- United States

- /

- Airlines

- /

- NasdaqGS:UAL

United Airlines' (UAL) Mixed Results: Are Cost Pressures or Optimistic Guidance Shaping Its Future?

Reviewed by Sasha Jovanovic

- Earlier this past week, United Airlines Holdings reported mixed third-quarter 2025 results, delivering an earnings per share beat while falling slightly short on revenue expectations and experiencing lower operating margins amid rising cost pressures.

- The company nevertheless issued a robust outlook for the fourth quarter and full year 2025, highlighting anticipated record revenue and continued investment in premium services and technology upgrades.

- Next, we'll review how United's ongoing cost challenges and optimistic future guidance may influence the company's investment narrative.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

United Airlines Holdings Investment Narrative Recap

To feel confident as a shareholder in United Airlines Holdings, one typically needs to believe that investments in premium services, international expansion, and digital technology upgrades will offset rising cost pressures and support margin recovery, even as the industry hurdles structural and competitive risks. The recent mixed third-quarter results, while leading to a short-term stock decline, do not appear to fundamentally alter the company's main earnings catalyst: stronger premium travel demand and continued network optimization. However, persistent margin questions tied to higher operating and labor costs remain the most important short-term risk for United’s investment case.

Among United’s latest announcements, its new Summer 2026 international routes are particularly relevant, broadening the airline’s transatlantic footprint and appealing to higher-yield leisure and premium customers. This continued expansion comes as United guides for record fourth-quarter revenue, underlining the company’s reliance on international and premium travel trends to meet ambitious earnings targets.

Yet, in contrast to growing international demand, investors should remain alert to the structural pressures from ongoing operating complexity and rising labor costs…

Read the full narrative on United Airlines Holdings (it's free!)

United Airlines Holdings is projected to achieve $67.6 billion in revenue and $4.2 billion in earnings by 2028. This outlook relies on a forecasted annual revenue growth rate of 5.2% and a $0.9 billion increase in earnings from the current $3.3 billion.

Uncover how United Airlines Holdings' forecasts yield a $121.45 fair value, a 23% upside to its current price.

Exploring Other Perspectives

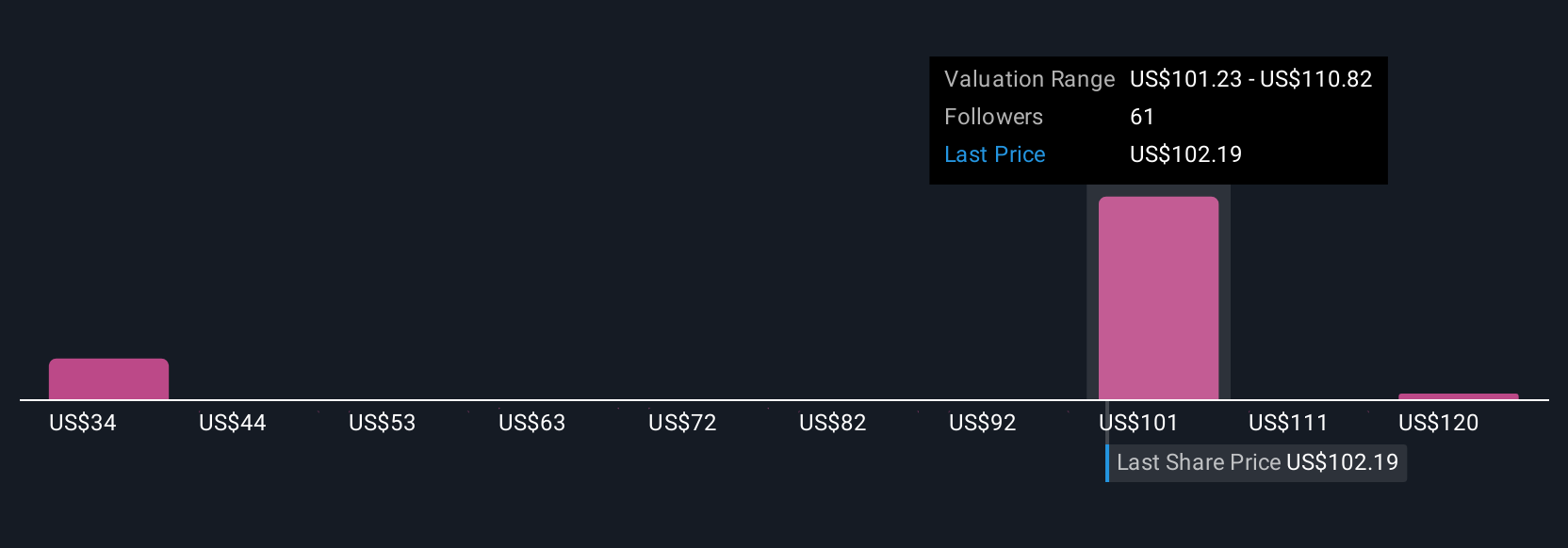

Fair value estimates from six Simply Wall St Community members span from US$69.62 to US$130, revealing wide-ranging views on United Airlines’ potential. While some see international growth as a catalyst, others point to margin pressures as a key factor for performance, explore multiple perspectives to inform your outlook.

Explore 6 other fair value estimates on United Airlines Holdings - why the stock might be worth as much as 31% more than the current price!

Build Your Own United Airlines Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your United Airlines Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free United Airlines Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate United Airlines Holdings' overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UAL

United Airlines Holdings

Through its subsidiaries, provides air transportation services in the United States, Canada, Atlantic, the Pacific, and Latin America.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives