- United States

- /

- Marine and Shipping

- /

- NasdaqCM:PXS

Pyxis Tankers (NASDAQ:PXS) Has A Somewhat Strained Balance Sheet

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Pyxis Tankers Inc. (NASDAQ:PXS) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Pyxis Tankers

What Is Pyxis Tankers's Debt?

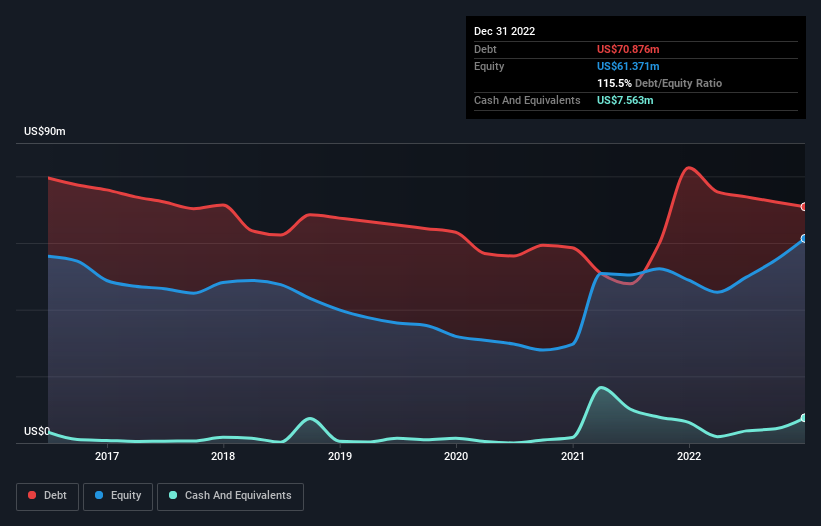

As you can see below, Pyxis Tankers had US$70.9m of debt at December 2022, down from US$82.6m a year prior. On the flip side, it has US$7.56m in cash leading to net debt of about US$63.3m.

How Strong Is Pyxis Tankers' Balance Sheet?

The latest balance sheet data shows that Pyxis Tankers had liabilities of US$12.6m due within a year, and liabilities of US$65.0m falling due after that. On the other hand, it had cash of US$7.56m and US$11.1m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$59.0m.

When you consider that this deficiency exceeds the company's US$58.5m market capitalization, you might well be inclined to review the balance sheet intently. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Pyxis Tankers has a debt to EBITDA ratio of 2.7 and its EBIT covered its interest expense 4.0 times. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. One redeeming factor for Pyxis Tankers is that it turned last year's EBIT loss into a gain of US$18m, over the last twelve months. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Pyxis Tankers can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it is important to check how much of its earnings before interest and tax (EBIT) converts to actual free cash flow. Looking at the most recent year, Pyxis Tankers recorded free cash flow of 27% of its EBIT, which is weaker than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

Mulling over Pyxis Tankers's attempt at staying on top of its total liabilities, we're certainly not enthusiastic. But at least its EBIT growth rate is not so bad. Looking at the bigger picture, it seems clear to us that Pyxis Tankers's use of debt is creating risks for the company. If all goes well, that should boost returns, but on the flip side, the risk of permanent capital loss is elevated by the debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 3 warning signs for Pyxis Tankers (2 are concerning) you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:PXS

Pyxis Tankers

Operates as a maritime transportation company with a focus on the tanker and dry-bulk sectors worldwide.

Undervalued with adequate balance sheet.