- United States

- /

- Marine and Shipping

- /

- NasdaqCM:PXS

Investors Aren't Entirely Convinced By Pyxis Tankers Inc.'s (NASDAQ:PXS) Revenues

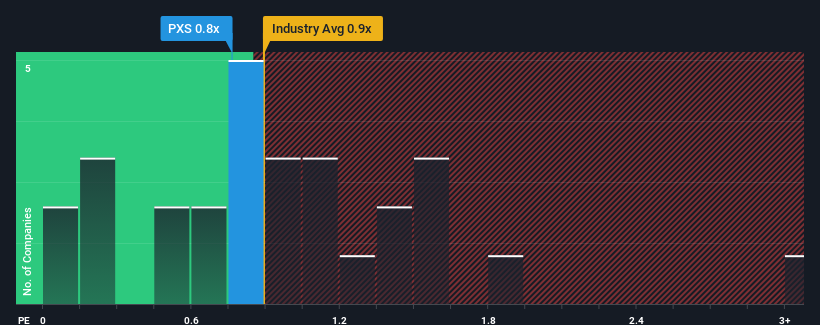

It's not a stretch to say that Pyxis Tankers Inc.'s (NASDAQ:PXS) price-to-sales (or "P/S") ratio of 0.8x right now seems quite "middle-of-the-road" for companies in the Shipping industry in the United States, where the median P/S ratio is around 0.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Pyxis Tankers

What Does Pyxis Tankers' P/S Mean For Shareholders?

With revenue growth that's exceedingly strong of late, Pyxis Tankers has been doing very well. It might be that many expect the strong revenue performance to wane, which has kept the share price, and thus the P/S ratio, from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Although there are no analyst estimates available for Pyxis Tankers, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Pyxis Tankers' Revenue Growth Trending?

Pyxis Tankers' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company grew revenue by an impressive 48% last year. The strong recent performance means it was also able to grow revenue by 112% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing that to the industry, which is predicted to shrink 5.9% in the next 12 months, the company's positive momentum based on recent medium-term revenue results is a bright spot for the moment.

With this in mind, we find it intriguing that Pyxis Tankers' P/S matches its industry peers. It looks like most investors are not convinced the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

What Does Pyxis Tankers' P/S Mean For Investors?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Pyxis Tankers revealed its growing revenue over the medium-term hasn't helped elevate its P/S above that of the industry, which is surprising given the industry is set to shrink. There could be some unobserved threats to revenue preventing the P/S ratio from outpacing the industry much like its revenue performance. Perhaps there is some hesitation about the company's ability to stay its recent course and swim against the current of the broader industry turmoil. The fact that the company's relative performance has not provided a kick to the share price suggests that some investors are anticipating revenue instability.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Pyxis Tankers, and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on Pyxis Tankers, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:PXS

Pyxis Tankers

Operates as a maritime transportation company with a focus on the tanker and dry-bulk sectors worldwide.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives