- United States

- /

- Transportation

- /

- NasdaqGS:LYFT

Lyft (LYFT): Exploring Valuation as Growth Accelerates and Management Drives Renewed Investor Interest

Reviewed by Simply Wall St

Lyft (LYFT) is catching the attention of investors this week as the company’s impressive growth and profit momentum, driven in part by strategic management changes, puts its stock in an interesting position compared to its peers.

See our latest analysis for Lyft.

Lyft’s share price has been on a remarkable ride, climbing over 48% year-to-date with a surge of 37% in just the last 90 days. Investors are responding to strong growth, shifting management, and optimism around its competitive position. Even taking a longer view, Lyft’s one-year total shareholder return of nearly 47% signals momentum is building, especially given its attractive valuation compared to industry peers.

If Lyft’s breakout performance has your attention, it might be the perfect time to widen your lens and discover fast growing stocks with high insider ownership.

With shares rallying and profits surging, the key question for investors is whether Lyft’s current valuation still leaves room for upside or if the market has already accounted for the company’s renewed momentum and future growth prospects.

Most Popular Narrative: 5.7% Overvalued

With Lyft’s fair value set at $19.12 by the most followed narrative, there is a $1.09 premium at the last close price of $20.21. This puts Lyft above the consensus for now, as analysts weigh the latest catalysts and risks.

The ongoing rollout and consumer adoption of autonomous vehicles, backed by new partnerships with tech leaders like Baidu and operational capabilities in both the U.S. and Europe, are expected to significantly expand Lyft's total addressable market, lower labor costs, and increase long-term gross margins and earnings.

Want the real reason behind this high valuation? The narrative’s strongest claims rest on powerful revenue and earnings projections tied to ambitious technology upgrades and global partnerships. Discover the bold math that justifies this premium. One key number could surprise you.

Result: Fair Value of $19.12 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heightened competition from larger rivals and persistent regulatory uncertainties could quickly challenge Lyft's growth story and undermine this optimistic narrative.

Find out about the key risks to this Lyft narrative.

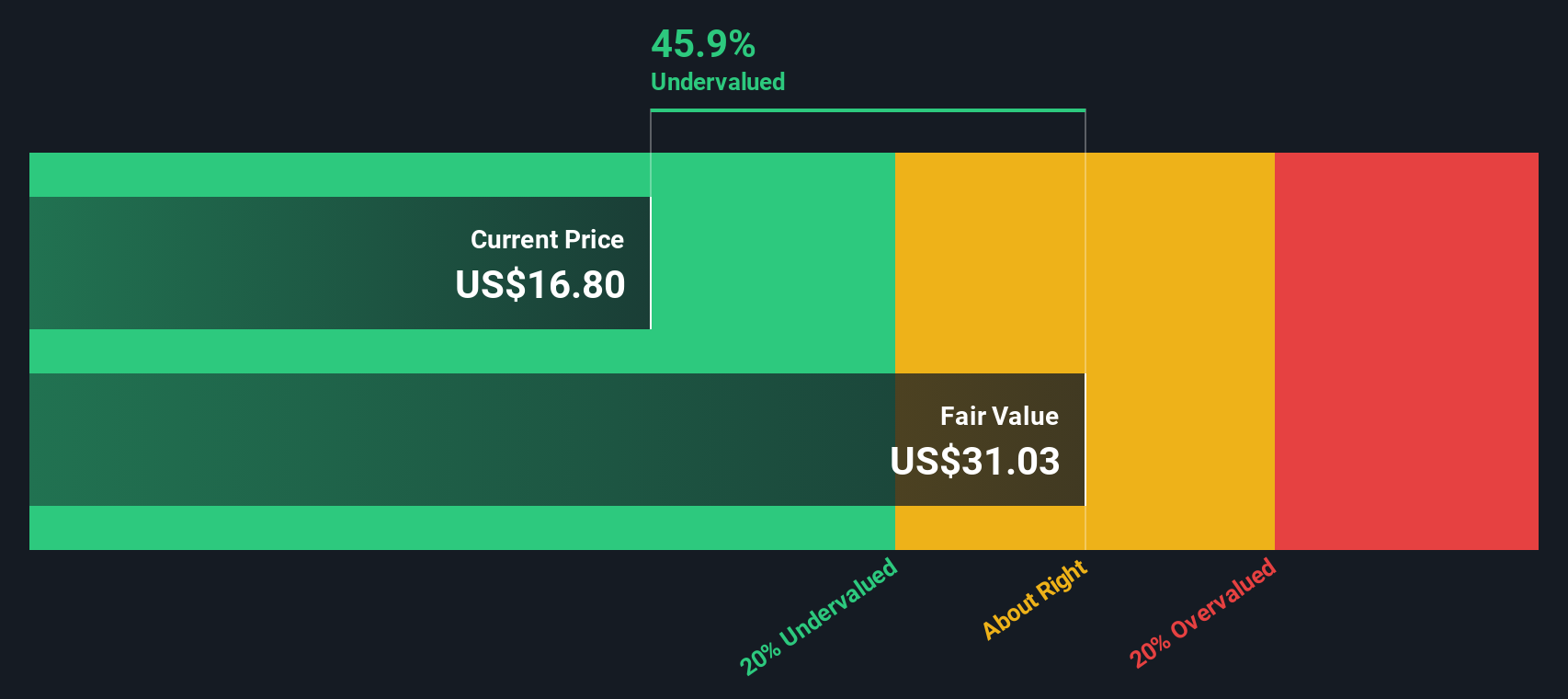

Another View: Discounted Cash Flow Says Undervalued

Looking from a different angle, our DCF model calculates Lyft's fair value at $30.01. This is almost a third higher than the current share price. This model suggests Lyft might be undervalued despite what the multiples are showing. Could this signal hidden potential the market is missing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Lyft for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Lyft Narrative

If you have your own perspective, or want to dig into the details yourself, it takes just a few minutes to build your own view and narrative. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Lyft.

Looking for more investment ideas?

Seize new opportunities and stay ahead of the market by using the Simply Wall Street Screener for fresh growth stories and high-potential companies you might be missing.

- Boost your portfolio’s yield by tapping into these 17 dividend stocks with yields > 3% offering consistently strong payouts and the potential for steady income.

- Get ahead of innovation with these 24 AI penny stocks focused on artificial intelligence, where rapid advances are driving exciting new investment frontiers.

- Strengthen your strategy by selecting from these 874 undervalued stocks based on cash flows trading below their true worth based on underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LYFT

Lyft

Operates a peer-to-peer marketplace for on-demand ridesharing in the United States and Canada.

High growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives