- United States

- /

- Beverage

- /

- NasdaqCM:CELH

Three US Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As the U.S. markets continue to show resilience, with record highs in major indices like the Nasdaq and S&P 500, investors are keenly observing trends that might suggest sustainable growth. In this context, growth companies with high insider ownership can be particularly compelling, as significant insider stakes often align leadership interests with shareholder goals, potentially enhancing company performance amidst current market conditions.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

| PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.2% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 22.1% |

| Duolingo (NasdaqGS:DUOL) | 15% | 48.1% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

| Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.7% | 60.9% |

| Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

| BBB Foods (NYSE:TBBB) | 22.9% | 100.1% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

Let's dive into some prime choices out of from the screener.

Southern California Bancorp (NasdaqCM:BCAL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Southern California Bancorp, with a market cap of $251.82 million, operates as the holding company for Bank of Southern California, N.A., serving various banking needs.

Operations: The primary revenue stream, totaling $92.58 million, is derived from commercial banking activities.

Insider Ownership: 23.1%

Return On Equity Forecast: N/A (2027 estimate)

Southern California Bancorp is poised for robust growth with its earnings forecast to increase by 70.9% annually, outpacing the US market's 14.7%. Revenue is also expected to surge at a rate of 40.4% per year, significantly above the market average of 8.6%. Despite a challenging first quarter in 2024 with a drop in net income and interest income, the company benefits from a competitive price-to-earnings ratio of 11.2x against the market's 16.7x. Additionally, regulatory approvals for its merger with California BanCorp could enhance future prospects, set to finalize in Q3 2024.

- Take a closer look at Southern California Bancorp's potential here in our earnings growth report.

- Our valuation report here indicates Southern California Bancorp may be overvalued.

Celsius Holdings (NasdaqCM:CELH)

Simply Wall St Growth Rating: ★★★★★☆

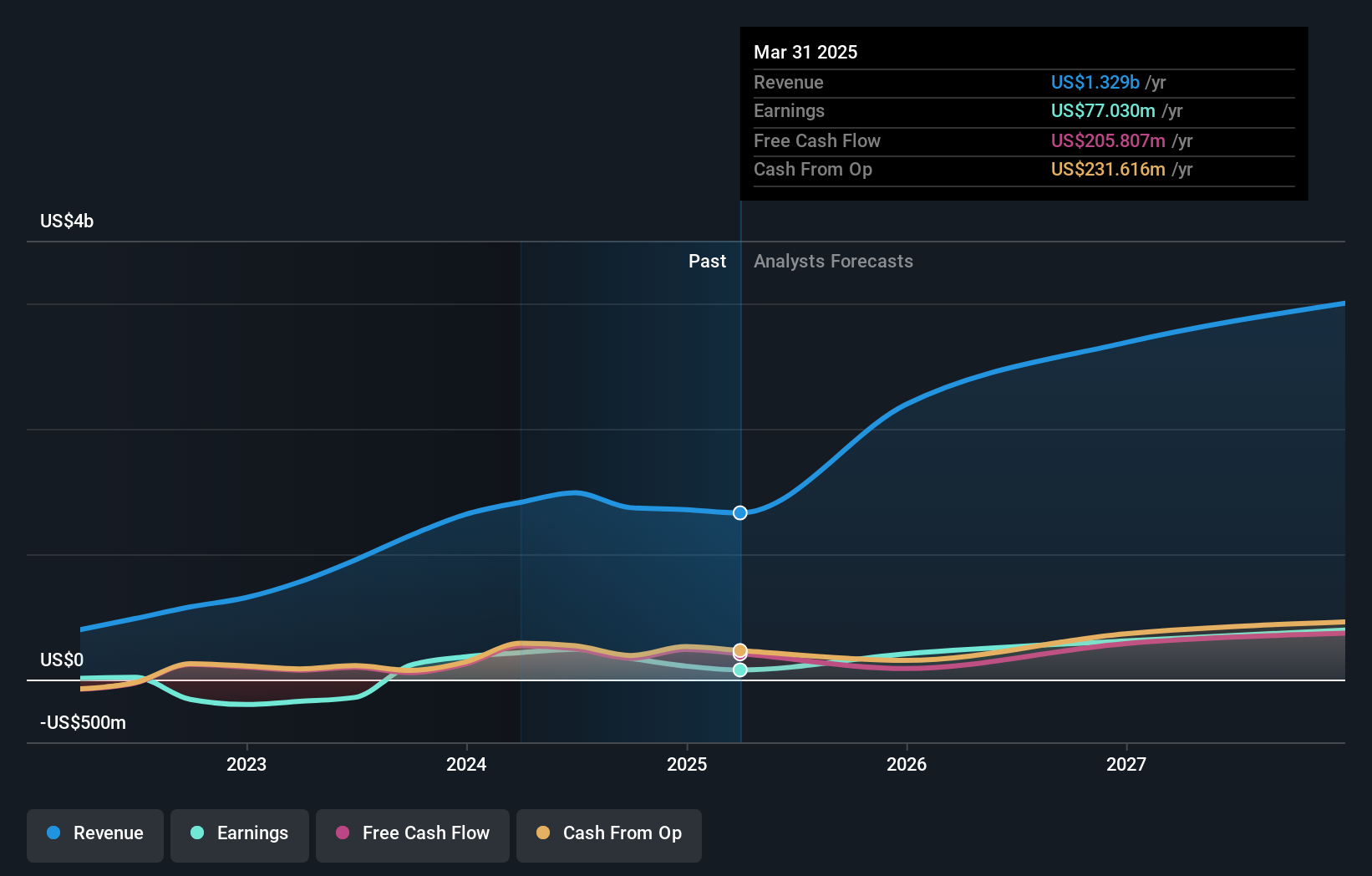

Overview: Celsius Holdings, Inc. is a global company that develops, markets, and distributes functional energy drinks and liquid supplements, with a market capitalization of approximately $13.48 billion.

Operations: The company generates its revenue primarily from the sale of non-alcoholic beverages, totaling $1.41 billion.

Insider Ownership: 10.5%

Return On Equity Forecast: 42% (2027 estimate)

Celsius Holdings has demonstrated significant growth, with a recent earnings report showing a substantial increase in sales and net income. The company's revenue and earnings are expected to grow at 19.9% and 21.68% per year respectively, outpacing the US market averages. Despite this positive outlook, there has been notable insider selling over the past three months, which could raise concerns among investors. Additionally, Celsius is expanding internationally, planning sales launches in multiple European countries through strategic partnerships.

- Click here to discover the nuances of Celsius Holdings with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Celsius Holdings' share price might be too optimistic.

Frontier Group Holdings (NasdaqGS:ULCC)

Simply Wall St Growth Rating: ★★★★★☆

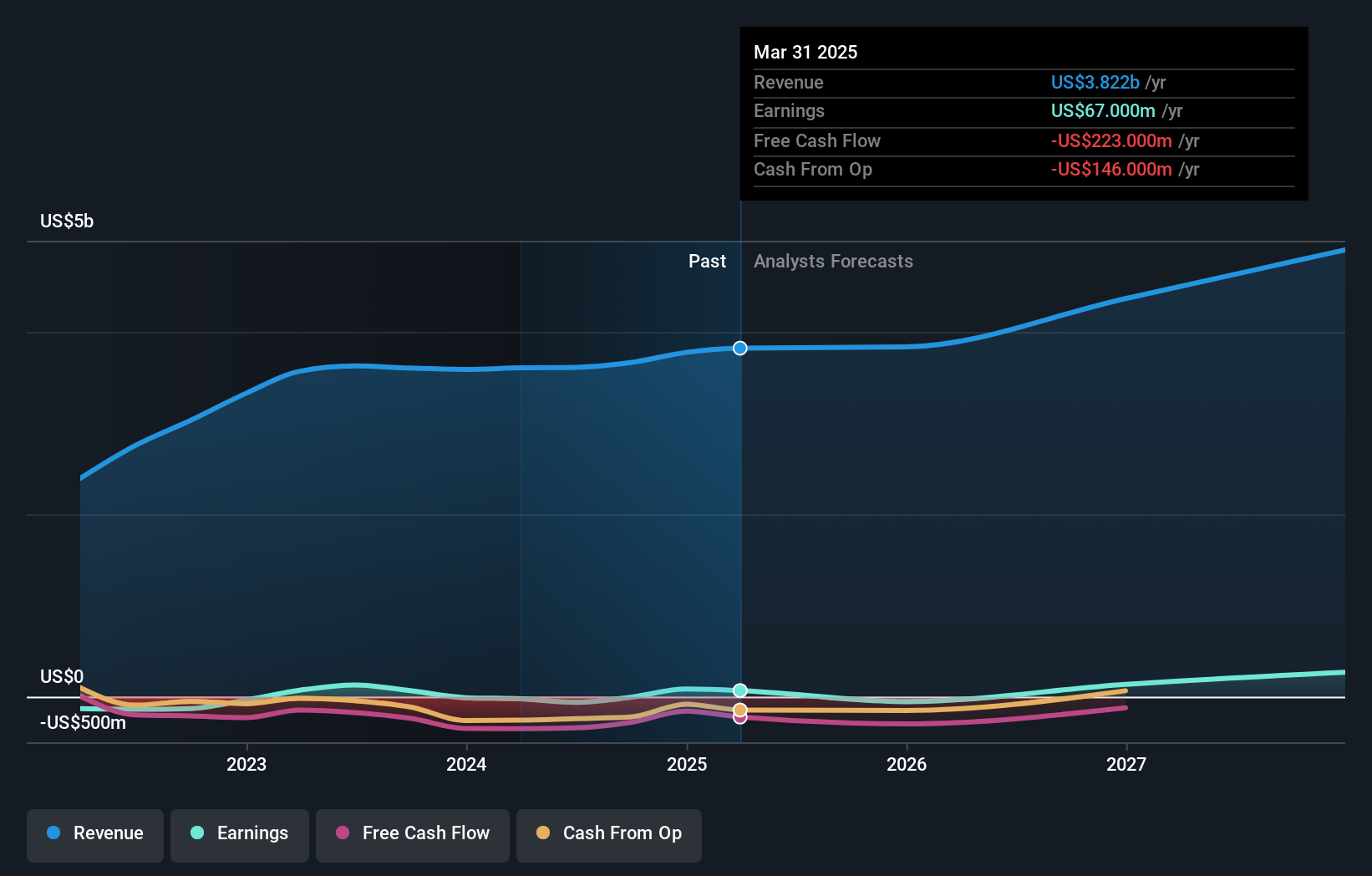

Overview: Frontier Group Holdings, Inc. operates as a low-fare passenger airline serving leisure travelers in the United States and Latin America, with a market capitalization of approximately $1.07 billion.

Operations: The company generates its revenue primarily through providing air transportation for passengers, totaling approximately $3.61 billion.

Insider Ownership: 34.8%

Return On Equity Forecast: 29% (2027 estimate)

Frontier Group Holdings, despite a challenging financial quarter with increased losses, is anticipated to see substantial capacity growth ranging from 12% to 15% annually. This growth projection aligns with their strategic expansions and recent executive board enhancement by appointing Nancy L. Lipson, known for her legal and corporate governance expertise. However, insider transactions have not shown significant buying activity, suggesting cautious optimism among insiders about the company's future performance.

- Get an in-depth perspective on Frontier Group Holdings' performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, Frontier Group Holdings' share price might be too pessimistic.

Key Takeaways

- Get an in-depth perspective on all 183 Fast Growing US Companies With High Insider Ownership by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CELH

Celsius Holdings

Develops, processes, markets, distributes, and sells functional energy drinks and liquid supplements in the United States, Australia, New Zealand, Canadian, European, Middle Eastern, Asia-Pacific, and internationally.

Flawless balance sheet with reasonable growth potential.