- United States

- /

- Transportation

- /

- NasdaqGS:SAIA

A Fresh Look at Saia (SAIA) Valuation Following Upbeat Analyst Forecasts and Mixed Q3 Results

Reviewed by Simply Wall St

See our latest analysis for Saia.

Saia’s performance over the past year has been rocky, with its share price sliding nearly 36% since January and its one-year total shareholder return dropping 47%. However, recent upward earnings estimate revisions and analyst confidence suggest momentum could be turning, especially as the company continues navigating industry headwinds with solid strategies.

If you’re interested in other companies showing strong growth and insider conviction, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With the stock down sharply this year, but analyst confidence on the rise, investors are left to ponder whether Saia is trading below its true value or if the market has already priced in future gains.

Most Popular Narrative: 13.9% Undervalued

According to the most widely followed valuation narrative, Saia's fair value is pegged at $331.10, well above the most recent close of $285.04. This suggests room for upside based on forward-looking earnings projections and margin expansion assumptions.

The ongoing expansion and maturation of Saia's national terminal network, combined with network densification, is starting to unlock cost efficiencies and higher shipment volumes in new and legacy markets. This positions the company for top-line revenue growth and improved operating margins as these facilities move toward scale.

Curious how Wall Street is crunching the numbers? The fair value hinges on expectations around accelerating earnings, resilient profit margins, and a bold leap in future profitability. Wondering which bullish forecasts hold all the weight? Only a deeper read reveals the powerful assumptions driving this narrative’s target.

Result: Fair Value of $331.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weak shipment growth or rising costs could challenge the bullish narrative and limit Saia’s ability to deliver on projected margin gains.

Find out about the key risks to this Saia narrative.

Another View: Multiple-Based Valuation

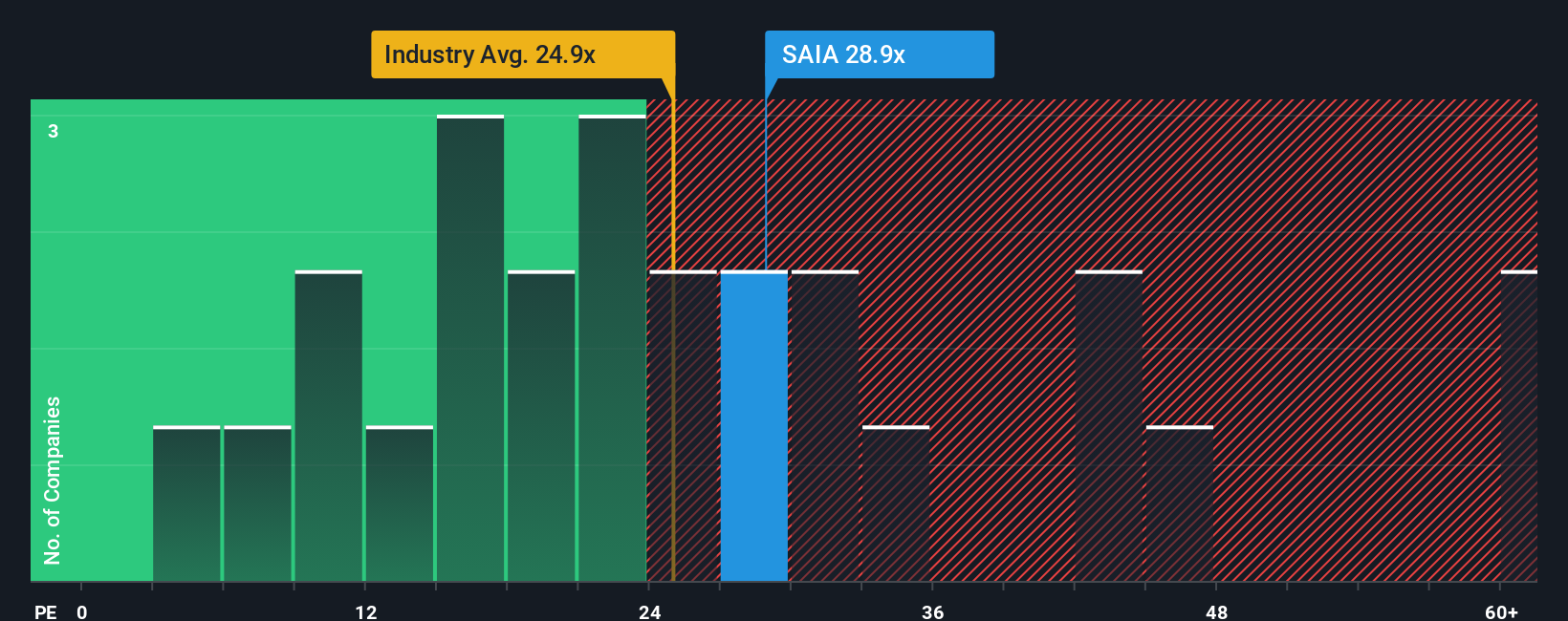

Looking through a market-based lens, Saia's price-to-earnings ratio sits at 26.7x. This is just below the US Transportation industry average of 27.6x and well beneath the peer average of 39.8x. However, it stands in stark contrast to the fair ratio of 14.4x. This signals caution for investors if the market shifts toward a more conservative valuation.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Saia Narrative

Keep in mind, if you see things differently or want to dive into the data yourself, it only takes a few minutes to put together your personal view. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Saia.

Looking for More Investment Ideas?

Get ahead of the market and seize new opportunities with Simply Wall Street’s powerful screeners tailored for smart investors like you.

- Jump on emerging returns by reviewing these 883 undervalued stocks based on cash flows to see which companies are trading below their true worth right now.

- Tap into innovation and check out these 27 AI penny stocks, your shortcut to leading names at the center of artificial intelligence breakthroughs.

- Boost your portfolio’s income potential by exploring these 14 dividend stocks with yields > 3%, which features options offering robust yields above 3% and a track record of reliability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SAIA

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives