- United States

- /

- Transportation

- /

- NasdaqGS:LYFT

Is Lyft's Atlanta Autonomous Vehicle Launch a Signal for Further Gains in 2025?

Reviewed by Bailey Pemberton

Let’s be honest, deciding what to do with Lyft stock right now feels like standing at a busy intersection. The traffic is moving fast, there are new players in town, and every day brings a fresh signal about where the next big move might come from. If you’ve been watching, you know Lyft’s story isn’t short on action. On the one hand, the stock recently closed at $21.99, capping some head-turning gains, up 32.0% over the last 30 days and a hefty 61.1% return so far this year. That kind of rebound naturally has people wondering, “Am I seeing the start of something big, or are we already late to the party?”

Recent news may have provided some extra fuel for this rally. With a new autonomous vehicle partnership being piloted in Atlanta, Lyft isn’t waiting on the sidelines while the next phase of transportation emerges. At the same time, regulatory clarity in California about how drivers are classified and what rights they’ll have to organize helps paint a less risky picture for investors worried about legal headwinds. Add in Lyft’s presence alongside high-profile names in the fintech sphere, such as Stripe, and it’s clear why risk tolerance around the name is starting to look different from just a year ago. Still, the long-term performance tells a different story, with a five-year return of -20.9%, reminding us that this stock has had its share of potholes along the way.

So, what do the numbers say about Lyft’s value? Using our six-point valuation framework, Lyft scores just a 2. Under the hood, it only looks undervalued on two out of six checks. But here’s where things get interesting. We’ll break down how that score was reached with each valuation approach next, plus share a smarter, more holistic way to judge Lyft’s real worth at the end of the article.

Lyft scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Lyft Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a valuation approach that estimates a company's worth by projecting its future cash flows and then discounting those amounts back to today's value. This helps investors understand what the business is fundamentally worth, without being swayed by short-term market noise.

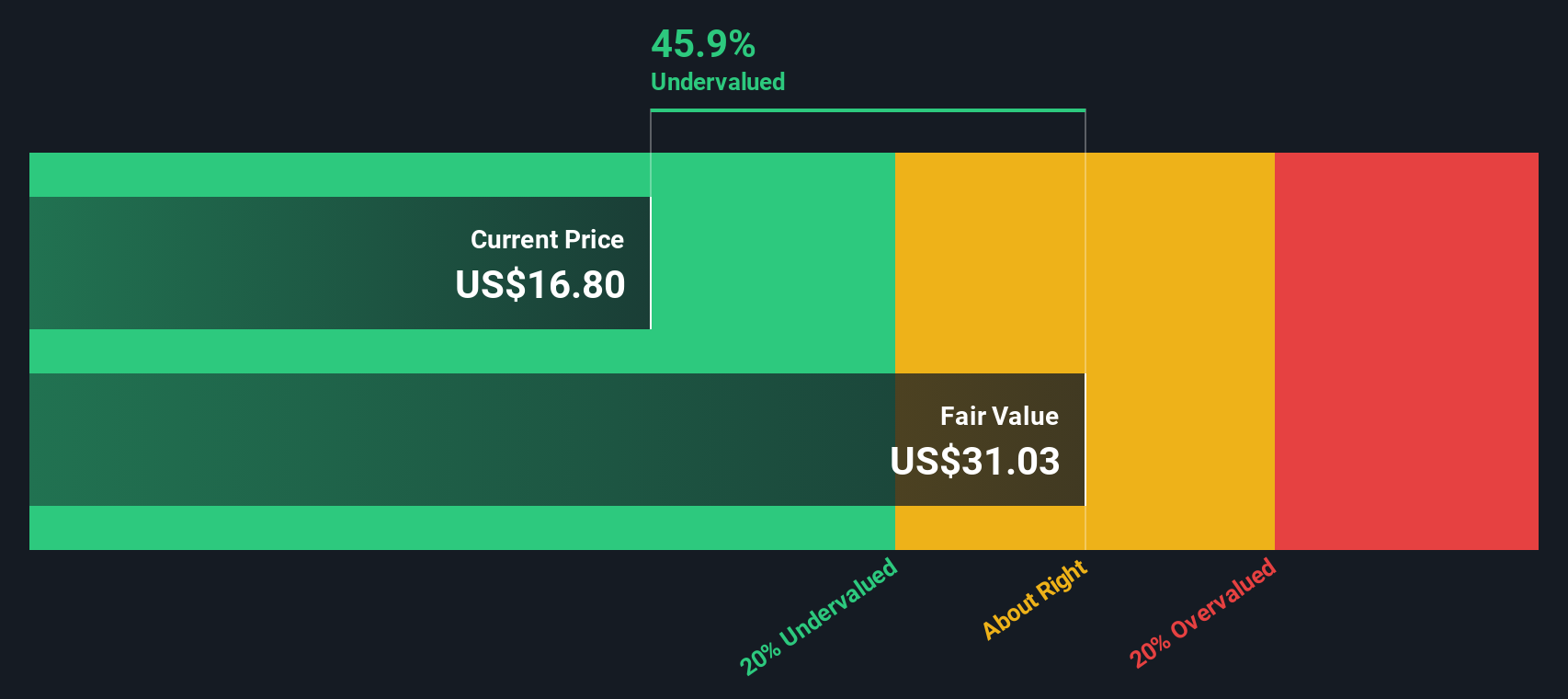

For Lyft, the current estimated Free Cash Flow (FCF) stands at $923.5 Million. Analyst forecasts extend out five years, with projections gradually slowing as we look further ahead. By 2029, FCF is forecasted to be $718 Million. Beyond that, financial modeling from Simply Wall St extrapolates cash flows to continue growing modestly through 2035, all reported in US dollars.

When all anticipated future cash flows are tallied and discounted back to the present, the intrinsic value for Lyft stock comes out to $30.01 per share. With Lyft’s recent closing price at $21.99, this DCF analysis suggests the stock trades at a 26.7% discount. In other words, it is currently undervalued based on cash flow outlook.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Lyft is undervalued by 26.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Lyft Price vs Earnings

The price-to-earnings (PE) ratio is widely recognized as one of the most useful valuation tools for profitable companies because it connects a company’s stock price directly to its earnings. Since Lyft has moved into profitability, the PE ratio helps investors assess how much they are paying for each dollar of current profits, which brings clarity when comparing against peers or broader market expectations.

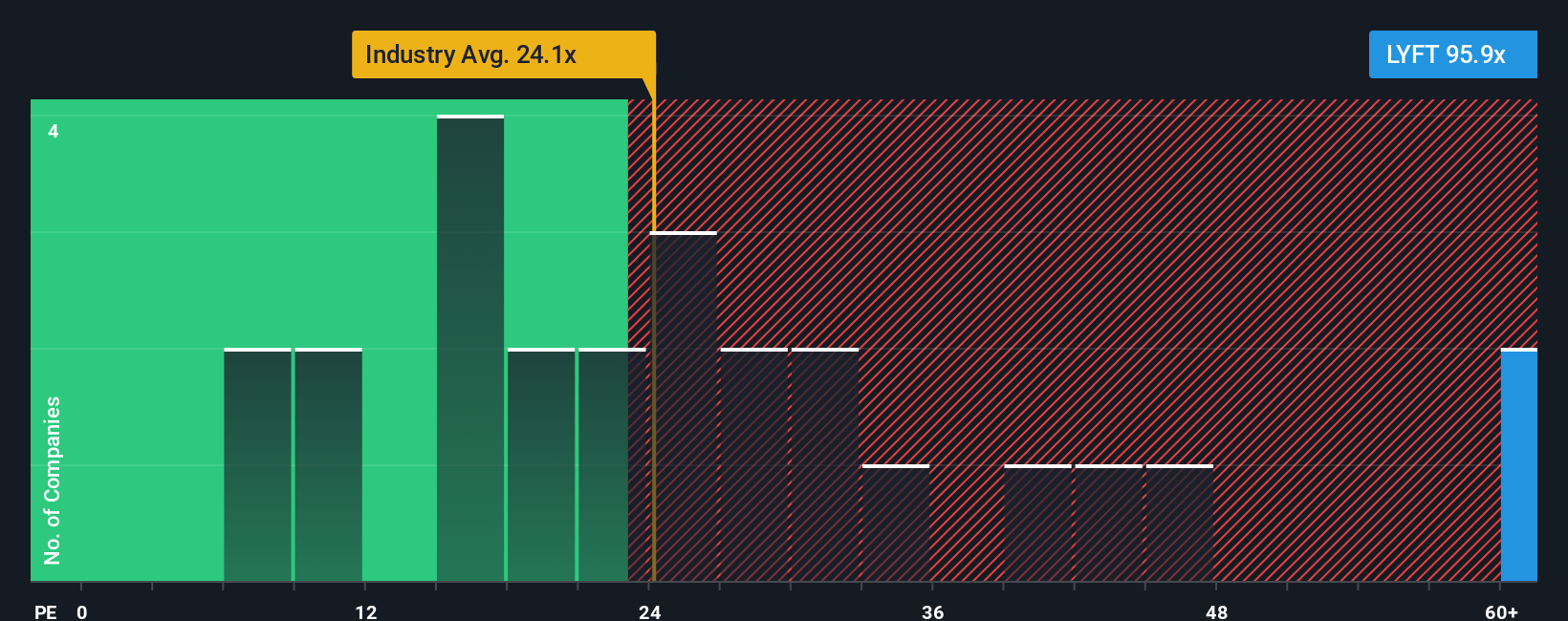

However, what counts as a “normal” or “fair” PE ratio isn’t set in stone. Growth expectations and risk play key roles. Fast-growing companies often deserve higher PE ratios, while businesses with shaky earnings or higher risks typically trade at a lower multiple. For Lyft, the current PE ratio stands at 97x, far above both the transportation industry average of 24x and the peer average of 24x. This suggests that, at first glance, investors are willing to pay a significant premium for the company’s earnings, possibly pricing in robust future growth or unique competitive advantages.

That is where Simply Wall St’s Fair Ratio comes in. Rather than simply lining up Lyft against industry or peer averages, the Fair Ratio customizes the “expected” PE by factoring in the company’s own growth prospects, profit margins, market cap, and risk profile. This approach offers a more holistic valuation picture. For Lyft, the Fair Ratio has been calculated at 21x. Since its current PE is much higher than this custom benchmark, the stock screens as overvalued on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Lyft Narrative

Earlier we mentioned that there is an even better way to assess valuation, so let’s introduce you to Narratives. A Narrative is your personal viewpoint or “story” about a company’s future, backed up by your own assumptions for revenue, margins, and fair value. It goes beyond just the headline numbers.

With Narratives, you can link what’s happening in the real world to your financial outlook. This means connecting developments like new partnerships or regulatory changes directly to potential share price targets. As a result, you are empowered to make more informed, conviction-driven decisions by comparing your calculated Fair Value with the current stock price, helping you determine if it’s time to buy, sell, or simply wait.

Narratives are easy to create and update right within Simply Wall St’s Community page, a feature used by millions of investors to share perspectives and track their thinking as news breaks or earnings roll in. Narratives automatically refresh when new data is published, allowing you to stay agile in fast-moving markets.

For example, among recent Narratives for Lyft, some investors see global partnerships and autonomous vehicle expansion supporting a fair value as high as $28. More cautious views highlight competitive and regulatory risks, with targets closer to $10. No matter your take, Narratives make it simple to turn your insights into actionable, up-to-date investment decisions.

Do you think there's more to the story for Lyft? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LYFT

Lyft

Operates a peer-to-peer marketplace for on-demand ridesharing in the United States and Canada.

High growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives