- United States

- /

- Airlines

- /

- NasdaqGS:SKYW

Did Strong Q2 Results and Share Buybacks Just Shift SkyWest's (SKYW) Investment Narrative?

Reviewed by Simply Wall St

- SkyWest recently announced its second quarter 2025 results, reporting revenue of US$1.04 billion and net income of US$120.27 million, both up from the prior year, alongside progress on its share repurchase program.

- The combination of strong earnings growth and share buybacks highlights ongoing improvements in operational performance and an emphasis on returning value to shareholders.

- We'll explore what SkyWest's continued earnings growth and share repurchases could mean for its future investment potential.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

SkyWest Investment Narrative Recap

To believe in SkyWest as a shareholder, you have to be confident in the company’s ability to grow profitably despite ongoing economic uncertainty and supply chain risks. The latest earnings report, with revenue and net income both sharply higher year-over-year, reinforces the near-term catalyst of continued fleet and block hour expansion. However, the news does not directly alter the biggest risk: potential delays in receiving new E175 jets, which could disrupt those growth plans if supply chains tighten further.

The recent progress on SkyWest’s share buyback program stands out, with over 5.16 million shares repurchased, representing 12.01% of total shares since May 2023. This adds support to the ongoing theme of capital returns, which may appeal to investors seeking signals of management’s confidence and a cushion for earnings per share as the company pursues fleet modernization and contract growth opportunities.

But even with rising profits and buybacks, investors should also be aware that supply chain bottlenecks for new aircraft remain a critical...

Read the full narrative on SkyWest (it's free!)

SkyWest's narrative projects $4.4 billion revenue and $439.8 million earnings by 2028. This requires 6.3% yearly revenue growth and a $76.6 million earnings increase from $363.2 million.

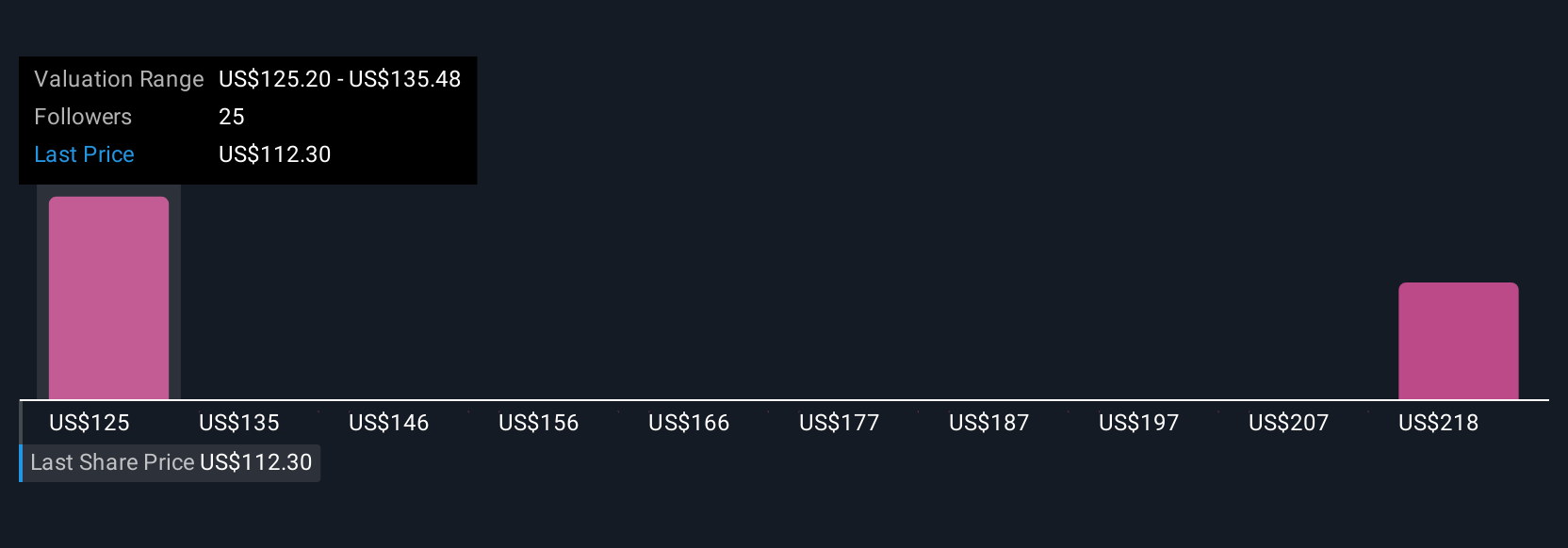

Uncover how SkyWest's forecasts yield a $125.20 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members offered two fair value estimates for SkyWest, ranging from US$125.20 to US$228.31 per share. With future aircraft delivery timing still uncertain, opinions on the growth path can differ widely, check out the full range of views to see where you stand.

Build Your Own SkyWest Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SkyWest research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free SkyWest research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SkyWest's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SKYW

SkyWest

Through its subsidiaries, engages in the operation of a regional airline in the United States.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives