- United States

- /

- Marine and Shipping

- /

- NasdaqCM:OP

OceanPal Inc.'s (NASDAQ:OP) Shares Leap 32% Yet They're Still Not Telling The Full Story

OceanPal Inc. (NASDAQ:OP) shares have had a really impressive month, gaining 32% after a shaky period beforehand. But the last month did very little to improve the 87% share price decline over the last year.

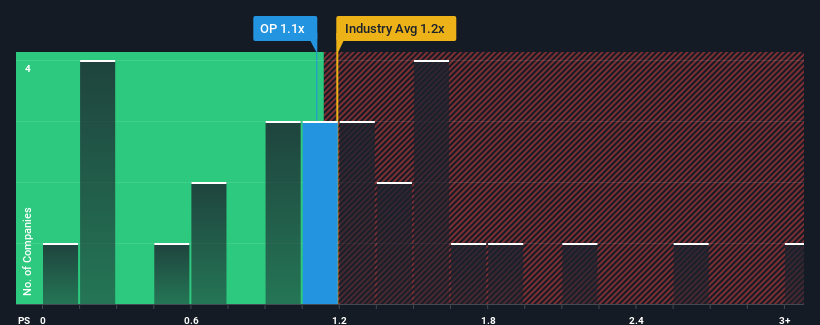

Although its price has surged higher, it's still not a stretch to say that OceanPal's price-to-sales (or "P/S") ratio of 1.1x right now seems quite "middle-of-the-road" compared to the Shipping industry in the United States, where the median P/S ratio is around 1.2x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for OceanPal

How OceanPal Has Been Performing

The recent revenue growth at OceanPal would have to be considered satisfactory if not spectacular. One possibility is that the P/S is moderate because investors think this good revenue growth might only be parallel to the broader industry in the near future. If not, then at least existing shareholders probably aren't too pessimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on OceanPal's earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For OceanPal?

In order to justify its P/S ratio, OceanPal would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a decent 6.5% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 101% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 5.1% shows it's a great look while it lasts.

In light of this, it's peculiar that OceanPal's P/S sits in line with the majority of other companies. It looks like most investors are not convinced the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

The Key Takeaway

Its shares have lifted substantially and now OceanPal's P/S is back within range of the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of OceanPal revealed its growing revenue over the medium-term hasn't helped elevate its P/S above that of the industry, which is surprising given the industry is set to shrink. When we see a history of positive growth in a struggling industry, but only an average P/S, we assume potential risks are what might be placing pressure on the P/S ratio. Without the guidance of analysts, perhaps shareholders are feeling uncertain over whether the revenue performance can continue amidst a declining industry outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

And what about other risks? Every company has them, and we've spotted 3 warning signs for OceanPal (of which 2 are a bit concerning!) you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:OP

Adequate balance sheet low.

Market Insights

Community Narratives