that for every $1 worth of shareholders' equity, the company generated $0.18 in profit.

Does Universal Logistics Holdings Have A Good ROE?

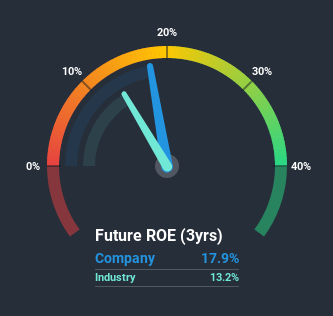

By comparing a company's ROE with its industry average, we can get a quick measure of how good it is. Importantly, this is far from a perfect measure, because companies differ significantly within the same industry classification. As is clear from the image below, Universal Logistics Holdings has a better ROE than the average (13%) in the Transportation industry.

That is a good sign. However, bear in mind that a high ROE doesn’t necessarily indicate efficient profit generation. Especially when a firm uses high levels of debt to finance its debt which may boost its ROE but the high leverage puts the company at risk.

How Does Debt Impact Return On Equity?

Most companies need money -- from somewhere -- to grow their profits. The cash for investment can come from prior year profits (retained earnings), issuing new shares, or borrowing. In the first and second cases, the ROE will reflect this use of cash for investment in the business. In the latter case, the debt required for growth will boost returns, but will not impact the shareholders' equity. In this manner the use of debt will boost ROE, even though the core economics of the business stay the same.

Combining Universal Logistics Holdings' Debt And Its 18% Return On Equity

Universal Logistics Holdings does use a high amount of debt to increase returns. It has a debt to equity ratio of 2.05. While its ROE is respectable, it is worth keeping in mind that there is usually a limit as to how much debt a company can use. Debt does bring extra risk, so it's only really worthwhile when a company generates some decent returns from it.

Conclusion

Return on equity is useful for comparing the quality of different businesses. A company that can achieve a high return on equity without debt could be considered a high quality business. If two companies have around the same level of debt to equity, and one has a higher ROE, I'd generally prefer the one with higher ROE.

But when a business is high quality, the market often bids it up to a price that reflects this. The rate at which profits are likely to grow, relative to the expectations of profit growth reflected in the current price, must be considered, too. So I think it may be worth checking this free report on analyst forecasts for the company.

If you would prefer check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

If you’re looking to trade Universal Logistics Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqGS:ULH

Universal Logistics Holdings

Provides customized transportation and logistics solutions in the United States, Mexico, Canada, and Colombia.

Adequate balance sheet slight.

Market Insights

Community Narratives