- United States

- /

- Marine and Shipping

- /

- NasdaqCM:PXS

Investors Continue Waiting On Sidelines For Pyxis Tankers Inc. (NASDAQ:PXS)

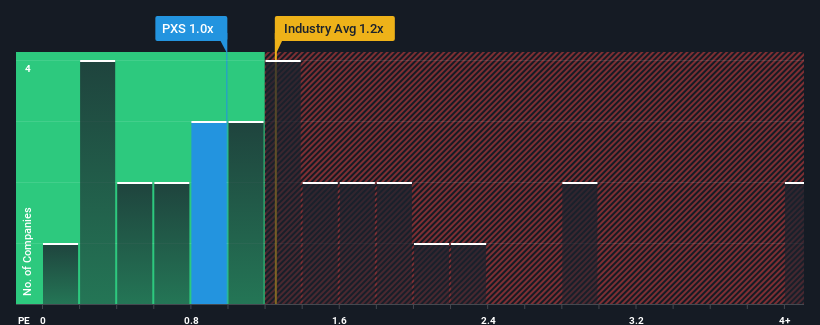

With a median price-to-sales (or "P/S") ratio of close to 1.2x in the Shipping industry in the United States, you could be forgiven for feeling indifferent about Pyxis Tankers Inc.'s (NASDAQ:PXS) P/S ratio of 1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Pyxis Tankers

What Does Pyxis Tankers' P/S Mean For Shareholders?

The recent revenue growth at Pyxis Tankers would have to be considered satisfactory if not spectacular. Perhaps the expectation moving forward is that the revenue growth will track in line with the wider industry for the near term, which has kept the P/S subdued. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Pyxis Tankers will help you shine a light on its historical performance.Do Revenue Forecasts Match The P/S Ratio?

Pyxis Tankers' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a decent 5.3% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 107% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to shrink 1.8% in the next 12 months, the company's positive momentum based on recent medium-term revenue results is a bright spot for the moment.

With this in mind, we find it intriguing that Pyxis Tankers' P/S matches its industry peers. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What Does Pyxis Tankers' P/S Mean For Investors?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As mentioned previously, Pyxis Tankers currently trades on a P/S on par with the wider industry, but this is lower than expected considering its recent three-year revenue growth is beating forecasts for a struggling industry. There could be some unobserved threats to revenue preventing the P/S ratio from outpacing the industry much like its revenue performance. Without the guidance of analysts, perhaps shareholders are feeling uncertain over whether the revenue performance can continue amidst a declining industry outlook. The fact that the company's relative performance has not provided a kick to the share price suggests that some investors are anticipating revenue instability.

Before you take the next step, you should know about the 3 warning signs for Pyxis Tankers (1 makes us a bit uncomfortable!) that we have uncovered.

If these risks are making you reconsider your opinion on Pyxis Tankers, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Pyxis Tankers, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:PXS

Pyxis Tankers

Operates as a maritime transportation company with a focus on the tanker and dry-bulk sectors worldwide.

Undervalued with adequate balance sheet.