- United States

- /

- Transportation

- /

- NasdaqGS:LYFT

Is Lyft (NASDAQ:LYFT) Using Debt Sensibly?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Lyft, Inc. (NASDAQ:LYFT) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Lyft

How Much Debt Does Lyft Carry?

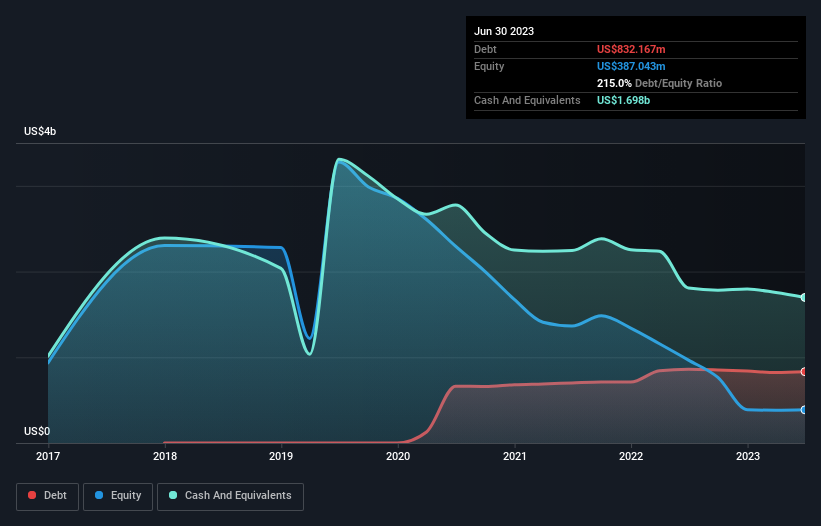

As you can see below, Lyft had US$832.2m of debt, at June 2023, which is about the same as the year before. You can click the chart for greater detail. But it also has US$1.70b in cash to offset that, meaning it has US$866.0m net cash.

A Look At Lyft's Liabilities

According to the last reported balance sheet, Lyft had liabilities of US$3.02b due within 12 months, and liabilities of US$1.04b due beyond 12 months. On the other hand, it had cash of US$1.70b and US$315.2m worth of receivables due within a year. So it has liabilities totalling US$2.05b more than its cash and near-term receivables, combined.

This deficit isn't so bad because Lyft is worth US$4.12b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk. Despite its noteworthy liabilities, Lyft boasts net cash, so it's fair to say it does not have a heavy debt load! There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Lyft's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year Lyft wasn't profitable at an EBIT level, but managed to grow its revenue by 15%, to US$4.3b. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

So How Risky Is Lyft?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And in the last year Lyft had an earnings before interest and tax (EBIT) loss, truth be told. Indeed, in that time it burnt through US$354m of cash and made a loss of US$1.3b. But the saving grace is the US$866.0m on the balance sheet. That kitty means the company can keep spending for growth for at least two years, at current rates. Overall, we'd say the stock is a bit risky, and we're usually very cautious until we see positive free cash flow. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Lyft is showing 2 warning signs in our investment analysis , you should know about...

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:LYFT

Lyft

Operates multimodal transportation networks that offer access to various transportation options through platform and mobile based applications in the United States and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

AMZN Narrative

Constellation Software: The Fortress the AI Panic Forgot to Account For

Microsoft: Real‑Terms Economic Value Anchored in Durability, Not Growth Assumptions

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

The "Physical AI" Monopoly – A New Industrial Revolution

Trending Discussion