- United States

- /

- Transportation

- /

- NasdaqGS:LYFT

Not Many Are Piling Into Lyft, Inc. (NASDAQ:LYFT) Stock Yet As It Plummets 26%

Unfortunately for some shareholders, the Lyft, Inc. (NASDAQ:LYFT) share price has dived 26% in the last thirty days, prolonging recent pain. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 14% in that time.

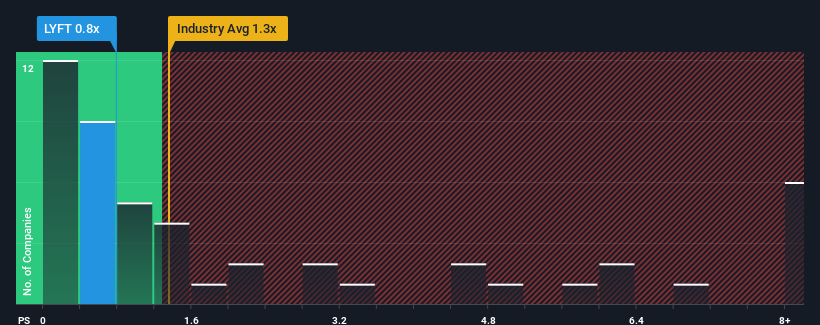

After such a large drop in price, Lyft's price-to-sales (or "P/S") ratio of 0.8x might make it look like a buy right now compared to the Transportation industry in the United States, where around half of the companies have P/S ratios above 1.3x and even P/S above 5x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Lyft

How Has Lyft Performed Recently?

With revenue growth that's superior to most other companies of late, Lyft has been doing relatively well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Lyft will help you uncover what's on the horizon.How Is Lyft's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Lyft's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 20% gain to the company's top line. Pleasingly, revenue has also lifted 109% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 14% per year as estimated by the analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 8.6% per annum, which is noticeably less attractive.

In light of this, it's peculiar that Lyft's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What Does Lyft's P/S Mean For Investors?

The southerly movements of Lyft's shares means its P/S is now sitting at a pretty low level. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

To us, it seems Lyft currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Lyft that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:LYFT

Lyft

Operates a peer-to-peer marketplace for on-demand ridesharing in the United States and Canada.

High growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives