- United States

- /

- Airlines

- /

- NasdaqGS:ULCC

Is Frontier’s Route Expansion and Spirit’s Bankruptcy Shaping a New Investment Outlook for ULCC?

Reviewed by Simply Wall St

- Frontier Group Holdings recently presented at Morgan Stanley’s 13th Annual Laguna Conference, following an insider sale by the Senior Vice President of Customers and an analyst upgrade from Deutsche Bank, which was linked to anticipated benefits after Spirit Airlines’ bankruptcy and plans to launch 20 new routes.

- A unique aspect is that while discussions between Spirit and Frontier executives focused on Spirit’s recovery efforts post-bankruptcy, there were no acquisition talks, suggesting independent strategies in a changing airline sector.

- We will now examine how Frontier’s route expansion plan, highlighted during the analyst upgrade, could influence its investment outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Frontier Group Holdings Investment Narrative Recap

To be a Frontier Group Holdings shareholder, you would need to believe in the company's ability to grow through low-cost, high-capacity expansion in secondary and Sun Belt markets, while managing risks from industry oversupply and volatile demand. The recent Morgan Stanley conference appearance and insider sale do not materially shift the main short-term catalyst, Frontier’s 20 new routes, or its biggest risk, which remains ongoing revenue and margin pressure from weak demand and high fixed costs.

The rollout of 20 new routes, highlighted in the Deutsche Bank upgrade, is especially relevant here. This expansion may help absorb surplus capacity and address fixed costs, yet its success likely hinges on whether industry capacity reductions keep pace, supporting yield and load factor improvements for the airline.

However, investors should be mindful that while route growth can offer upside, in contrast...

Read the full narrative on Frontier Group Holdings (it's free!)

Frontier Group Holdings' narrative projects $4.9 billion revenue and $253.9 million earnings by 2028. This requires 9.2% yearly revenue growth and a $287.9 million increase in earnings from -$34.0 million today.

Uncover how Frontier Group Holdings' forecasts yield a $5.39 fair value, a 4% upside to its current price.

Exploring Other Perspectives

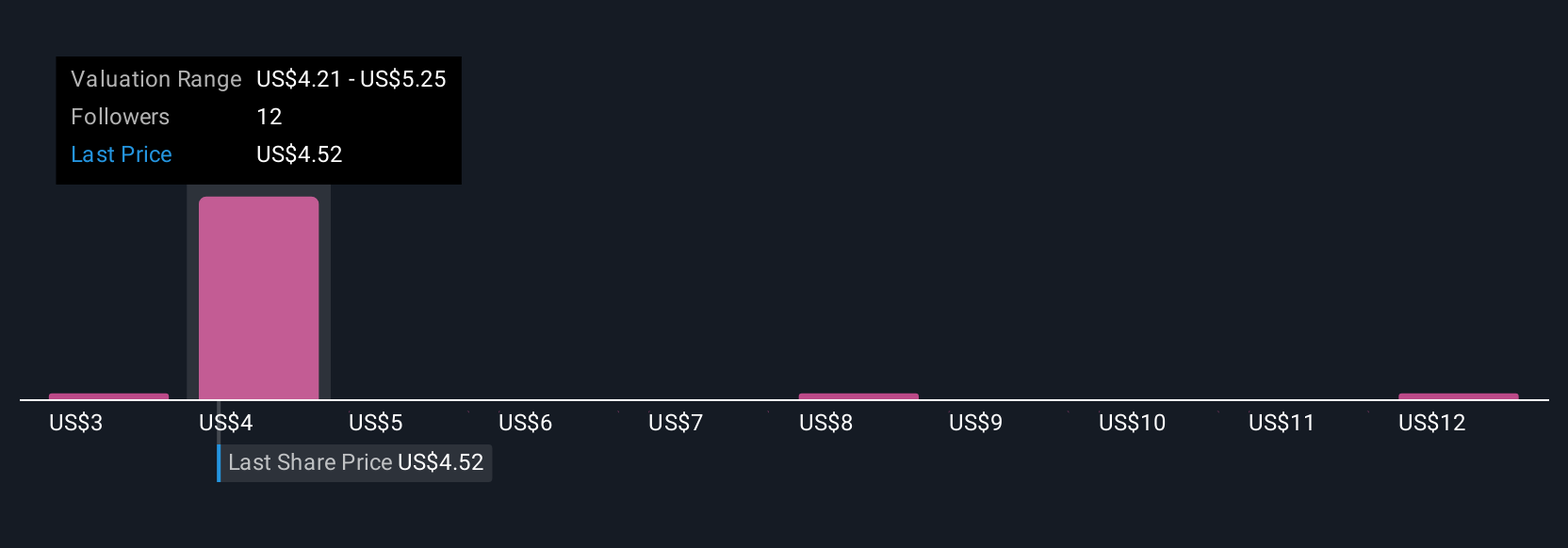

Fair value estimates from four Simply Wall St Community members span US$3.18 to US$13.52 per share. With airline oversupply and margin uncertainty top of mind, explore these varied perspectives on Frontier's outlook.

Explore 4 other fair value estimates on Frontier Group Holdings - why the stock might be worth over 2x more than the current price!

Build Your Own Frontier Group Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Frontier Group Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Frontier Group Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Frontier Group Holdings' overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ULCC

Frontier Group Holdings

Provides low-fare passenger airline services to leisure travelers in the United States and Latin America.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives