- United States

- /

- Transportation

- /

- NasdaqGS:SAIA

A Fresh Look at Saia (SAIA) Valuation as Investors Reassess Transportation Sector Prospects

Reviewed by Simply Wall St

Saia (SAIA) shares have shown modest movement over the past week, reflecting a generally steady market environment for transportation stocks. Investors are watching recent trends in the company's returns and what they could signal for the months ahead.

See our latest analysis for Saia.

Saia’s share price has slipped over 30% year-to-date, signaling a notable cool down after several years of strong momentum. Its three- and five-year total shareholder returns of 56.6% and 115.9% show the business has delivered for longer-term holders. Recent swings reflect investors reassessing transport sector risks and opportunities rather than any one event, so momentum could build quickly with changing market sentiment.

If you’re ready to spot what’s next in the market, now’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

With the stock trading below analyst targets and a modest intrinsic valuation discount, the central question is whether Saia is quietly undervalued or if the market has fully accounted for its future growth prospects.

Most Popular Narrative: 8% Undervalued

Saia’s most closely-watched narrative values the stock at $337.25, which is moderately higher than its last close of $310.39. This narrative is fueling ongoing debate about whether the market fully appreciates Saia’s transformation and future earnings potential.

The ongoing expansion and maturation of Saia's national terminal network, combined with network densification, is starting to unlock cost efficiencies and higher shipment volumes in new and legacy markets. This is positioning the company for top-line revenue growth and improved operating margins as these facilities move toward scale.

What’s driving that premium? There is a bold set of growth assumptions baked into the forecast. Hint: it is not just about more shipments or new terminals. The full narrative unpacks key margin factors and a set of financial levers that could reshape Saia’s future value. Dive in to uncover the projections and scenarios that could justify this target.

Result: Fair Value of $337.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued muted shipment growth and rising operational costs could challenge these growth assumptions and may serve as catalysts for a shift in Saia’s valuation story.

Find out about the key risks to this Saia narrative.

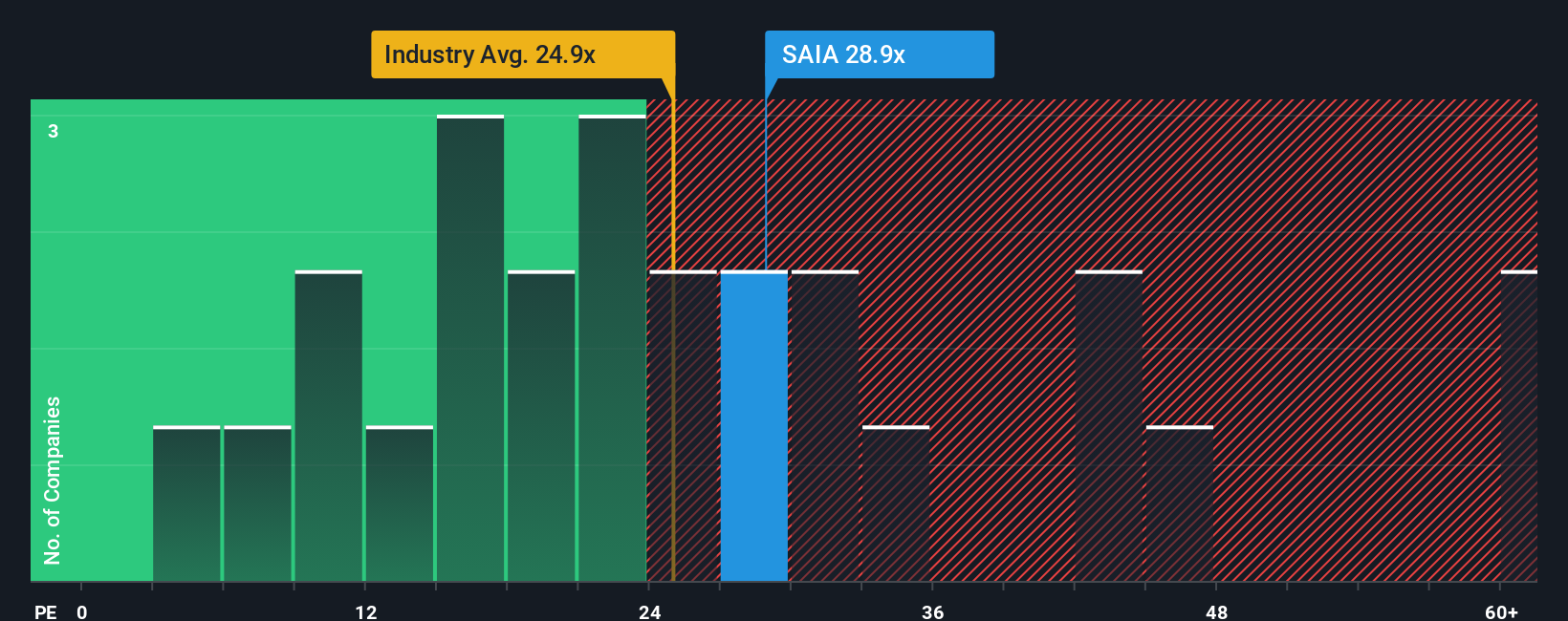

Another View: Market Ratios Suggest Expensive Territory

While the narrative and intrinsic approaches identify Saia as undervalued, the market’s go-to ratio tells a different story. Saia trades at a price-to-earnings ratio of 28.4x, which is higher than both the US Transportation industry average of 26.7x and our fair ratio estimate of 14.1x. That gap signals the market is pricing in plenty of optimism and adds potential downside risk if high expectations are not met. Which approach best captures the real opportunity for investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Saia Narrative

If you see things differently or want to dig deeper into the numbers yourself, it only takes a few minutes to build your own narrative. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Saia.

Looking for more investment ideas?

Stock markets reward those who stay sharp and seize unique opportunities. Don’t let great investments pass you by. Step up your search and see what you might be missing.

- Capture tomorrow’s AI breakthroughs by browsing these 24 AI penny stocks that are harnessing artificial intelligence to transform entire industries and drive remarkable growth.

- Tap into reliable cash flow and solid yields with these 17 dividend stocks with yields > 3% designed to help you secure your portfolio with companies offering consistently high dividends.

- Stretch your investment strategy to include potential under-the-radar winners by reviewing these 877 undervalued stocks based on cash flows that trade below their intrinsic value today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SAIA

Adequate balance sheet and fair value.

Market Insights

Community Narratives