- United States

- /

- Transportation

- /

- NasdaqGS:ODFL

Old Dominion Freight Line (ODFL): Evaluating Valuation After Capital Spending Cuts and Cost Discipline in a Soft Freight Market

Reviewed by Simply Wall St

Old Dominion Freight Line (ODFL) is responding to 2025’s weak freight demand by prioritizing operational efficiency and cost discipline, including a 20% reduction in capital expenditures this year. These moves are intended to support margins and future growth opportunities.

See our latest analysis for Old Dominion Freight Line.

Old Dominion Freight Line’s share price has slipped 25.7% year-to-date, and its total shareholder return for the past year is down 38.7%. While strategic belt-tightening and efficiency gains suggest long-term growth potential, recent pressure on volume and margins has affected momentum in the short run.

If you’re watching logistics leaders adapt to shifting demand, it’s a smart move to broaden your scope and discover fast growing stocks with high insider ownership

With the stock trading at a significant discount to analyst price targets after recent declines, the key question is whether Old Dominion shares now offer a compelling entry point or if the market has already factored in future growth prospects.

Most Popular Narrative: 16.8% Undervalued

The most closely followed narrative places Old Dominion Freight Line’s fair value well above the latest closing price. This suggests analysts see significant upside potential driven by future earnings growth and margin improvement.

Continued investments in capacity through their capital expenditure plan, even amidst macroeconomic uncertainty, position Old Dominion to capture significant market share as the economy rebounds. This could potentially increase revenue. The company's dedication to superior service and disciplined yield management supports long-term market share gains and operational density improvements. These factors could enhance operating leverage and improve earnings.

Curious what drives that premium valuation? There is a quantitative blend of growth, margins, and profit expectations beneath the surface. But which dynamic assumption really makes the difference? Don’t miss the key findings that justify this bold price target.

Result: Fair Value of $156.95 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent freight weakness and higher overhead costs could undermine margin improvements. These factors may pose challenges to analysts’ bullish outlook in the near term.

Find out about the key risks to this Old Dominion Freight Line narrative.

Another View: The Role of Multiples

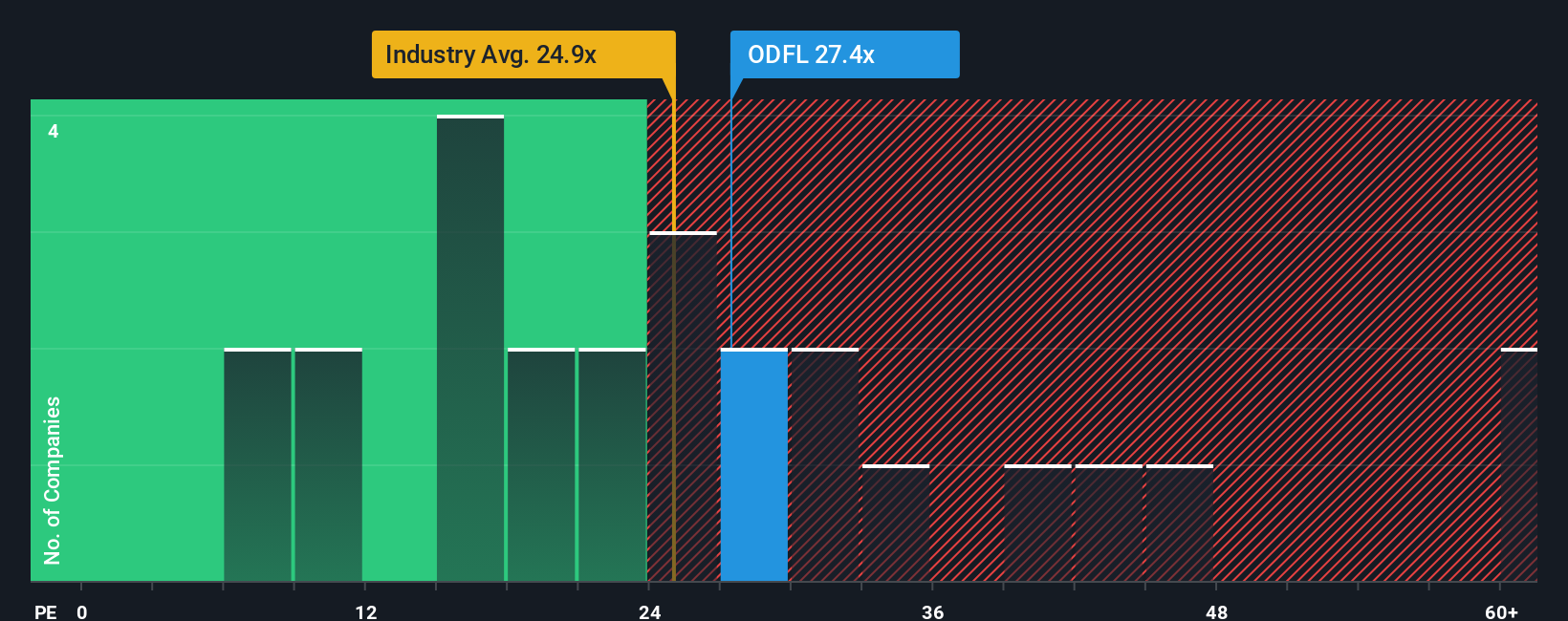

While fair value estimates suggest Old Dominion Freight Line is undervalued, a look at its current price-to-earnings ratio of 25.8x reveals a different story. This ratio is slightly higher than the US Transportation industry average of 25.7x, and notably above the company’s fair ratio of 16.4x. This gap implies investors may be paying a premium relative to what is justified by fundamentals or sector norms. This raises the question: could future sentiment or earnings justify this premium, or is there downside risk ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Old Dominion Freight Line Narrative

If you want to dig into the figures yourself and shape a story that fits your perspective, our platform makes it quick and easy. Create your version in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Old Dominion Freight Line.

Looking for More Smart Investment Ideas?

Don’t limit your options—there’s a world of exciting opportunities waiting for you. Start building a watchlist with high-potential themes and diversify your strategy today.

- Capture market shifts by tapping into these 908 undervalued stocks based on cash flows where analysts see quality stocks trading below their intrinsic value.

- Unlock the power of innovation with these 26 quantum computing stocks, a focus on companies that are pushing boundaries in quantum computing and next-gen tech.

- Maximize income potential by targeting these 18 dividend stocks with yields > 3%, which highlights companies offering attractive yields over 3% and steady financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ODFL

Old Dominion Freight Line

Operates as a less-than-truckload motor carrier in the United States and North America.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives